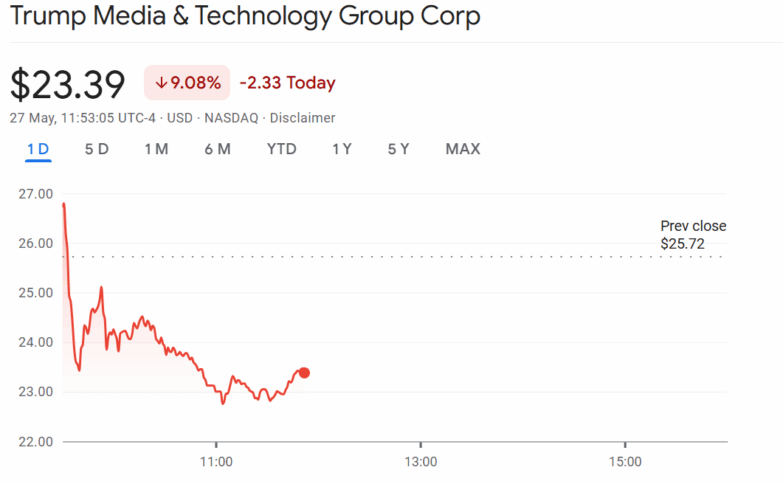

In a twist that could only be described as a cosmic joke, the Trump Media & Technology Group (DJT) has seen its stock plummet by over 9% today. This delightful drop came right after the announcement of a $2.5 billion private placement to create a Bitcoin treasury. Naturally, this has led to the burning question: did the company’s BTC plan just take a nosedive into the abyss of failure?

Trump Media’s Grand Bitcoin Treasury Scheme

According to the press release, which was likely written while sipping a fine cup of tea, the company plans to raise $1.5 billion through common stock and a staggering $1 billion through zero-interest convertible senior secured notes. About 50 institutional investors have agreed to this deal, which is expected to close by May 29, 2025—just in time for the next intergalactic council meeting. Crypto.com and Anchorage Digital will be the lucky custodians of the Bitcoin treasure, because who doesn’t want to babysit digital gold?

Trump Media boldly declared that their goal is to build a Bitcoin treasury so large it could rival the vaults of Scrooge McDuck. CEO Devin Nunes, in a moment of profound insight, proclaimed, “We view Bitcoin as an apex instrument of financial freedom.” Because nothing says freedom quite like a volatile cryptocurrency, right?

He further elaborated that the company aims to evolve into a holding company of high-value assets, all while waving the “America First” banner. The funds raised will also help expand Truth Social and support fintech projects under the Truth+ and Truth.Fi brands—because who doesn’t want more truth in their social media?

The common stock will be priced at the last market close, while the convertible notes come with a 35% premium and 0% interest. Ah, the sweet smell of exclusivity! This private placement is only for selected investors, not the public—because why let everyone in on the fun?

DJT Stock Takes a Dive

In a classic case of “what goes up must come down,” DJT initially jumped more than 10% in premarket trading, only to plummet back down to $23.39. The stock has now dropped over 26% since the beginning of the year, proving that gravity is indeed a harsh mistress.

Before the crash, DJT was trading around $25 for the week, but the speculation surrounding the Bitcoin reserve plan brought volatility that was more dramatic than a soap opera. The price briefly soared to $26 before doing a spectacular U-turn and plummeting back down.

At the end of the first quarter of 2025, Trump Media had $759 million in cash and short-term investments. Bitcoin will now join the assets on the company’s balance sheet, because why not throw a little digital currency into the mix? The placement agents helping with this grand scheme include Yorkville Securities, Clear Street, BTIG, and Cohen & Company, with Cantor Fitzgerald acting as the financial advisor—because every circus needs a ringmaster.

Moreover, this is one of the largest BTC treasuries announced by a public company recently. Devin Nunes explained that the Bitcoin investment supports the company’s goal to “defend our Company against harassment and discrimination by financial institutions.” Because nothing says “defense” like a cryptocurrency that can disappear faster than a magician’s rabbit.

Peter Schiff Weighs In

In a post on X, Peter Schiff, a well-known gold supporter and Bitcoin critic, chimed in with his thoughts. He suggested that DJT dropped because the market is simply tired of companies building treasuries. He also raised an eyebrow at how the company could create a Bitcoin reserve using investor funds while Trump himself had already bought BTC privately. A curious case of financial sleight of hand, perhaps?

Schiff questioned, “Also, how can Trump’s company front-run the strategic Bitcoin reserve, using taxpayers’ dollars to pump up what he bought first?” This comment adds a delightful layer of intrigue to the debate around the company’s Bitcoin strategy, implying that the move might unfairly boost Trump’s own holdings. Oh, the tangled webs we weave!

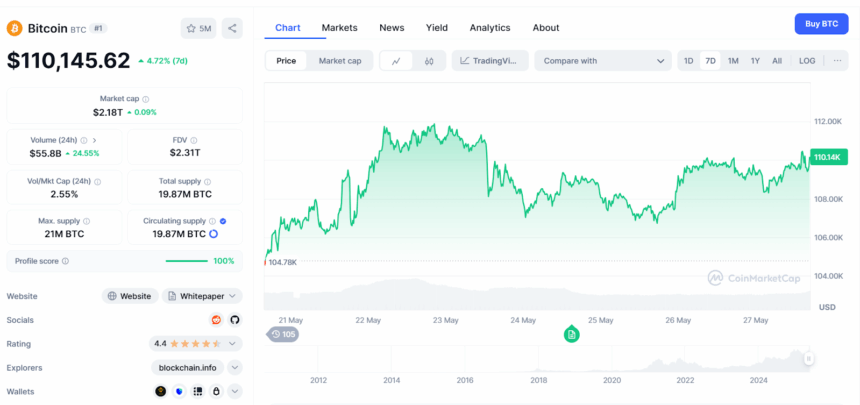

Meanwhile, Bitcoin price reacted to the news with a surprising surge, climbing above $110,000. As of this very moment, the BTC price is trading for $110,145, a 4.72% surge recorded in the last 24 hours, with a 24.55% increase in trading volume to $55.8 billion. It seems Bitcoin is having a better day than DJT!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-05-27 19:51