In a move even the most seasoned casino gambler would envy, the US government is about to let your grandkids’ retirement savings dabble in the mysterious world of cryptocurrencies and other ‘risky’ investments – because why not turn grandma’s nest egg into a rollercoaster? 🎢💸

Bitcoin Gets a Boost as Trump Thinks about Playing with Digital Dollars

Word on the street (or rather, the mainstream media, which is almost as reliable as a fortune teller after three sherries) is that President Donald Trump is signing an executive order this Thursday that’s so daring, it makes daring look dull – allowing 401(k) plans to hold private equity, real estate, and yes, even crypto. The reaction? Bitcoin sprinted up 1.15%, probably yelling, “I’m in! Hold my blockchain!” while the stock markets, as expected, played it cautiously with a mug of lukewarm tea ☕️.

//www.cambridgeassociates.com/wp-content/uploads/2020/11/WEB-2020-Q2-USPE-legacy-Benchmark-Book.pdf”>Details here

.

According to the wise oracles at Vaneck, Bitcoin’s track record is pretty impressive – outshining other assets in eight out of eleven recent years. Despite its legendary volatility, it manages to turn heads and portfolios alike. Now, thanks to Mr. Trump’s upcoming signature, your retirement fund may soon get a shot at that digital gold rush. 💰✨

Market Numbers, because humans love shiny things

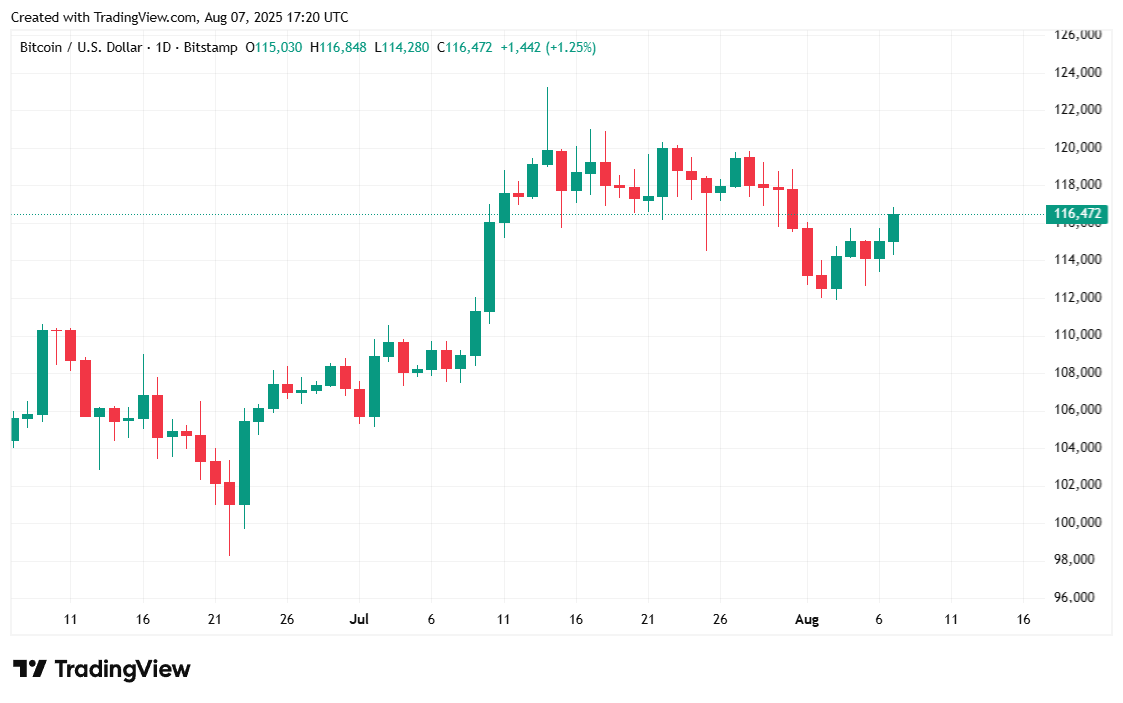

Bitcoin is sitting pretty at $116,326.23 – up 1% in the last 24 hours, but still down a smidge since last week. It’s been oscillating between $114,279.71 and $116,844.08, kind of like a cat who can’t decide whether it wants to nap or knock everything off the table.

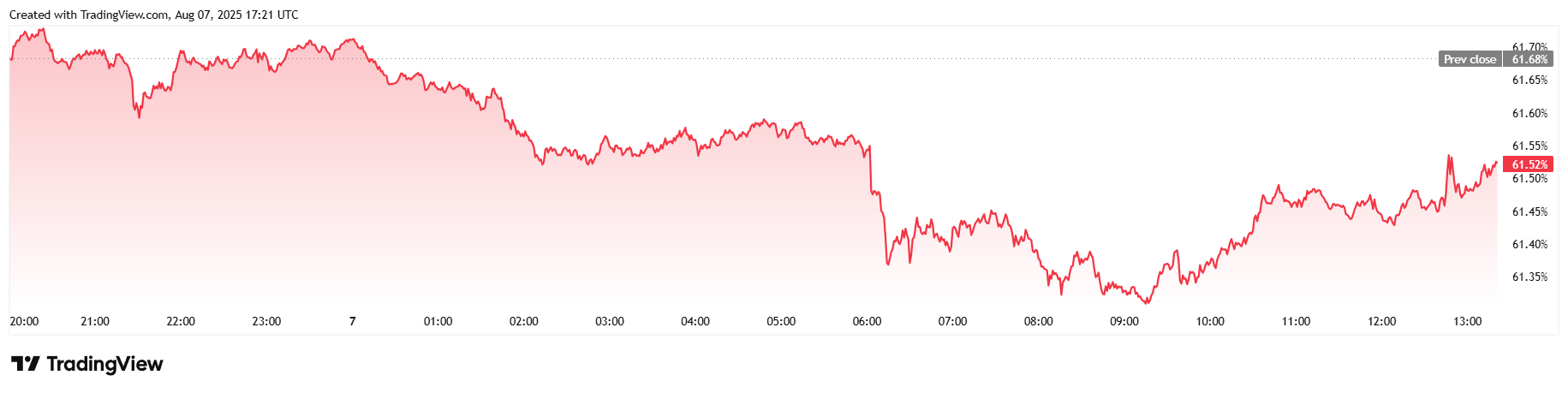

Daily trading volume shot up 5.82%, reaching $60.27 billion, because Americans love their digital dollar thrill rides. Market cap? Up 1.06% to $2.31 trillion – enough to make even the most hardened Wall Street cowboy tip his hat. Bitcoin’s dominance dipped slightly to 61.52% – probably worried about losing its crown, but still very much the alpha in the room.

Futures are also feeling the love – open interest hit $80.44 billion, up nearly 2%, while liquidations balanced out at $39.58 million, because even the market likes a good nap now and then. Short positions, probably thrown out like yesterday’s donut, totaled $31.12 million in losses, and a mere $8.46 million in longs also went gently into that good night.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- The Best Actors Who Have Played Hamlet, Ranked

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

2025-08-07 21:18