Ah, Trump—our beloved economic maestro—has taken center stage once again, conducting a symphony of chaos with his economic policies. You’d think he was trying to win a gold medal in market turbulence, given the way stock prices are doing the cha-cha! 💃 Or is it more like a dive into uncertainty? As the United States grapples with a mind-boggling debt maturity of $7 trillion, all eyes are on whether Trump’s famous tariffs can coax the Federal Reserve into lowering interest rates. Because nothing says “I love you, economy” quite like uncertainty, right?

In a riveting chat with Erwin Voloder, the European Blockchain Association policy wizard, and Vincent Liu, the investment oracle at Kronos Research, we learned that while Trump might be waving his tariff threats like a magician pulling a rabbit out of a hat, the crowd isn’t clapping for more. They’re worried the risks might be bigger than his ego. And we all know that’s saying something!

The US Debt Dilemma

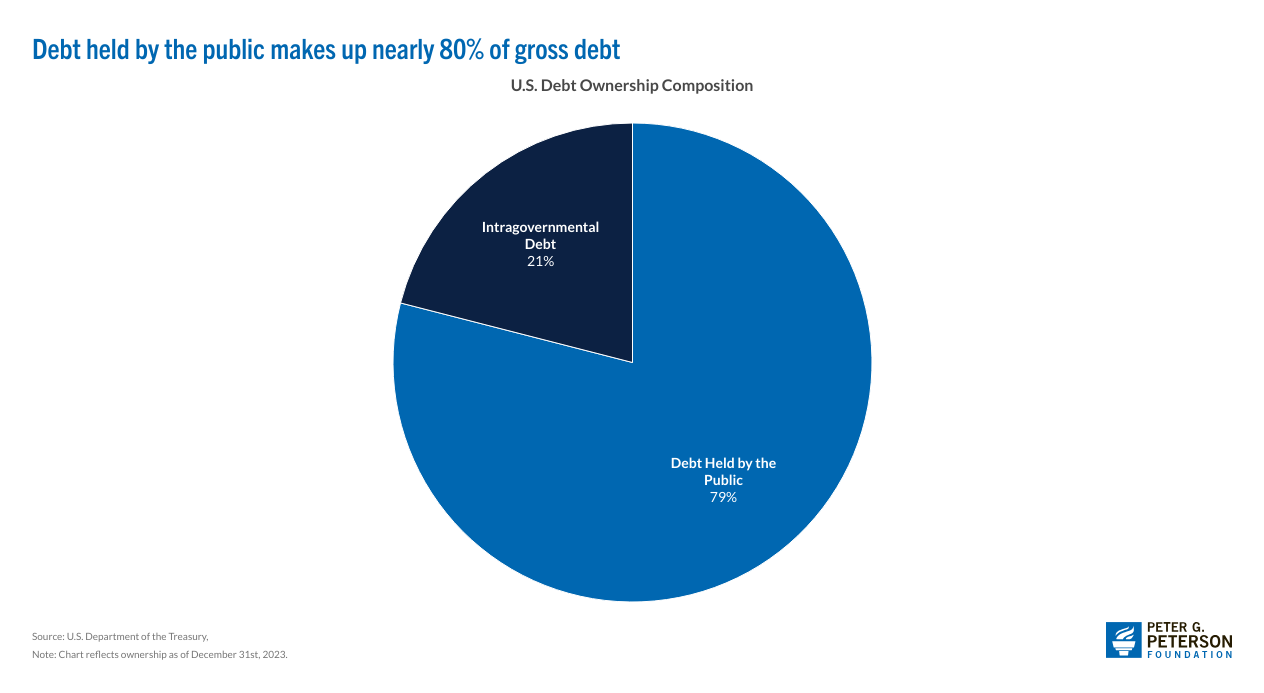

So, let’s talk numbers: the United States is sitting pretty on a national debt of $36.2 trillion. That’s right—trillion! This grand total is what Uncle Sam owes after borrowing to fund his endless shopping sprees. 🛒

In layman’s terms, the government has racked up quite the tab, and it’s time to face the music soon—like, in the next six months, to be precise. 🎶 Let’s just hope there’s something left in the old wallet to cover that $7 trillion bill!

When the government borrows, it issues debt securities—think Treasury bills and notes that are just as unexciting as they sound. Look, they have a maturity date, which means the government needs to return what it took. Talk about a ticking time bomb! 💣

Now, they could either pay the debt—or, plot twist!—refinance. But let’s be real, refinancing is like taking out a new credit card to pay off your old one—classic move, very responsible. But with interest rates built like a skyscraper, who knows how that’ll play out.

High Interest Rates: An Obstacle to Debt Refinancing

If the government chooses to refinance, they can roll over their debt, which means they’re just kicking that can down the road—noble! But alas, high interest rates put a damper on the party!

This week, in a surprising turn of events, the Federal Reserve announced it will keep interest rates spiked between 4.25% and 4.50%. It seems they’ve figured out that keeping rates high is a fun way to control inflation. On one hand, yay for investors who want better bond returns; on the other hand, our government will be crying in their soup—a big, budget-busting soup. 🥣

“In practical terms, even a 1% higher interest rate on $7 trillion equates to $70 billion more in interest expense per year. A 2% difference would be $140 billion extra annually—real money that could otherwise fund programs or reduce deficits,” noted Voloder. Someone pass him a tissue!

This scenario makes it crystal clear: the United States is playing a high-stakes game of monetary limbo, and judging by the upcoming deadlines, they might just need to embrace stability. But here comes Trump waving his tariff wand like it’s 2016 again. 🤦♀️

Trump’s Tariff Policies: A Strategy or a Gamble?

Throughout his illustrious terms (or rather, stints), Trump has been all about throwing tariffs like confetti at parties—wedding parties, however, where someone typically leaves unhappy. Just ask Canada and Mexico! But really, who can resist the allure of shaking up trade policies while attempting to revive those good old American dollars?

In his latest speech, Trump boldly professed that his tariff policies are here to ‘protect American workers.’ I mean, who knew protection could feel so much like a double-edged sword? 😬

“I will immediately begin the overhaul of our trade system to protect American workers and families,” Trump declared. Magnificent, except the resulting economic uncertainty has made investors feel like they’re on a roller coaster—thrilling yet slightly nauseating! 🎢

In truth, the recent market reactions have sent investors into a panic mode that rivals only the latest episode of “Real Housewives.” Stocks plummeted, Bitcoin hit the panic button, and Wall Street’s fear index is off the charts, marking its highest peak of the year. 🙈

“Intentionally rising economic uncertainty via tariffs carries steep risks: markets could overreact, plunging and increasing percentages for a possible recession, as seen in 2018’s trade war drop,” Liu advised. Because who wouldn’t want to relive that stress? 🤷♂️

Whenever traditional markets are in a tizzy, crypto follows suit like an overzealous friend. Welcome to the wild ride!

“Trump’s production-first, America-First economics mean digital asset markets must grapple with higher volatility and less predictable policy inputs,” Voloder quipped. Buckle up, folks!

Some see these measures as erratic maneuvers of a reckless captain steering a ship into a stormy sea. Others call it a master plan. Either way, eyes are glued to the dance floor as we await the next economic misstep.

Is Trump Using Tariffs to Influence the Federal Reserve?

In a spit-take-inducing video, Anthony Pompliano, some finance dude with a flair for the dramatic, suggested Trump is deliberately crashing the market. Because nothing says “I care” like a good ol’ market meltdown, right?

The President and his team are intentionally crashing the market.

Is this a master plan or are we watching uncontrolled destruction?!

— Anthony Pompliano (@APompliano) March 10, 2025

It seems tariffs act like that obnoxious friend who eats all the chip dip—disruptive, costly, and often the source of economic uncertainty that keeps everyone on edge. Investors are understandably nervous, and businesses are opting to batten down the hatches, waiting for the storm to pass. 🌪️

So, as we dive deeper into this chaotic financial ride, the question remains—will Trump’s tactic of *tariff-raising* lead to a dramatic fall in interest rates, or will it leave us all in economic purgatory forever? Stay tuned!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-21 18:43