For well over a century, stocks have pirouetted their way to glory as the belle of the ball when it comes to investor returns, though the occasional two-step with volatility does keep one’s knees knocking. The venerable S&P 500, that stately dance card of equities, and its companions the Dow Jones Industrial Average – ever the top-hatted gentleman – and the Nasdaq Composite, sprightly as a debutante in a ball gown, have all waltzed merrily toward record highs.

Yet among this grand ballroom of investments, there exists an exclusive quadrille: the trillion-dollar market cap club. Only 11 members strong, this ensemble includes the “Magnificent Seven” – tech’s own Avengers – alongside Warren Buffett’s Berkshire Hathaway, Taiwan Semiconductor Manufacturing, Broadcom, and Saudi Aramco, which prefers to sip tea in Riyadh rather than strut on Wall Street.

Breaking into this coterie requires more luck than a blindfolded golfer at a charity tournament, with the nearest contender needing to conjure $200 billion from thin air. But lo! President Trump’s tariff policies, those economic confetti cannons, may just scatter the confetti required for a new member. And would you believe it – this Cinderella story stars not a silicon valley prince, but a retailer with more staying power than a pair of well-worn brogues.

The tariff tango stirs inflation’s tea leaves

On April 2’s stage, after the curtain fell on Wall Street’s daily performance, His Tariffness unveiled a global 10% tariff baseline – a tariff tango with dozens of nations that’ve been rather cheeky with their trade balances. Reciprocal rates followed, though adjustments have been made with all the consistency of a London fog.

While trade deals have been stitched together with diplomatic needlework, uncertainties linger like an unwanted houseguest. Will American goods face cold shoulders abroad? Might anti-American sentiment bloom like a noxious rose? These questions hang heavier than a wet fog at midnight.

Yet the true bogeyman here is inflation, that mischievous poltergeist rattling the economic rafters. A December report from Liberty Street Economics – four clever clogs at the New York Fed – revealed how Trump’s China tariffs of yore treated inflation like a champagne bottle at a wedding: shaken, not stirred.

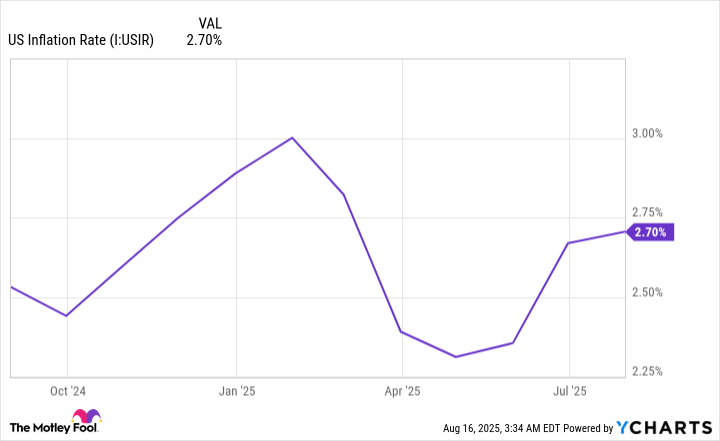

Output tariffs, you see, target finished goods – a blunt instrument for protecting domestic industries. Input tariffs, however, tax the very building blocks of production, from precious metals to humble fasteners. These insidious levies seep into inflation like tea into a saucer, nudging the CPI-U upward from 2.35% to 2.7% as tariff tremors register on the economic Richter scale.

For most firms, this inflationary dragon rearing its snout spells trouble. But for one retail Goliath, it’s a positively Jeevesian opportunity.

Walmart: The plucky protagonist of the trillion-dollar play

Imagine our hero, Walmart (WMT), currently $202 billion shy of trillionaire status – a mere stone’s throw in financial fables. While AI stocks preen like peacocks at a garden party, this Arkansas-based stalwart marches steadily toward its goal, pockets stuffed with bulk discounts.

When inflation’s chill wind blows, Walmart becomes the warmest of cardigans. Its bulk-buying brawn – a talent akin to Mary Poppins’ bottomless handbag – allows it to undercut rivals while maintaining margins thinner than a vicar’s smile at a budget committee meeting. Even should Trump’s tariffs nibble at its margins, the resulting consumer stampede to low prices would make up the difference faster than a butler’s apology for spilled crumpet.

But wait! There’s more! Artificial intelligence, that wizard of the modern age, now assists Walmart’s inventory management with the precision of a Swiss watchmaker. Automation hums in warehouses like well-trained bees in a hive, while Walmart+ subscription services buzz merrily toward profitability – a recurring revenue stream as reliable as a grandfather clock.

In the fiscal first quarter, e-commerce sales surged 22%, with U.S. operations turning the corner from red to black with all the grace of a swan emerging from a pond. This $800 billion enterprise, armed with AI and old-fashioned grit, stands poised to inherit the trillion-dollar crown when inflation’s winds blow strongest.

While tariff tantrums and inflationary frolics might send lesser ships to the financial iceberg, Walmart steams ahead like the Queen Mary at full throttle. The cards may yet shuffle, but if history’s dealt this hand correctly, the next trillion-dollar tale shall be written not in silicon valley, but in the hallowed aisles of America’s favorite shopping emporium. 🎩🛒

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Zack Snyder Shares New Ben Affleck Batman Image: ‘No Question — This Man Is Batman’

2025-08-19 11:38