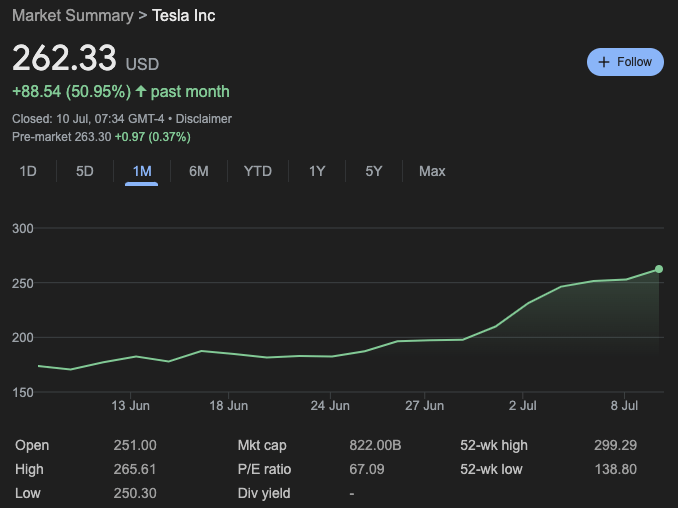

As a seasoned crypto investor with a keen interest in the tech sector, I’ve closely followed Tesla’s stock performance over the years. Tesla’s recent winning streak, marked by ten consecutive trading sessions of impressive gains, has been nothing short of remarkable. The electric vehicle giant’s shares have surged by an astounding 43.7% during this period, outperforming most of its peers in the S&P 500.

Tesla’s stock has experienced an extraordinary rise in value as of late, based on a MarketWatch report by Emily Bary. For the past ten business days, Tesla’s shares have seen consistent gains, representing their longest uninterrupted period of growth in over twelve months. Consequently, Tesla’s stock achieved its highest closing price since last October.

Over the past ten trading days, Tesla’s stock has experienced a remarkable surge, with an impressive gain of 43.7%. This is the company’s best 10-day streak since early February 2023, as MarketWatch reports. On Tuesday specifically, Tesla’s stock price increased by 3.7%, outpacing most stocks in the S&P 500 during that session.

In the second half of 2023, Tesla experienced a remarkable shift in fortune, contrasting its disappointing first-half performance. Previously, the company’s stock had faced challenges, recording substantial losses for the year up until then. However, this recent streak of success not only wiped out these losses but propelled Tesla into positive annual growth with a 5.6% increase. It is important to mention that despite this recovery, Tesla remains below its peers among the “Magnificent Seven” tech stocks in terms of year-to-date gains.

As a researcher, I’ve come across some intriguing data regarding Tesla’s impressive market gains reported by MarketWatch. Since the onset of this winning streak, Tesla has experienced an approximate $250 billion surge in its market value. To put this growth into perspective, I’d like to note that this increase alone surpasses the entire market capitalization of any other automaker, with the exception of Toyota.

As a researcher, I’ve come across an article from MarketWatch highlighting Tesla’s impressive delivery numbers reported in early July as a significant contributor to the company’s recent momentum. However, it’s important to note that this article presents a well-rounded perspective from industry analysts.

According to Rusch’s perspective, Tesla’s stock direction hinges significantly on the estimated worth of its Full Self-Driving (FSD) and Artificial Intelligence (AI) platform. In simpler terms, while Tesla has shown remarkable progress in recent times, the journey forward for this trailblazing electric vehicle company may still present formidable challenges and ambiguities.

Based on an analysis by Alexandra Canal for Yahoo Finance, Morningstar’s equity strategist, Seth Goldstein, pointed out that the investment community’s perspective towards Tesla’s expansion has recently improved. This development follows Tesla’s below-par Q1 deliveries, which initially raised doubts about its growth pace among investors. However, the recent surge in Tesla’s stock price indicates growing optimism regarding the company’s future potential.

As a Tesla investor, I’m eagerly anticipating the release of the company’s next quarterly results on July 23, which will be announced after market hours. One aspect that particularly piques my interest is Tesla’s progress in developing more affordable electric vehicles. Goldstein underscores the significance of Tesla delivering a clear and definitive timeline for launching these vehicles. The company has hinted at a potential rollout as early as 2025. This timeline holds immense importance for preserving my confidence in Tesla’s growth story, given its potential impact on the mass market adoption of electric vehicles.

As a researcher following Tesla’s stock performance, I believe that for the company’s shares to maintain their strength, it is crucial that they meet or even expedite their delivery growth schedule beginning in 2026. Showcasing a solid second wave of deliveries would likely bolster investor confidence and keep sentiment positive. However, any delays or ambiguity from Tesla’s management regarding this timeline might trigger a decline in the stock value.

Beyond earnings and shipments, investors are equally intrigued by Tesla’s prospects in the autonomous vehicle sector. As noted by Yahoo Finance, Tesla plans to reveal its highly anticipated robotaxi on August 8. This announcement is viewed as another potential avenue for expansion for the company, fueling further anticipation and conjecture about Tesla’s future progress.

Read More

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Skeet Ulrich Reportedly Set to Return For ‘Scream 7’

2024-07-10 14:54