![]()

There exists, in the intricate tapestry of modern commerce, a certain class of enterprise whose influence far exceeds its public recognition. One thinks of the skilled artisan, laboring unseen, whose work underpins the grandest displays. So it is with Taiwan Semiconductor Manufacturing Company – TSMC, as it is known – a name perhaps unfamiliar to the casual observer, yet utterly central to the burgeoning age of artificial intelligence. It is not a creator of visions, but the diligent hand that renders them real, transforming abstract designs into the very substance of the digital world.

Companies such as Nvidia and AMD may capture the headlines with their innovations, but it is TSMC that possesses the singular capacity to make those innovations a tangible reality. Without this quiet colossus, the entire chain of supply, the delicate network that sustains the AI revolution, would falter. And yet, despite its undeniable ascendancy, the market, in its perpetual restlessness, seems to undervalue its worth.

The Measure of a Master

Efficiency, one might say, is a virtue often spoken of, but rarely achieved with such consistent mastery. TSMC does not merely manufacture; it refines. Scale is not simply a matter of expansion, but of controlled precision. Yield – that most telling of metrics, the percentage of flawless creations – is consistently elevated, a testament to years of dedicated refinement. Dependability, in a world obsessed with novelty, has become a rare and precious commodity, and TSMC offers it in abundance. It is, quite simply, the preferred choice for those who demand – and can afford – the very best.

The company’s origins lie in the production of chips for mobile telephones, a market now crowded and competitive. But TSMC has demonstrated a remarkable capacity for adaptation, seizing the opportunities presented by the current surge in demand for advanced AI processors. It now commands a dominant share of this crucial sector, a position secured not by chance, but by foresight and unwavering commitment to quality. The numbers speak for themselves: a market share comfortably exceeding ninety percent – a veritable monopoly, if one dares use the term.

A Year of Quiet Triumph

The year 2025 witnessed a revenue of $122.4 billion, a figure representing an increase of nearly thirty-six percent over the previous year. This is not merely a growth spurt; it is a landmark achievement, the first time the company has surpassed the hundred-billion-dollar threshold. The margin of success is particularly noteworthy, a testament to the company’s operational efficiency. Gross margins increased from 56.1% to 59.9%, while operating margins climbed from 45.7% to 50.8%. In the final quarter alone, gross and operating margins reached 62.3% and 54% respectively – figures that would elicit envy from even the most seasoned of industrialists.

Such a combination of substantial revenue growth and expanding margins is a rare and compelling sign of a company operating at the peak of its capabilities. It also reveals a degree of pricing power – the ability to dictate terms in a market increasingly reliant on its services. When one is, for all intents and purposes, the only game in town, a premium can – and should – be charged.

A Valuation Worth Considering

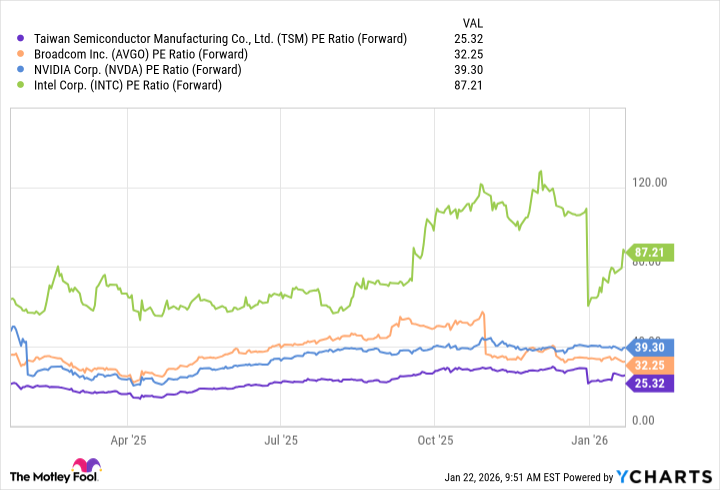

Despite a commendable increase of approximately sixty-nine percent in its stock price since the beginning of 2025 (as of January 22nd), TSMC currently trades at a relatively modest multiple of 25 times its projected earnings. This represents a significant discount compared to its peers, such as Broadcom, Intel, and Nvidia – companies often lauded for their innovation, but lacking the same degree of operational control.

Considering its market dominance, its pricing power, and the vast opportunities that lie ahead, the current valuation appears remarkably attractive, particularly for long-term investors. The stock may be trading slightly higher than its historical average, but the underlying business is demonstrably stronger – a testament to years of strategic investment and unwavering commitment to excellence. TSMC is not a speculative venture; it is a foundation upon which the future will be built – a holding one could comfortably maintain for years to come.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-01-26 23:02