In the vast theater of commerce, where the rustle of capital whispers to the ambitions of men, Twilio (TWLO) emerges as both architect and acolyte of a new epoch. This cloud communications company, with its labyrinthine APIs, has woven itself into the sinews of modern enterprise, stitching together voice, text, and video like a weaver of digital destinies. Yet the path to its glory is strewn with the detritus of uncertainty, for even the most well-laid plans of shareholders and CEOs are subject to the whims of markets that dance to no mortal’s tune.

The year 2025 has been a crucible for Twilio’s stock. It has lost 4% of its value thus far-a trifling sum in the grand ledger of history, yet a wound keenly felt by those who trade in its shares. February’s collapse was a tempest, and August’s quarterly report, a second storm. Shares plummeted 19%, as if the market itself had turned its back on the company’s promises. And yet, amid this turbulence, there lingers a quiet confidence among analysts, who, like scribes in an ancient council, whisper of a 27% ascent to $131. What unseen currents stir such conviction?

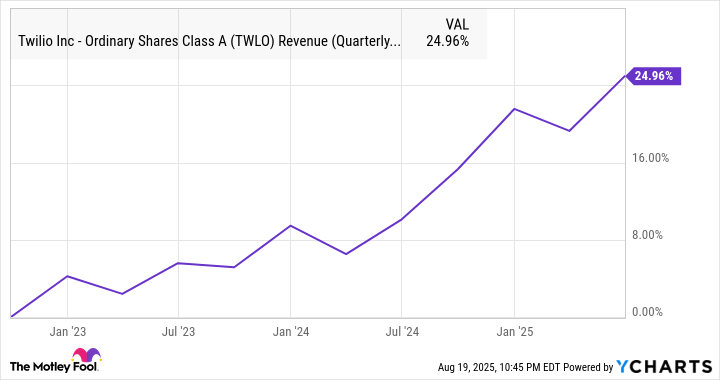

Twilio’s Q2 earnings, a modest 13% revenue increase and a 37% leap in EPS to $1.19, are but the first notes in a symphony of growth. The company’s customer base, like a river swelling with spring rains, has grown from 313,000 to 349,000 active accounts by Q2 2025. The dollar-based net expansion rate, a metric as opaque as it is vital, has climbed from 102% to 108%. These numbers, cold and clinical, speak of a deeper truth: the human hunger for connection, for tools that transcend mere transaction and touch the soul of commerce.

Twilio’s AI tools, those silent alchemists of data, are the fulcrum upon which this growth pivots. Conversational intelligence-extracting meaning from voice, transcribing calls in real-time, measuring sentiment-has become the lifeblood of enterprises seeking to monetize every syllable. The company’s management, with the fervor of prophets, declares an 86% surge in customers adopting these tools. One might ask: Is this progress, or merely the latest iteration of humanity’s restless invention? Does the machine, in learning to listen, become a mirror to our own loneliness?

Investors Need to Look Past the Near-Term Guidance

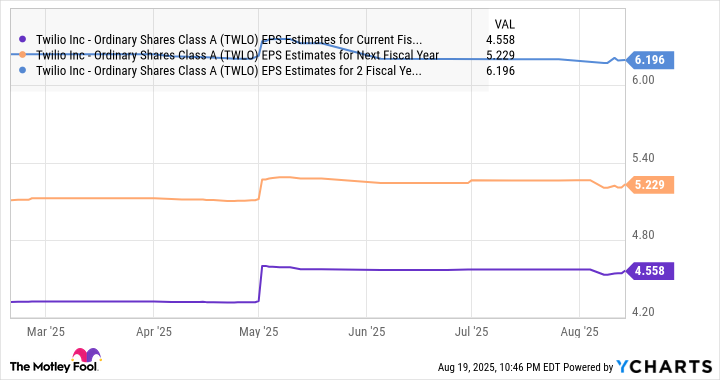

The Q3 guidance, with its 10%-11% revenue growth, is a shadow cast by a brighter sun. The earnings forecast of $1.01-$1.06 per share, a mere flicker compared to last year’s $1.02. Yet herein lies the paradox of markets: the present is but a prologue to futures untold. For Twilio stands at the edge of a $10 billion opportunity in AI-driven contact centers by 2032, a realm where today’s $2 billion seems as quaint as a candle in the age of electric light.

If Twilio’s earnings reach $6.20 by 2027, trading at 30 times forward multiples (in line with the Nasdaq-100), its stock price could soar to $186-a 80% leap from current levels. Such a trajectory is not mere arithmetic; it is the unfolding of a destiny. Investors, those modern-day pilgrims, must choose: cling to the ephemeral or stake their faith in the eternal. For in the grand tapestry of commerce, the needle moves not by chance, but by the hands of those who dare to thread the future. 🤖

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

2025-08-23 04:11