The market has a way of throwing up these shiny objects every decade. Most are fool’s gold. This time, it’s artificial intelligence. Billions chasing a ghost, or so it seemed at first. Now, the money’s real enough. Nvidia’s talking about a three to four trillion dollar data center spend by 2030. That’s a landscape change, and somebody’s going to build the foundations.

Taiwan Semiconductor Manufacturing – TSM – is that somebody. They don’t pick winners in the AI race; they supply the chips for all the contenders. A neutral position in a war is always a good position to be in. It’s a quiet power, the kind that doesn’t shout, but underpins everything. I’ve been watching them for a while. The stock’s been solid, but it hasn’t exactly taken off. That’s the opportunity. It’s a slow burn, but the kind that leaves a lasting impression.

I figure it’s got room to run. And if you haven’t taken a position yet, you might want to reconsider. The price is right, for a change.

Building a Fortress

TSM doesn’t just make chips; they manufacture potential. Logic chips, the brains of the operation. They’re the bottleneck in this whole AI rush, and they know it. There are competitors, of course, but they’re playing catch-up. TSM has the capacity, the footprint, and a decade of experience servicing demanding clients. Loyalty isn’t a virtue in this business, but it’s a byproduct of competence.

The location, naturally, is a concern. An island off the coast of a very large country with a long memory. Rumors fly like dust devils. But TSM isn’t sitting still. They’re spreading out, building plants in Arizona, Germany, Japan. Nvidia’s new Blackwell GPU? Made with chips fabricated in the U.S. It doesn’t eliminate the risk, but it diversifies it. A smart move. They’re hedging their bets, and so should you.

They’re forecasting monstrous growth in the AI chip sector – nearly 60% CAGR through 2029. That confirms what Nvidia’s been saying, and it’s not just hype. But AI isn’t the whole story. Smartphones, computers, everything needs chips. TSM isn’t relying on a single trend. They’re building a foundation for the future, not a house of cards.

Overall, they’re projecting revenue growth of 25% CAGR from 2024 to 2029. It’ll likely slow down, but they still expect to be above 20% in 2029. That’s a sustained level of growth that’s rare in this business. And the stock is priced like they’re just another hardware company. A disconnect, and a potential opportunity.

The Price of Progress

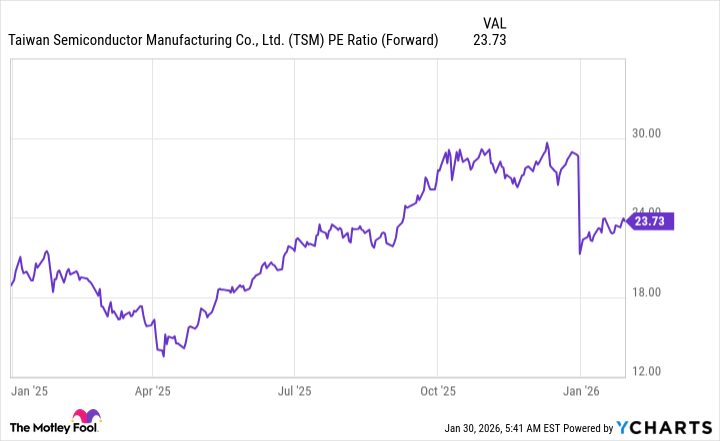

Most big tech stocks are trading at 25 to 30 times forward earnings, fueled by hope and promises. You’d expect TSM to be even higher, given its growth rate. But you’d be wrong.

TSM is trading at a reasonable 24 times forward earnings. A bargain, almost.

That price, combined with its growth rate and the unstoppable AI trend, makes it a top pick. As long as the money keeps flowing into AI, TSM will thrive. And that doesn’t look like it’s slowing down anytime soon. It’s a calculated risk, of course. There are always risks. But sometimes, the biggest risk is doing nothing at all.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-03 22:02