As a seasoned researcher who has witnessed the ebb and flow of financial markets for decades, I find myself both intrigued and alarmed by Trump’s sudden interest in cryptocurrency, particularly Bitcoin. Having lived through the aftermath of the 2008 financial crisis, I can’t help but draw parallels between the deregulation of mortgage derivatives then and the potential loosening of oversight for crypto assets now.

A current article published by The New Yorker reveals an astonishing shift in the 2024 U.S. presidential campaign – Donald Trump has surprisingly taken up the cause of cryptocurrencies, with a strong emphasis on Bitcoin.

Trump’s Crypto Conversion

The article from The New Yorker states that Trump, who previously dismissed Bitcoin’s worth as being “built on nothing but air,” has since become its most ardent supporter. According to this report, Trump’s speech at a Bitcoin conference in Nashville included a pledge to establish a “strategic reserve of Bitcoins” and aim for the U.S. to be recognized as the world’s leading Bitcoin powerhouse.

Regulatory Rollback Concerns

An important point made by The New Yorker is their observation that President Trump has vowed to dismiss Gary Gensler, the present head of the Securities and Exchange Commission (SEC). The piece emphasizes that Gensler has been outspoken against the cryptocurrency sector, labeling it as marked by “a history of collapses, scams, and bankruptcies.” If he were to be removed from his position, as suggested by The New Yorker, this could potentially indicate a lessening of regulatory scrutiny.

Parallels to Past Financial Crises

In a similar vein as the 2008 financial crisis, an article published by The New Yorker raises concerns about the possible repercussions of relaxing regulations on cryptocurrencies. This piece refers back to the Commodity Futures Modernization Act of 2000, which excluded certain types of financial instruments from regulation, causing a surge in mortgage derivatives that significantly contributed to the economic collapse.

Integration with Mainstream Finance

An article published by The New Yorker highlights worries over the future introduction of cryptocurrencies, which are currently not heavily regulated, into traditional banking systems. Dennis Kelleher, president of Better Markets, voices his concerns about potential issues that could arise if a crypto market collapse occurs in a scenario where cryptocurrencies have been fully integrated within the financial system, potentially impacting banks as well.

Political Influence of Crypto Money

As an analyst, I’ve found some interesting insights in a recent article published by The New Yorker about the crypto industry. It sheds light on the substantial political contributions made within this sector. Specifically, it references data from Bloomberg that indicates three prominent pro-crypto Super PACs have amassed $170 million from donors such as Coinbase, Ripple, and venture capital firm Andreessen Horowitz. The article raises the possibility that these funds could potentially shape policy decisions in a manner advantageous to the crypto industry.

Trump’s Personal Interests

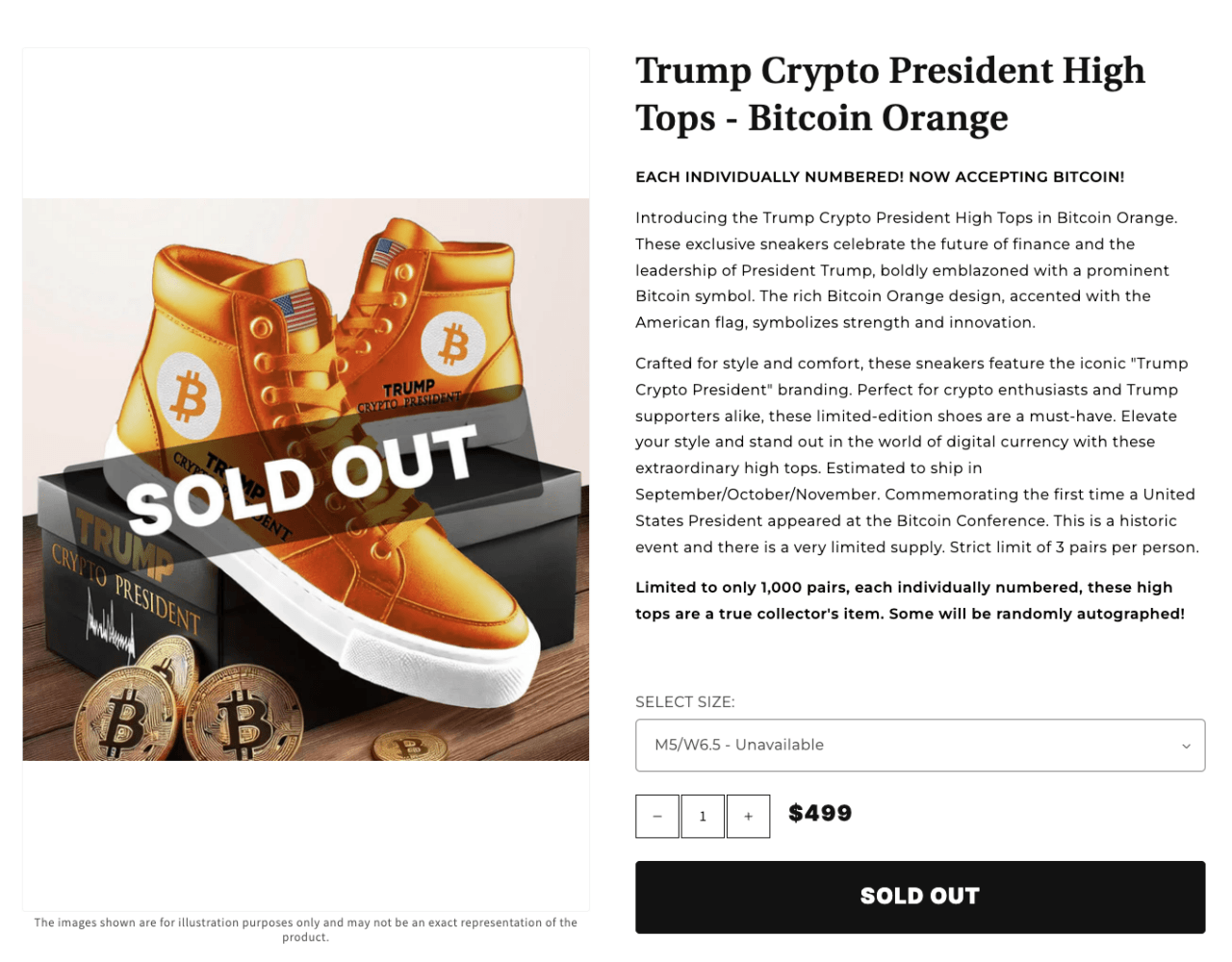

The magazine The New Yorker notes that Donald Trump’s support for cryptocurrencies goes beyond just policy suggestions. In fact, Trump’s business has released a series of sneakers themed around Bitcoin, indicating a personal stake in the success of this digital currency. This could create potential conflicts if Trump were to re-enter the White House, as it might influence his decision-making regarding crypto.

Lack of Clear Social Purpose

One point The New Yorker magazine raises is that it’s unclear what significant societal benefit cryptocurrencies provide. In contrast, earlier financial inventions like mortgage-backed securities were marketed as helping to increase homeownership, even if they ultimately fell short of this goal. The lack of a clear social purpose for cryptocurrencies, according to The New Yorker, makes it challenging to support less stringent regulations given the potential risks involved.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-08-06 19:23