It is said – and Charles Schwab, a purveyor of earthly comforts, confirms – that one requires approximately $2.3 million to be considered, shall we say, properly wealthy. A mere $839,000, however, buys one the illusion of financial comfort. An amusing distinction, wouldn’t you agree? As if a few hundred thousand dollars could truly shield a soul from the existential dread of a poorly performing portfolio. The masses, it seems, are perpetually chasing a phantom solvency.

Investing, naturally, is the favored method of this pursuit. Not because it is inherently logical – the stock market, after all, operates on a blend of hope, fear, and the occasional stroke of inexplicable luck – but because it offers the appearance of control. One can, at least, pretend to be master of their own financial fate, even as the market dances to a tune composed by forces beyond comprehension. The goal, let us suppose, is two million dollars. A sum sufficient to purchase a modest measure of peace, or perhaps a particularly extravagant collection of porcelain cats.

The Index and Its Discontents

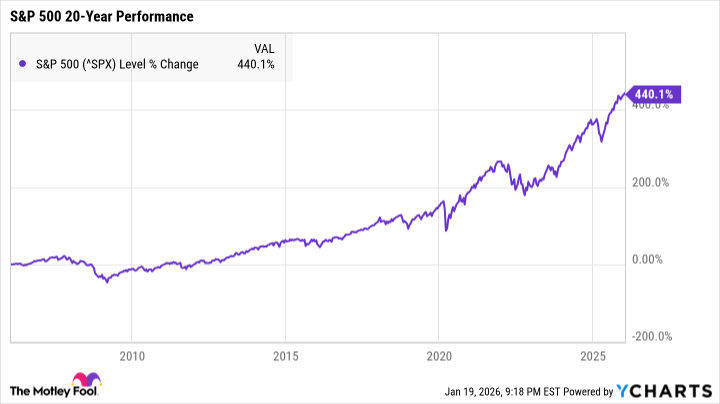

The S&P 500. A collection of five hundred leading American enterprises, a sort of corporate aristocracy. Investing in an exchange-traded fund that mimics its performance is, for the novice, a remarkably straightforward proposition. It’s akin to placing a bet on the entire kingdom, rather than a single, unpredictable knight. A sensible strategy, if one lacks the stomach for genuine risk. Or, indeed, the inclination to actually understand what one is doing.

Crestmont Research, those diligent chroniclers of financial history, have observed that, over any twenty-year period, the S&P 500 has, invariably, produced positive returns. A comforting thought, isn’t it? That even in the face of economic chaos, political upheaval, and the occasional rogue comet, one’s investments will, eventually, recover. Though, one suspects, the details of those recoveries are often…massaged. Like a particularly unreliable witness in a rather important trial.

The Monthly Tribute

Time, as always, is the crucial ingredient. Decades, preferably. The sooner one begins sacrificing a portion of their income to the market gods, the better. The precise amount, naturally, depends on one’s ambition and the prevailing winds of fortune. Let us examine the arithmetic, shall we? Assuming, of course, a rather optimistic 10% annual return – a figure that would likely elicit a knowing chuckle from any seasoned investor.

| Number of Years | Amount Invested Each Month | Total Portfolio Value |

|---|---|---|

| 20 | $3,000 | $2.062 million |

| 25 | $1,700 | $2.006 million |

| 30 | $1,050 | $2.073 million |

| 35 | $625 | $2.033 million |

| 40 | $400 | $2.124 million |

The S&P 500 ETF, while reliable, is, alas, incapable of miracles. It delivers average returns, which, in a world obsessed with exceptionalism, is often considered a failing. One might achieve greater gains by selecting individual stocks, but this requires effort, research, and a willingness to accept a significantly higher degree of risk. A gamble, in essence. And who, truly, enjoys gambling with their future?

So, there you have it. A pathway to potential wealth, paved with monthly sacrifices and guarded by the fickle spirits of the market. The S&P 500 ETF: a simple, straightforward investment. But remember, even the most carefully constructed plan can be undone by a sudden act of fate, a poorly timed sneeze, or the inexplicable whims of the invisible hand. Begin investing early, be consistent, and pray, perhaps, to whatever deity oversees the accumulation of earthly possessions. It couldn’t hurt.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-21 23:32