The air is thick with bullshit, friends. Trump, that gilded phantom, still crowing about the market as if it’s some personal victory lap. The S&P 500 and Nasdaq… yeah, they’ve been twitching upwards, a pathetic 15% and 19% respectively since he slithered back into office. But don’t mistake a fever dream for a recovery. This isn’t prosperity; it’s a rigged game, fueled by artificial intelligence and infrastructure promises that smell suspiciously like swamp gas.

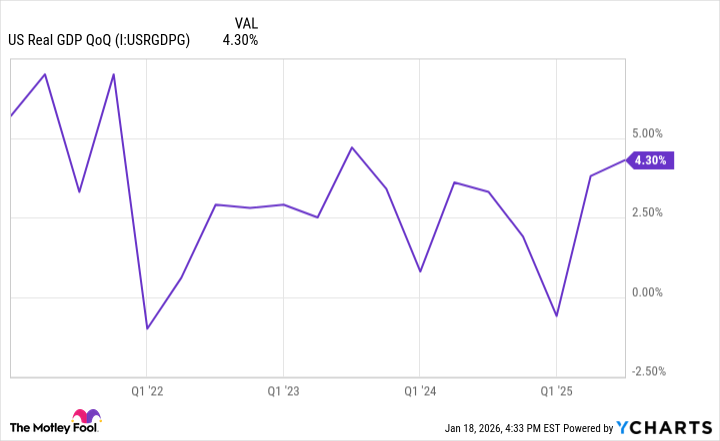

Everyone’s gushing about GDP, that supposedly sacred cow of economic health. 4.3% annualized growth in the last quarter? Fine. But numbers are just that – numbers. They don’t tell you about the hollow ache in the gut of the working man, the mounting debt, the creeping sense that everything is about to… unravel. Treasury Secretary Bessent, babbling about a “surprise on the upside” and a 7-8% nominal GDP? Don’t fall for it. Nominal, real… it’s all smoke and mirrors. They’re propping this thing up with tariffs, slapping taxes on everything until the consumer is choking. A temporary high, bought and paid for with your future purchasing power.

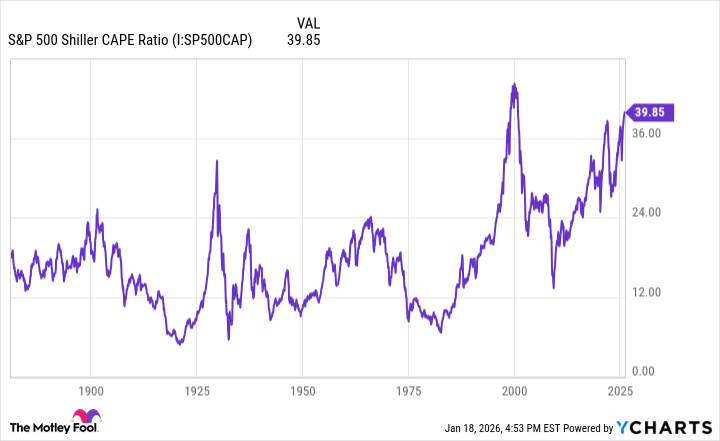

The sheep in Washington are bleating about optimism, but I smell a trap. A beautiful, glittering, utterly dangerous trap. And the stock market? It’s sending out distress signals, flashing red warnings that nobody wants to acknowledge. They’re too busy counting their phantom gains. The CAPE ratio… now there’s a metric worth paying attention to. Currently hovering around 40? That’s not a healthy glow, that’s a pre-collapse flush. We’ve only seen this level twice before: the roaring twenties, right before the Great Depression, and the dot-com bubble, before it all went up in flames. History doesn’t repeat itself, they say. It rhymes. And this rhyme is sounding awfully ominous.

The big tech companies are doubling down on infrastructure, building data centers, hoarding chips… all very impressive. But unemployment is still a festering wound, and the Fed is playing some kind of twisted game with interest rates. This isn’t sustainable. It’s a house of cards built on a foundation of debt and delusion. So, what’s a sane investor to do? Forget about chasing the latest hyped-up growth stock. Those are just fool’s gold. I’m talking about blue-chip dividend payers. Solid, dependable companies that have weathered storms before. Businesses with a history of rewarding shareholders, even when the world is going to hell.

And for God’s sake, hold some cash. Real, tangible liquidity. A safety net to cushion the inevitable fall. A reserve to buy the dip when the vultures start circling. Because a correction is coming. It always does. The question isn’t if, it’s when. And when it hits, the smart money will be ready. Forget the frenzy. Forget the hype. Focus on value. Focus on dividends. And prepare for the storm. This isn’t a time for heroes. It’s a time for survivors.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-01-21 14:22