Each month, I add to my retirement account with the same steady rhythm that a farmer tends his fields-without fanfare but with purpose. This discipline has been the backbone of my financial growth, though it is not without its challenges. Markets are unpredictable, and opportunities must be weighed against risks. Yet, when funds arrive, I aim to deploy them swiftly into investments that offer both safety and potential.

This September, two exchange-traded funds (ETFs) stand out as particularly worthy of attention: the Schwab U.S. Dividend Equity ETF (SCHD) and the JPMorgan NASDAQ Equity Premium Income ETF (JEPQ). These are not mere instruments of speculation; they are tools designed to generate passive income while shielding me from the worst excesses of market volatility.

A Pathway to Steady Dividend Growth

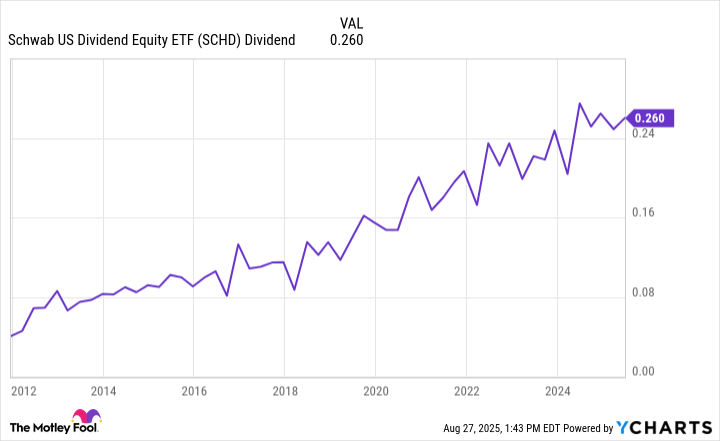

The Schwab U.S. Dividend Equity ETF tracks an index composed of 100 high-yielding dividend stocks. These companies are selected not by chance but through rigorous screening. The criteria include yield, consistency of payments over five years, and financial health-a process akin to separating wheat from chaff. The result? An average dividend yield nearing 4%, with annual payment increases exceeding 8% over the past half-decade.

Consider Chevron, the largest holding in this fund. It has raised its dividend for 38 consecutive years. Others in the top tier have done so for over fifty. Such resilience speaks volumes about their ability to weather economic storms. The combination of current income and future growth makes this ETF a bulwark against uncertainty. Since its launch in 2011, it has delivered an average annual total return of 11.5%. For those seeking stability, these numbers carry weight.

A curated selection of Nasdaq-100 companies chosen using fundamental analysis enhanced by modern data science.

In the past year alone, this approach has yielded an income stream surpassing 11%. Meanwhile, the underlying equities retain their growth potential. Combined, these elements have produced an average annual total return of 14.9% since the fund’s inception in 2022. Here lies a paradox: greater returns with less risk-a rare bird indeed.

Building for the Long Haul

These two funds embody complementary virtues. The Schwab ETF offers dependable income from established firms, whose histories of dividend growth suggest enduring strength. The JPMorgan ETF, meanwhile, provides higher immediate yields alongside controlled exposure to one of the world’s most dynamic indices. Together, they form a foundation upon which a secure retirement can be built-not hastily or recklessly, but thoughtfully and deliberately.

There is no magic here, only method. No shortcuts, only steady progress. And perhaps, just perhaps, there is hope for those who wish to navigate the treacherous waters of modern finance with integrity and foresight. 🌱

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-08-31 18:41