As a seasoned crypto investor with over a decade of experience navigating the rollercoaster that is digital asset markets, I can’t help but feel a mix of intrigue and trepidation upon hearing about Donald Trump’s potential acquisition of Bakkt. Having seen my fair share of ambitious projects that fizzled out or pivoted unexpectedly, I find myself cautiously optimistic about this move.

According to a report from The Financial Times, the purchase indicates that TMTG is increasingly engaged with digital currencies and blockchain innovation.

Initially designed by Intercontinental Exchange’s (ICE) subsidiary, Bakkt, with the goal of facilitating everyday bitcoin transactions – notably teaming up with Starbucks to investigate cryptocurrency payments for beverages – Bakkt’s lofty beginnings have taken a turn. Now, it primarily concentrates on providing crypto custody and trading services. However, this change in direction hasn’t been without challenges; earlier this year, Bakkt disclosed that it was running low on funds, with only enough resources to carry on for another year.

The Deal: A High-Stakes Gamble

Although Bakkt’s market capitalization remains approximately $150 million, The Trump Media and Technology Group (TMTG), with little revenue generated so far, boasts an impressive $6 billion valuation. This high valuation is primarily fueled by enthusiastic retail investor interest following Donald Trump’s re-election. If the acquisition goes through, Bakkt’s trading services could become part of Trump’s expanding media empire, possibly making TMTG a significant player in the digital assets sector.

Significantly, the crypto custody business of Bakkt, responsible for holding cryptocurrencies such as Bitcoin and Ether, is not part of the agreement. This move corresponds with TMTG’s emphasis on trading activities and wider market involvement, rather than providing secure storage services.

Trump’s Crypto Playbook Expands

The action is being taken as Trump increases his engagement within the cryptocurrency sphere. Previously, he had advocated for World Liberty Financial, a decentralized finance (DeFi) initiative with connections to the Trump family. The purchase of Bakkt would strengthen Trump’s position in this area, possibly shaping the crypto policy and adoption during his term.

Stoking further intrigue, Bakkt’s shares (BKKT) skyrocketed by 160% after the announcement of a possible deal, highlighting the market’s excitement about Trump’s potential involvement. In addition, it appears that President-elect Trump is set to discuss with Coinbase CEO Brian Armstrong, hinting at increased interaction with influential figures in the cryptocurrency sector.

Crypto on the Rise

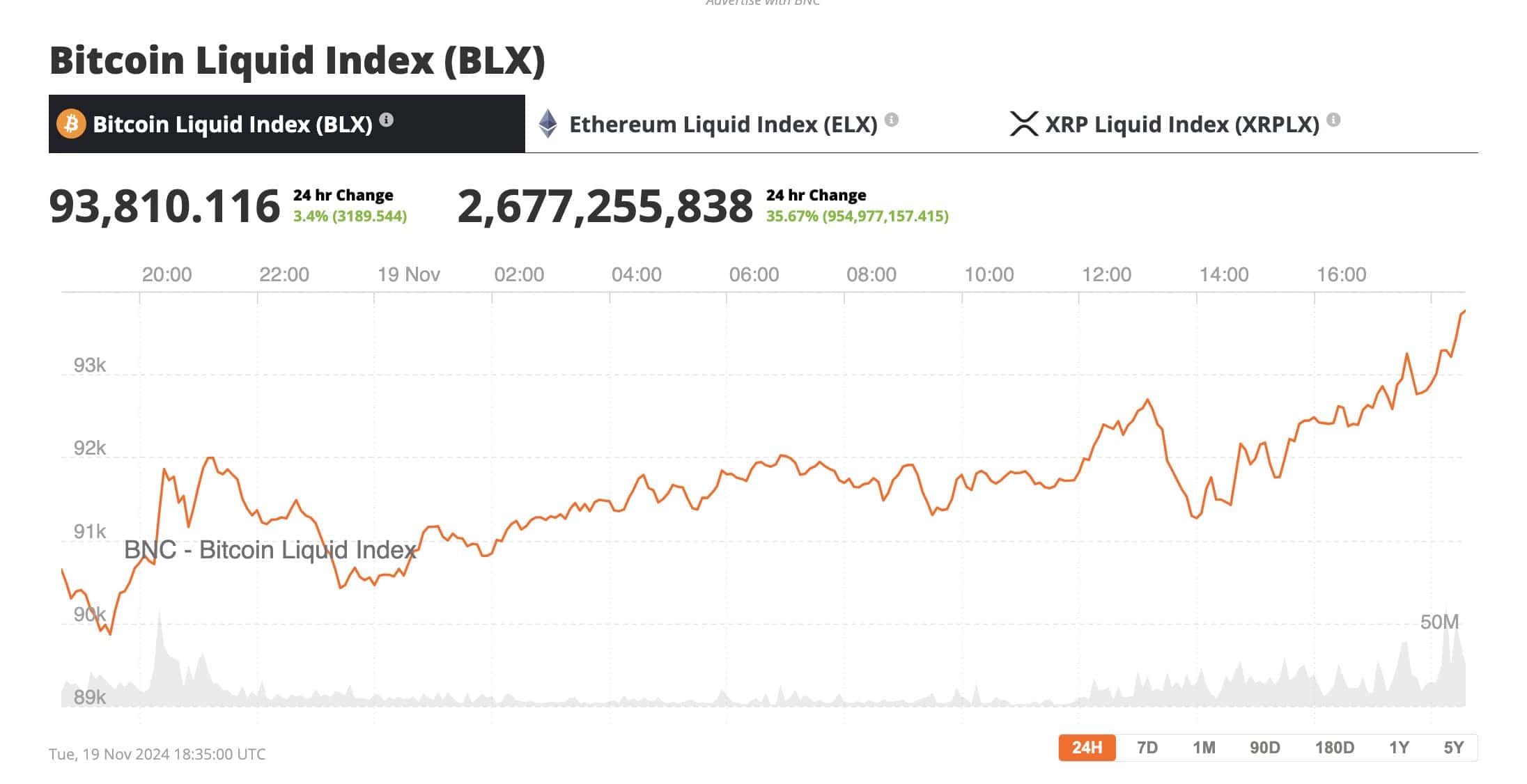

The timing for this acquisition coincides with a broader uptrend in the market. In the last month, Bitcoin has surged by more than 30%, hitting unprecedented highs of $93,800 today. By incorporating Bakkt’s services, TMTG stands to profit from the renewed fascination with digital assets, possibly redefining its product range and positioning itself more closely with the burgeoning crypto sector.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-11-20 13:58