Ah, the TRUMP price, a veritable rollercoaster of financial folly, has found itself in a most unfortunate predicament, trading at a meager $21 after a staggering descent of approximately 72% from its lofty heights. In the span of a mere 24 hours, this meme coin has plummeted another 9%, extending its weekly losses to nearly 30%. One might say it is the financial equivalent of a cat falling from a great height—graceful in theory, but disastrous in practice. 🐱💸

In the past fortnight, TRUMP has shed nearly $10 billion in market capitalization, a reflection of the relentless selling pressure that seems to haunt it like a specter. The technical indicators, such as the RSI and CMF, remain as weak as a cup of tea left to steep for too long, leaving the meme coin at a crossroads: will it regain its former glory, or will it continue its descent into the abyss? 🤔

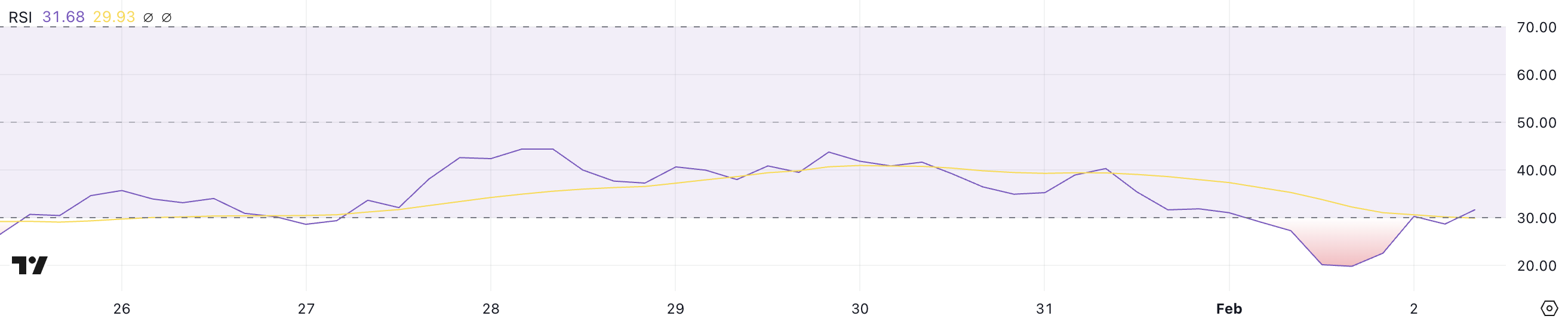

TRUMP RSI: A Tale of Sellers’ Dominance

The RSI for TRUMP languishes at a dismal 31.68, having remained below the neutral 50 mark for a week, with a particularly disheartening low of 19.8 recorded on February 1. This prolonged period of weakness suggests that the sellers are still firmly in control, as the token struggles to muster the strength for a meaningful recovery. It’s as if the coin is trying to climb a mountain while wearing lead boots. 🥾

The sharp dip to 19.8 reveals an extreme level of bearish sentiment, yet the recent recovery to 31.68 hints at a glimmer of hope. However, the inability to breach the 50 mark suggests that bullish strength is as elusive as a good Wi-Fi signal in the countryside, leaving TRUMP in a precarious position. 📉

The Relative Strength Index (RSI), that fickle friend of traders, measures the speed and magnitude of price movements, ranging from 0 to 100. Readings above 70 indicate overbought conditions, while those below 30 suggest an asset is oversold and may be poised for a rebound. With TRUMP’s RSI at 31.68, it hovers just above the oversold territory, yet still below the neutral 50 level, indicating that sellers continue to reign supreme. 🏰

The failure to reclaim the 50 mark over the past week reinforces a bearish outlook, reflecting a lack of sustained buying pressure necessary to shift the market sentiment. It’s like trying to push a boulder uphill—exhausting and seemingly futile. ⛰️

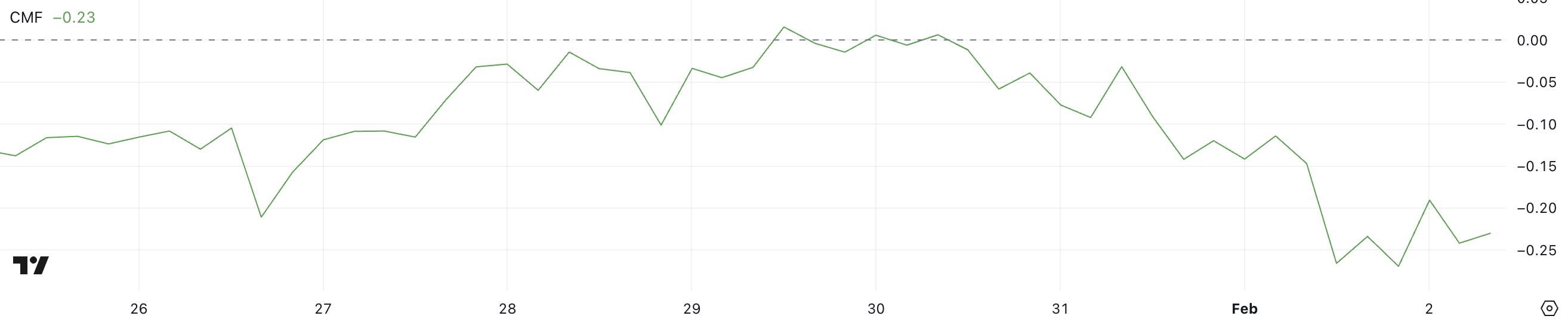

CMF: A Dismal Indicator of Capital Flow

The CMF for TRUMP currently sits at -0.23, marking its third consecutive day in negative territory. Just yesterday, it hit an all-time low of -0.27, a testament to the significant outflow of capital. It appears that the only thing flowing into TRUMP is despair. 😩

This sustained negative reading suggests that selling pressure has decisively outweighed buying interest, with more volume transacted at lower prices than one would care to admit. While the slight recovery to -0.23 indicates a modicum of stabilization, the overall trend remains bearish, signaling that TRUMP is struggling to attract consistent liquidity inflows. 💧

The Chaikin Money Flow (CMF), that ever-reliable indicator of capital accumulation and distribution, ranges from -1 to 1. Positive values indicate strong buying pressure, while negative values suggest persistent selling pressure. A CMF reading of -0.23 means that sellers are firmly in control, as more volume is flowing out of TRUMP than into it. Given that the CMF has remained negative for three days and recently hit its lowest level ever, one can only conclude that demand is as weak as a kitten. 🐾

TRUMP Price Prediction: A Future of Corrections?

The TRUMP meme coin, now trading near the $21 level, faces a formidable resistance at $24.58. As one of the most hyped meme coins ever launched, a resurgence in momentum could lead to a breakout above this resistance. If buying pressure strengthens and TRUMP

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- Does Oblivion Remastered have mod support?

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- DODO PREDICTION. DODO cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- Elder Scrolls Oblivion: Best Bow Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2025-02-02 17:52