As a researcher observing the economic landscape, I’ve noticed a significant turbulence in financial markets following President Donald Trump’s recent tariff proposal. This announcement seems to have ignited a steep decline in major U.S. stock indexes.

EU Retaliation Looms as Trump Issues Tariff Ultimatum

According to several reports, the president has unveiled a bold new plan: a 50% tax on imports from the European Union and a 25% tariff on iPhones made overseas, both scheduled to kick in on June 1. According to the Trump administration, the aim is twofold—put pressure on the EU amid ongoing trade tensions and nudge production of popular tech gadgets back on American soil.

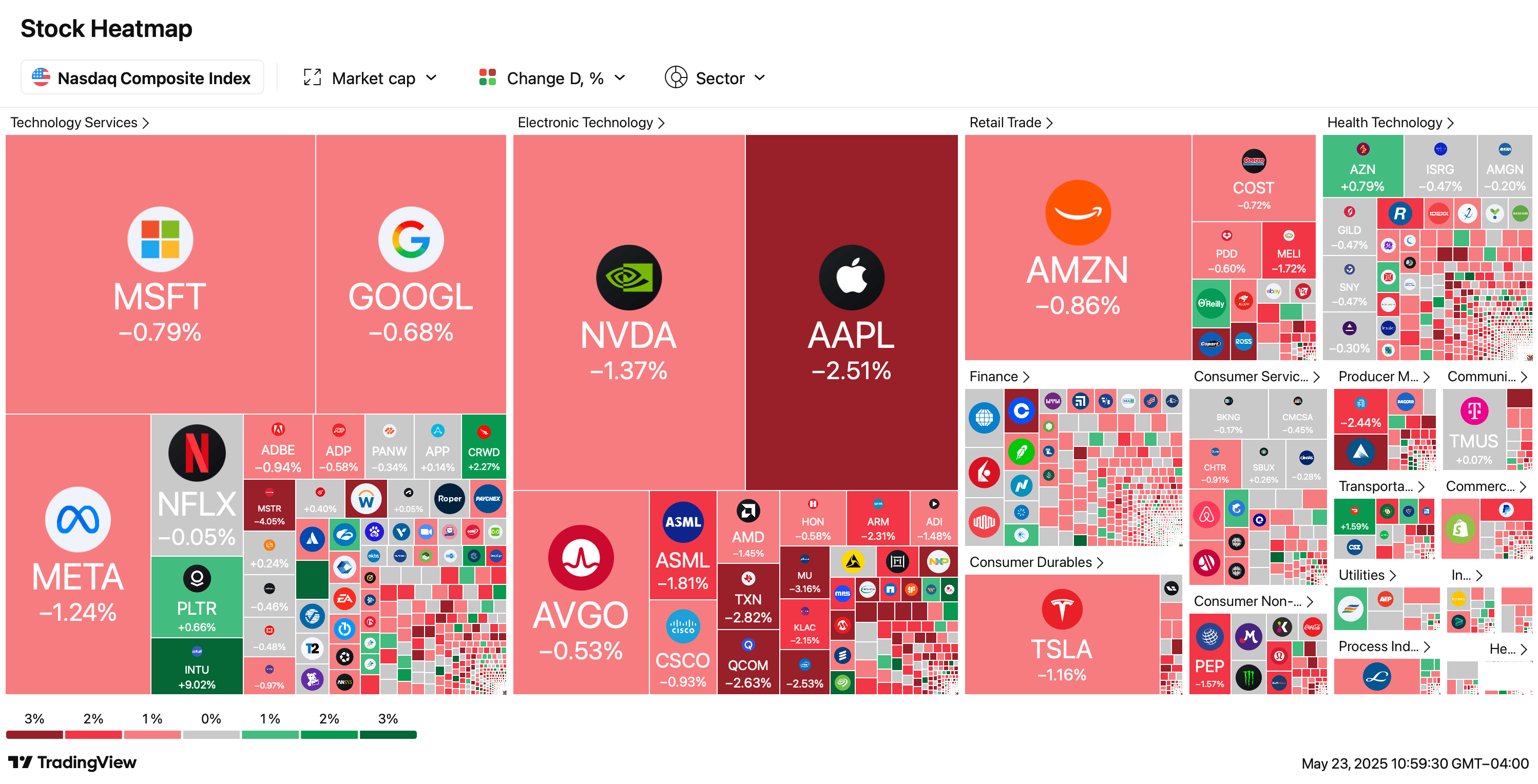

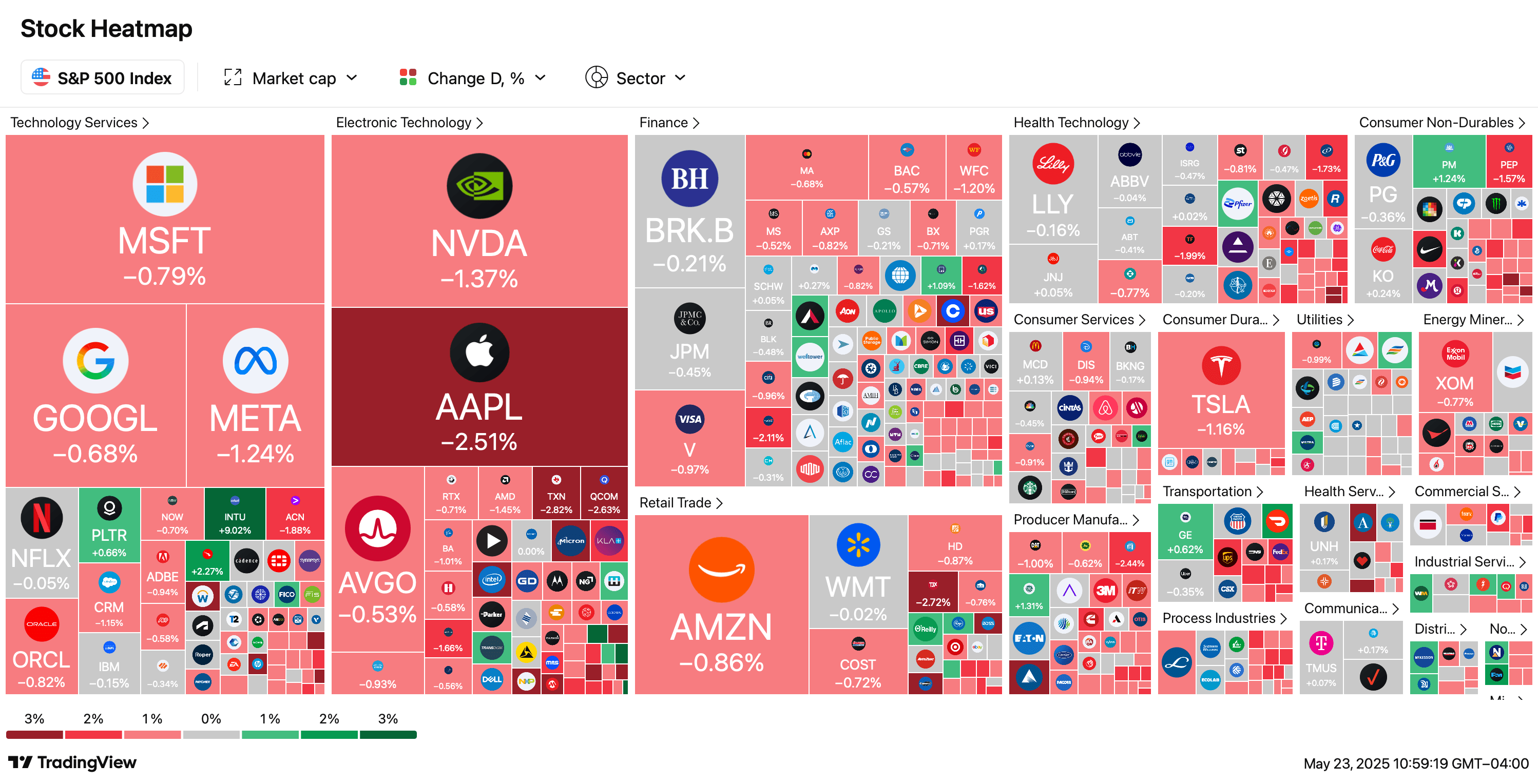

Wall Street wasted no time reacting. The Dow Jones Industrial Average tumbled, and the S&P 500 and Nasdaq followed suit with steep losses. This quick retreat highlights growing investor anxiety over the possible domino effect on international trade and corporate bottom lines.

Apple, front and center in this shake-up, watched its shares slide as investors worried that added costs might lead to higher prices and weaken demand for the popular iPhone. Other global giants in tech, autos, and consumer goods are also bracing for a bumpier, costlier road ahead.

Since Trump took office, economists have been waving caution flags, warning that these tariffs could push up prices for everyday shoppers and drag on the pace of economic expansion. Meanwhile, the EU could hit back with its own set of duties, raising the stakes and threatening smoother trade flows.

Despite the White House claiming that tariffs are part of a strategic trading strategy, there has been no resolution in these negotiations yet. U.S. and EU representatives continue to engage in discussions, and it’s understood that an ongoing impasse may prolong economic uncertainties within the market.

In light of the potential increase in cost for American products and the strain on family finances, both consumers and investors are facing new hurdles. As Wall Street prepares for further market fluctuations, the exact consequences of these proposed tariffs remain uncertain.

Read More

2025-05-23 19:17