In a bold display of bravado, Trump has unleashed a new wave of tariffs upon Canada, a move that echoes the defiance of a schoolyard bully demanding lunch money from a classmate. With a flourish, he has reiterated his desire to annex Canada, as if the northern neighbor were merely a wayward province rather than a sovereign nation.

As with his previous proclamations, this latest threat could send shockwaves through the crypto markets, yet one must ponder: are these tariffs already factored into the market, or are we merely witnessing the prelude to a recession that looms like a dark cloud over the horizon?

Trump’s Tariff Tactics: A Comedy of Errors

President Trump’s proposed tariffs are wreaking havoc on the crypto market, and it appears the chaos is far from over. Back in February, Canada and Mexico managed to delay these tariffs, providing a brief respite for the beleaguered crypto enthusiasts. But alas, the storm is brewing anew as Trump prepares to impose a fresh tariff on Canada:

dairy sales, automobile manufacturing, military spending, and, of course, the perennial call for annexation. Because why not?

This last demand, a complete obliteration of Canada’s national autonomy, has become a sticking point in this tariff saga. Following the US’s tariffs against China, the latter retaliated, and Canada, not to be outdone, joined the fray, igniting a fresh wave of support for its ruling party.

This surge in popularity is crucial, prompting Canada to adopt a tougher stance, to which Trump has responded with equal fervor. The situation escalates, and it seems both parties are trapped in a game of chicken with no clear exit strategy.

What does this mean for the crypto market? These tariffs have consistently heralded a bearish trend, with markets plummeting in tandem with each new announcement. 📉

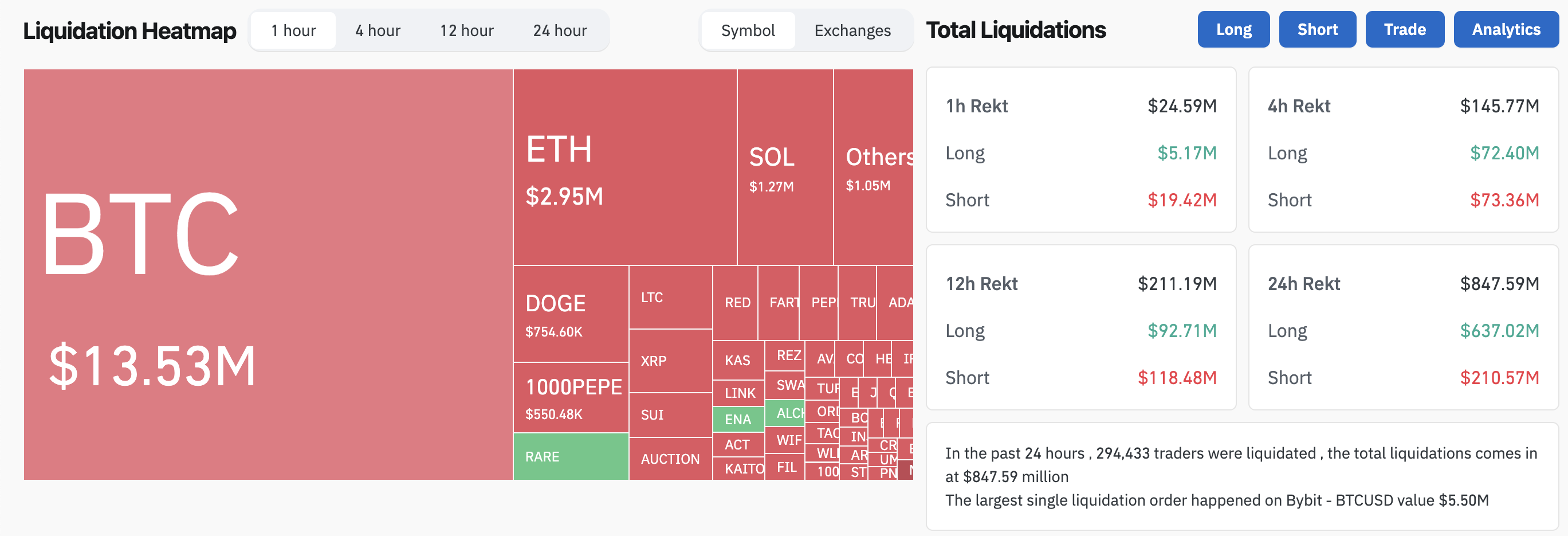

Moreover, crypto liquidations are already soaring, and Bitcoin‘s price is floundering like a fish out of water. New tariffs against Canada could spell disaster for the industry.

However, the market was already on a downward trajectory before Trump’s latest tariff announcement. The broader macroeconomic landscape appears grim, and these tariffs may not significantly alter the course.

The crypto community must remain vigilant as the situation unfolds, for when—or if—the tariffs take effect, their impact will become clearer.

Ultimately, “if” is the operative word here. Trump has previously hesitated to implement tariffs against Canada and Mexico; will he blink again? 🤔

This uncertainty is far more perilous than any tariff, as a loss of confidence in the market could have dire consequences for the crypto realm.

The most pressing question remains: will we soon face a full-blown recession? These tariffs may or may not materialize, and if they do, Trump could very well retract them within 24 hours. ⏳

In this chaotic moment, it is nearly impossible to ascertain whether any single policy could alter the course of events.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-03-11 21:40