Right. So, January 2025. I had this theory about Taiwan Semiconductor Manufacturing (TSM +2.21%). It involved chips, AI, and a vague sense that everyone else was missing something. Turned out, I was right. The stock went up. A lot. 54%, if you must know. Which is… gratifying. Though honestly, the moment it actually worked was slightly unsettling. It implies a level of competence I’m not entirely sure I possess.

Now it’s 2026. And everyone’s looking at TSMC like it’s some sort of overvalued behemoth. Like the party’s over. Which, let’s be honest, is exactly when I start to get interested. Because the sensible thing, the obvious thing, is rarely the right thing. At least, that’s what I tell myself to justify my questionable investment choices.

Things I’ve learned: Everyone loves a headline about Nvidia or AMD. It makes them feel…involved. But Nvidia and AMD don’t make the chips. They’re designers. Like architects. TSMC is the construction crew. The actual people getting their hands dirty. And when the AI boom happens – and it’s still booming, despite what the financial news keeps hinting – someone has to actually build the stuff. That someone is TSMC. It’s a surprisingly simple concept, really. Though explaining it to my friends usually ends with glazed expressions and talk of “the metaverse”.

Units of Cryptocurrency Lost: 12. Hours Spent Watching Charts: 9. Number of Panicked Texts to Friends: 24.

The fourth quarter numbers were…encouraging. Revenue up 26% year over year. Which is basically fancy finance-speak for “they’re still selling a lot of chips”. And they expect around 30% growth for 2026. Which, if you think about it, is quite a lot. Management is saying AI chip revenue will grow at a mid-to-high 50% compound annual growth rate for the next five years. Which sounds… ambitious. But then again, ambition is what separates the moderately successful from the spectacularly broke.

Valuation: Or, Why I’m Probably Wrong (But Still Buying)

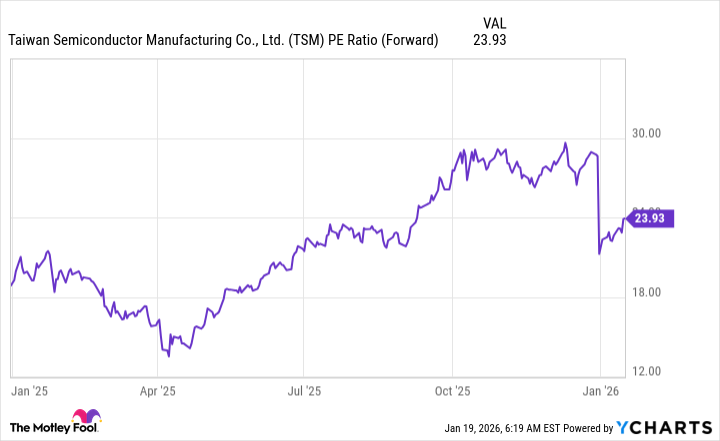

Back in 2025, I pointed out that TSMC’s valuation was reasonable. Trading at 23 times forward earnings. Now? 24 times. One extra time. It’s practically a bargain. Okay, that’s a slight exaggeration. But the point is, it hasn’t gone completely insane. It hasn’t reached that frothy, bubble-like state where even I start to feel uneasy. Which is saying something.

So, here I am, in 2026, still buying TSMC. Because everyone else seems to think it’s over. Because I have a deeply ingrained need to zig when everyone else zags. And because, deep down, I suspect that the future will be built on tiny, incredibly complex pieces of silicon. And someone has to make those. It’s probably a terrible idea. But then again, all the best ideas usually are.

Days Spent Questioning My Life Choices: 365. Number of Times I’ve Said “I Told You So” (to Myself): Countless.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- NEAR PREDICTION. NEAR cryptocurrency

- Wuthering Waves – Galbrena build and materials guide

- DOT PREDICTION. DOT cryptocurrency

- USD COP PREDICTION

- Silver Rate Forecast

- EUR UAH PREDICTION

- Games That Faced Bans in Countries Over Political Themes

- USD KRW PREDICTION

2026-01-24 18:43