![]()

Now, when folks speak of these “chip companies,” why, most naturally think of names like Nvidia or AMD. A right proper pair, they are, though they don’t actually make the chips themselves, you see. They’re designers, pure and simple – clever lads, to be sure, but they outsource the real work. It’s like a fella drawing up plans for a mansion but hiring someone else to lay the bricks. A sound enough business, I grant you, but there’s another player in this game, a quiet sort, that deserves a bit more attention, and that’s Taiwan Semiconductor Manufacturing – or TSMC, as they’re commonly called. They’re the ones doin’ the heavy liftin’, and a sight more of it than most realize.

It ain’t just Nvidia and AMD sendin’ their work TSMC’s way, neither. Apple, that purveyor of polished gadgets, relies on ’em too. TSMC’s the unseen hand behind a good many of these modern marvels. The designers get all the glory, naturally – a fella can’t help but admire a shiny new toy – but TSMC’s the silent partner, quietly churnin’ out the goods. It reminds me of a fella who builds a fine stagecoach, but it’s the horses that actually get you to your destination.

This has, as you might expect, brought TSMC a fair bit of prosperity these past few years. But I reckon there’s still plenty of room for growth, and the stock looks like a right shrewd investment for 2026. It’s the sort of opportunity that makes an old investor like myself rub his hands together with glee.

TSMC and the Coming AI Boom

Now, it’s no secret that TSMC stands to benefit handsomely from all this talk of “artificial intelligence.” If you hear tell of some grand data center being built, odds are a considerable portion of the chips within were crafted in TSMC’s facilities. It’s a bit like findin’ the same blacksmith’s mark on the horseshoes of every cavalry regiment.

For a long spell, that meant the work was done in Taiwan. But TSMC, bein’ a forward-thinkin’ company, has diversified. They’ve got a facility in Arizona now, churnin’ out chips for these new Blackwell graphics processing units. It’s a smart move, lessenin’ the worry about what might happen if China were to, shall we say, “rearrange” the political landscape of Taiwan. Though, truth be told, a conflict over there would throw the whole market into a right proper panic, and there wouldn’t be a safe harbor to be found. Still, it’s a concern some folks have, and I can’t say I blame ’em.

TSMC’s experiencin’ a change unlike anything it’s seen before. Management now believes AI-related revenue will grow at nearly 60% a year from 2024 to 2029. 2026 is comin’ up quick, but we ain’t even halfway through that projection yet. Plenty of growth left in the tank, as they say. That’s why management’s forecastin’ nearly 30% revenue growth for 2026. It’s a sight to behold, I tell ya.

Most reckon this data center spendin’ will continue for at least another half-decade, and if that holds true, TSMC will be a stock you simply must own. And thankfully for investors, it’s priced at a reasonable level. Seems like a steal, compared to some of these other fancy stocks on the market.

A Reasonable Price for a Fine Company

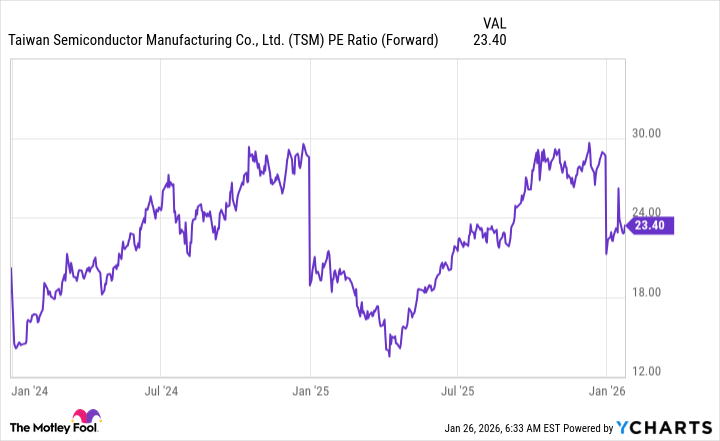

At 23.4 times forward earnings, TSMC looks like a right good buy. Most of these big tech companies trade for around 30 times earnings, and ain’t growin’ their revenue nearly as fast as TSMC. And the S&P 500, well, it trades for 22.2 times earnings, so TSMC is barely pricier than the overall market.

It ain’t often you find a stock that trades at a market-average premium but is growin’ at a clip of nearly 30%. And it’s even rarer to find one with established growth trends that ain’t expected to falter for another five years. This makes TSMC a pretty easy pick, and I’m mighty confident it’ll outperform the market over the next five years and be a major winner in 2026. A fella could do a lot worse, that’s for certain.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- Where to Change Hair Color in Where Winds Meet

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

2026-01-30 02:23