Okay, let’s start with the obvious. Dividend investors like me-no, wait, should I say “us”?-are a bit like gardeners, patiently cultivating our portfolios. The kind of people who believe that returns, much like tomatoes, will ripen over time (even if we’re still waiting for them). The trick, however, is that dividends don’t just come from doing nothing. There’s a method to this madness, and yes, there are stocks out there that are more than capable of paying you back, year after year. But finding the right ones? Well, that’s the *real* thrill.

So, after a lot of deliberation (and perhaps a glass of wine), I’ve found two dividend stocks worth considering. Here they are, along with a dash of reality and a sprinkle of wry humor:

1. PepsiCo Stock: Bubbly But a Little Underperforming

Now, don’t get me wrong. PepsiCo (PEP) is the reliable, slightly-too-perfect company you invite to your financial party because they *always* show up with something impressive. At first glance, their dividend yield is above 3.5%, which is *not bad* at all. But, of course, there’s a catch. The stock’s been a bit of a wallflower for the past two years, trailing the market, which, let’s face it, is often the case with steady dividend payers. The growth is… well, sluggish. This year’s expected organic sales growth is only 1.7%, a far cry from the 2% they saw last year. So, while the stock isn’t exactly *dancing* right now, it’s been stable, like that one friend who always brings snacks but never joins in on the conga line.

But wait, this story isn’t all doom and gloom. Pepsi’s operating margins are solid at 18%, and they’re projecting a handsome $9 billion in shareholder returns this year, mostly through dividends. Oh, and the dividend hike? A 5% bump for 2025-this is their 53rd consecutive increase. *Dividend King*, anyone? They might be stuck in a bit of a slow jam, but you can still get in at 2.2 times sales, a slight discount compared to last year’s 3 times sales. The strategy? Reworking their product mix to tap into the health-conscious consumer. I mean, who doesn’t like a bit of Poppi prebiotic soda, right?

2. McDonald’s: Still a Burger King (But with More Fries)

Oh, McDonald’s (MCD). They’re the one who keeps popping up in every conversation, aren’t they? I mean, who doesn’t know them? In August, McDonald’s announced that they were back in the groove with a 4% growth in comparable-store sales. The *secret* sauce? Focusing on value and pushing digital solutions-mobile ordering, delivery, the whole works. It’s like they’ve gone from being the fast-food equivalent of a “safe bet” to suddenly becoming that friend who can’t stop talking about how great their latest startup is.

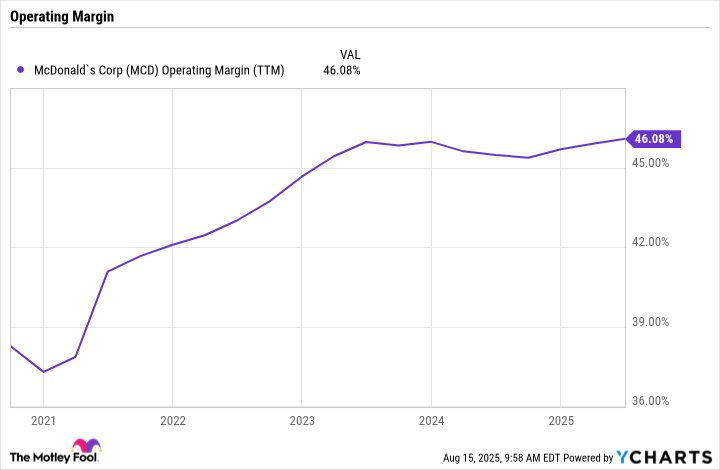

Profit-wise, McDonald’s is cruising-Q2 earnings were up 5%, and the operating margin is now flirting with 50%. They’ve got the kind of free cash flow that makes you feel all warm inside (like when you’re on the couch with a Big Mac and no one can judge you). And while it’s not all sunshine and rainbows, there’s real opportunity here. The stock’s dividend yield is 2.6%-not bad, but it’s still kind of underappreciated, especially when the tech stocks are all the rage these days. People seem to forget that McDonald’s is a cash machine, pumping out steady dividends for those who are patient enough to wait. And let’s not forget: they’re *good* at it.

So, there we have it. Two stocks, both with a bit of baggage, but both offering *that* reassuring income that keeps you feeling warm, like your grandmother’s knitted sweater. They might not be glamorous, but they’ll be there when you need them. Sometimes, that’s all you can ask for.

Of course, the trick is patience-and maybe a tiny bit of passive-aggressive optimism. But for now, let’s raise our glasses to dividends that keep coming. 🍷

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Top 15 Insanely Popular Android Games

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-19 15:07