![]()

In this world of ours, where the sacred and the profane dance a waltz of progress, semiconductors slink about like court jesters-unseen, yet indispensable. They are the silent alchemists of the digital age, and among them, Taiwan Semiconductor Manufacturing Company (TSMC) reigns, a sorcerer whose spells bind the circuits of civilization. Yet let us not mistake the scribe’s flourish for prophecy; the ink of optimism often blots out the parchment of reason.

TSMC, that colossus of the silicon steppes, commands a kingdom of 70% market share, while its rivals, like ants beneath a magnifying glass, scurry with paltry 7%. A foundry it is, yet not of bread or wine, but of chips-those crystalline totems of modernity. Its customers, like supplicants, bring their blueprints, and TSMC, with a nod and a wink, breathes life into their dreams. But what of the day the sorcerer’s apprentice dares to challenge the master? The kettle may sing, but it will not whistle.

At present, TSMC’s market cap hovers at $1.4 trillion, a sum that would require the alchemy of 14% annual returns to reach $2 trillion by 2028. One might scoff at such arithmetic, yet the company’s 29% average returns over the past decade whisper sweet nothings to the ears of investors. But let us recall: the past is a gilded cage, and the future, a riddle wrapped in a enigma. To bet on TSMC is to bet on the moon’s next full phase-predictable, yet fraught with the lunacy of hubris.

The Devil’s Due in the AI Ecosystem

TSMC is no generative AI, no Cheshire cat grinning from a screen. Yet in the infernal machinery of artificial intelligence, it plays the role of the unseen hand. Nvidia, AMD, and Alphabet-these titans of the digital realm design their chips with the fervor of mad scientists, but it is TSMC that forges their weapons. Without it, data centers would sputter like a broken gramophone, and AI’s symphony would descend into cacophony. One might imagine the Devil himself, perched on a boardroom chair, muttering, “Without TSMC, your algorithms are but ink on parchment.”

Advanced AI chips? They are TSMC’s Mephistopheles, binding the pact between silicon and soul. To abandon it would be to invite the chaos of the pre-industrial age-except here, the chaos is measured in nanometers and nanoseconds. The world, in its collective delirium, has made TSMC the gatekeeper of progress, and gatekeepers, as history teaches, are seldom kind to those who forget their place.

Profit Margins and the Illusion of Control

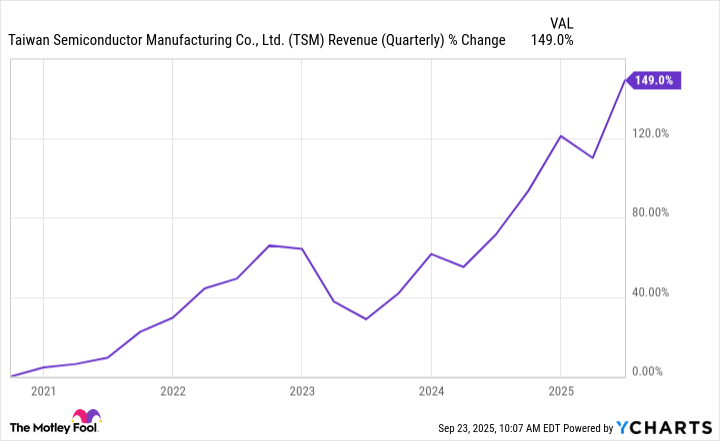

TSMC’s coffers swell like a bloated czar, basking in the gold of its monopolistic sun. Second-quarter revenue? A princely $30 billion, up 44% year-over-year. Should the third quarter bring $31.8 billion to $33 billion, the company’s growth would outpace even the most feverish dreamer. Yet what of the cracks in the edifice? The margins, expanding like a serpent’s grin-36.8% to 42.7%, 53.2% to 56.8%-speak of a company that has learned to milk the cow until it bleeds. But milk, as we know, curdles.

Nvidia’s latest earnings, with their $3-4 trillion AI infrastructure forecast, are a siren song to TSMC’s ears. Yet let us not forget: siren songs drown more sailors than they guide. The company’s customers, like Icarus in their hubris, fly ever closer to the sun, certain that TSMC’s wings will not melt. But what of the day the wax gives way? The fall, when it comes, will not be measured in percentages, but in empires.

These margins, one might argue, are the price of admission to a club where the only rule is that there are no rules. TSMC’s customers, in their desperation for the most potent chips, bow like penitents at the altar of progress. But what is a monopoly but a gilded cage, its bars forged in the fire of necessity? The company’s pricing power is a double-edged sword-one that cuts both ways when the world turns its back.

A Valuation for the Brave and the Foolish

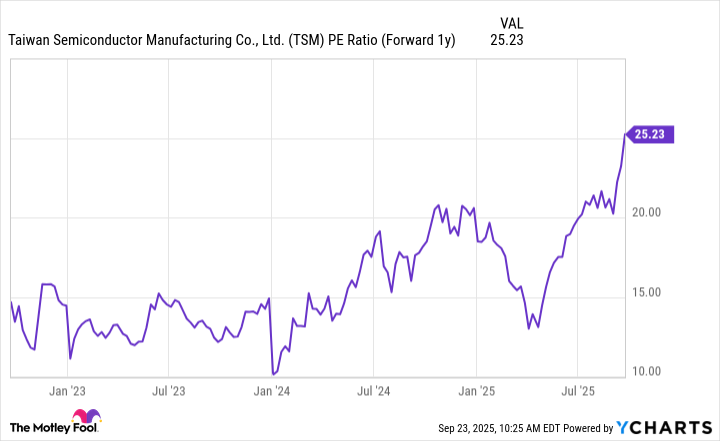

TSMC trades at 23.5 times its forward earnings, a price that would make even Don Quixote pause to consider the tilt of his lance. Not “cheap,” by any measure, but for a company that has mastered the art of the impossible, it is a price of admission to the theater of the absurd. The contrarian investor, ever the skeptic, sees not a golden goose, but a goose that honks with the urgency of a dying clock.

Its manufacturing prowess, they say, is a fortress. But fortresses crumble when the moat dries and the drawbridge is left unguarded. TSMC’s advantage is not in the chips themselves, but in the decades of alchemy required to forge them. Yet alchemy, for all its mystique, is no match for the arithmetic of time. The day will come when the apprentices rise, and the master’s secrets will be his undoing.

And so, the question lingers: Can TSMC join the $2 trillion club? Perhaps. But let us not mistake inevitability for destiny. The stock market is a stage where the players wear masks, and the audience, in its collective delirium, forgets to clap. To bet on TSMC is to bet on the moon’s next full phase-predictable, yet fraught with the lunacy of hubris. 🧙♂️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- USD PHP PREDICTION

2025-09-27 03:30