Dear reader, if you’ve ever wondered why the stock market behaves like a medieval knight with a compass, you’re not alone. This week, cannabis stocks danced like a dervish, fueled by whispers of President Trump’s “I’ll fix it” approach to drug policy. Trulieve, Curaleaf, Tilray, and Green Thumb Industries-our favorite players in the “green gold” game-saw their shares wobble like a drunk tightrope walker.

On Dec. 18, Trump signed an executive order that felt like a magician pulling a rabbit out of a hat-except the rabbit was a Schedule III classification. Let’s unpack this. The Controlled Substances Act, a medieval document if ever there was one, divides drugs into five categories. Schedule I? Think of it as the “I’m a monster” tier, reserved for substances with more potential for abuse than a toddler with a paintbrush.

How Trump’s Marijuana Rescheduling Shifts U.S. Drug Policy

Imagine a world where marijuana is as legally restricted as a pirate’s treasure map. Schedule I drugs are the “nope, not even in a lab” crowd. But Trump’s EO? It’s like giving a dragon a library card. Now, marijuana shares a shelf with anabolic steroids and ketamine-because nothing says “medical breakthrough” like a performance-enhancing drug and a hallucinogen.

But here’s the twist: reclassifying marijuana doesn’t make it legal. It’s more like upgrading your Netflix plan-still a subscription, just with better perks. For cannabis companies, this could mean fewer roadblocks in research and banking. Imagine a world where banks stop treating marijuana businesses like they’re selling cursed artifacts.

What Does Rescheduling Change for the Cannabis Industry?

Think of 280E as the IRS’s version of a medieval curse. It’s a tax provision so archaic, it should come with a warning label: “May cause headaches, lawsuits, and existential dread.” But with Schedule III, companies can deduct expenses like rent and utilities-like a wizard’s spell for profitability. Suddenly, product development and medical research feel less like a gamble and more like a calculated risk.

Is Now a Good Time to Buy Cannabis Stocks?

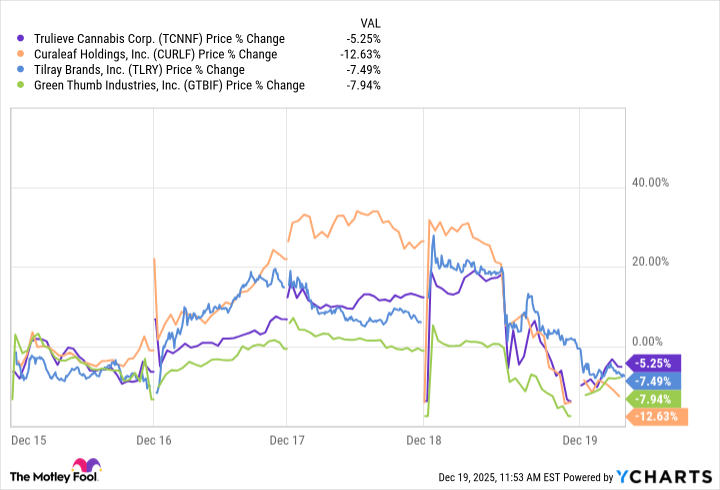

As the chart above shows, cannabis stocks took a nosedive post-EO. Why? Because investors are as confused as a penguin in a sauna. This reclassification is a first step, not a grand finale. It’s like saying “I’ll be back” after a poorly timed punchline. Implementation? Still a mystery. Will it boost medical research? Maybe. Will it make your portfolio feel better? Probably not.

So, dear reader, if you’re considering diving into cannabis stocks, think twice. This market is as volatile as a slapstick comedy. Day traders might find it entertaining, but long-term investors? They’re the ones who actually plan for retirement, not just the next high.

Remember: the stock market is a game of chess, and sometimes the pieces move like a drunken squirrel. Stay sharp, and may your investments be as stable as a well-timed joke.

🧠

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The Weight of Choice: Chipotle and Dutch Bros

- Top gainers and losers

2025-12-23 14:27