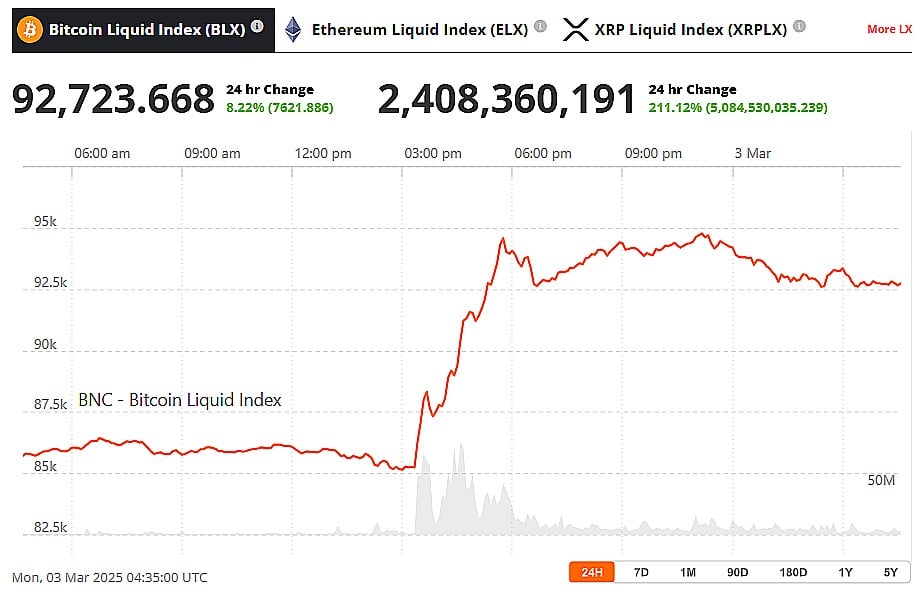

Ah, behold the tale of Bitcoin (BTC), that fickle friend of traders! In the past week, it has danced a merry jig, down ~1.5% yet soaring over 10% in the last 24 hours. What sorcery is this? A sudden spike, like a phoenix rising from the ashes, followed the grand proclamation of none other than President Donald Trump, who unveiled the five digital treasures destined for the new US crypto strategic reserve: Bitcoin, Ethereum (ETH), Solana (SOL), XRP (XRP), and Cardano (ADA). 🎉

Such news sent the digital assets soaring, as if they had been given wings after a long, dreary winter of despair. Fear had gripped the market, driven by whispers of a US reciprocal tariff plan that threatened inflation like a dark cloud. On February 27th, BTC dipped below ~US$80,000, but lo and behold, the weekend brought a miraculous recovery!

Trump’s Crypto Reserve: A List of Digital Wonders

“A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration,” Trump declared on March 2nd, via the Truth Social platform. “My Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA.” Who knew crypto could be so political? 🤔

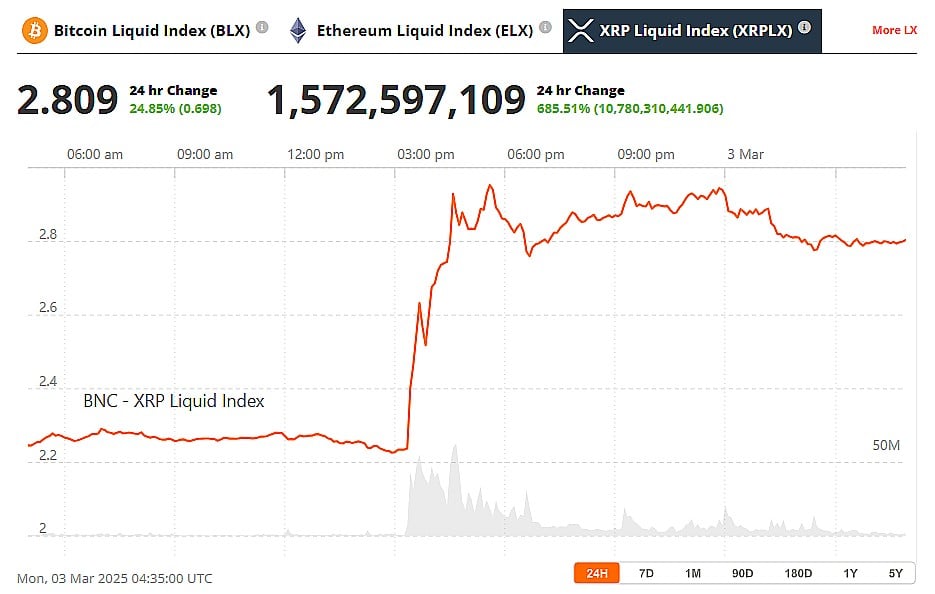

After a dramatic fall in February, the Trump announcement has breathed new life into the XRP price. Price Source – Brave New Coin XRP Liquid Index

These assets, once shrouded in mystery, have now burst forth into the limelight! Following the announcement, ADA skyrocketed by over 60%, XRP by over 30%, and SOL by over 20%. An hour later, Trump clarified, “And, obviously, BTC and ETH, as other valuable cryptocurrencies, will be the heart of the Reserve. I also love Bitcoin and Ethereum!” ETH, feeling the love, jumped by over ~13% after this tweet. Love is in the air! 💖

On March 1st, Rhode Island introduced the Bitcoin Reserve Bill H6007, allowing the State to invest 10% of public funds, including retirement funds, into BTC. Talk about a bold move!

On January 23rd, Trump signed his first executive order that could shake the crypto world. During a televised address with his “AI and crypto czar,” David Sacks, he announced the order aimed at “Strengthening American Leadership in ’Digital Financial Technology’.” Sounds fancy, right? 🧐

“Protecting and promoting the ability of individual citizens and private-sector entities alike to access and use for lawful purposes open public blockchain networks without persecution,” is one of its lofty goals. Most of the order is dedicated to establishing technology and rules around crypto and its development in the U.S. One of its most important aspects is the creation of a working group to consider a national digital asset stockpile, potentially derived from cryptocurrencies seized by the Federal Government. Who knew the government could be so resourceful? 😏

Crypto Surge Amid Tariff-Induced Chaos

During a February 24th news conference with French President Emmanuel Macron, Trump announced his planned 25% tariffs on Canada and Mexico “are going forward on time, on schedule.” This plan, along with reciprocal tariffs against the rest of the world and chip restrictions with tariffs against China, stirred inflation concerns in the days that followed. Oh, the drama!

Tariffs are inflationary, raising the cost of imported goods. American businesses, reliant on imported materials, will pass these costs onto consumers. Manufacturers depend on imported components, and consumers on imported goods like Chinese electronics. Any tariff-driven price hikes will affect investment capabilities and US monetary policy, possibly requiring a hawkish pivot to combat them. Yikes!

The new Trump tariffs sent investors in risk markets like crypto and tech stocks scrambling for safety. The S&P 500, Dow Jones Industrial Index, and Nasdaq 100 faced tough weeks, dragged down by the selling of major tech assets. Crypto’s risk profile also took a hit following the record-breaking ~US$1.5 billion of off-shore crypto exchange Bybit the week prior. From February 24, BTC’s price plummeted from ~US$96

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-03-03 08:33