In a move that surprised absolutely no one who’s ever read a headline, President Donald Trump decided to wave away the inflation fears that Thursday’s Producer Price Index (PPI) had invisibly planted in our collective subconscious. Apparently, inflation has taken a vacation, because Trump cheerfully declared it to be at a ‘perfect number,’ a phrase that probably means ‘close enough for government work’ in his universe. This declaration gave the stock market’s rollercoaster a fresh coat of optimism, as if investors suddenly found their brave faces again, clutching their 401(k)s like a lifeboat on a sinking ship.

“Hardly any inflation at all. 401(k)s and the stock are soaring,” President Trump noted. 😉

Crypto Market Reacts to Inflationary Pressures – Or Pretends Not to Notice

Now, just to keep things interesting, Thursday’s PPI hinted that next month’s Consumer Price Index (CPI) might be creeping up-like a teenager sneaking back home past curfew-causing the Fed to contemplate yet again whether to keep its benchmark rate at 4.5%. This caused an immediate panic among traders, especially those long on crypto, who saw over $1 billion vanish faster than your last paycheck. CoinGlass reports that a staggering $827 million of this was lost by long traders, who clearly had their hopes riding high-until reality gave them a slap. Ouch.

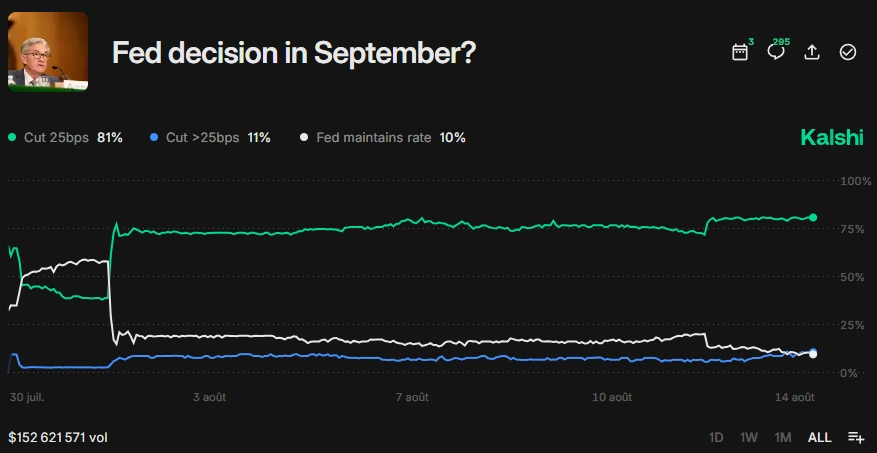

Despite the chaos, traders are still optimistic about a rate cut in September-an 81% chance, says Kalshi-probably because at this point, betting on ‘who will blink first’ is the only sport left. Interestingly, the same data shows a tiny but notable 11% rate chance of a full 50 basis points cut. That’s almost enough excitement for one day, if you like your political and financial chaos served with a dash of drama.

What’s Next for the Cryptocurrency Bull Market? Or When Will It Finally Get Off the Pot?

The crypto bull market has been riding high lately, especially after Bitcoin (BTC) and Ethereum (ETH) decided to do their best impression of a phoenix rising-smoke, ashes, and all. Institutional investors are diving in like it’s Black Friday, boosting demand and whispering sweet nothings about crypto treasury strategies, probably just to see what all the fuss is about.

And here’s the cherry on the digital cake: President Trump recently signed an executive order allowing the overachieving 401(k) plans, which hold a staggering $8 trillion, to diversify into cryptocurrencies. Because nothing says ‘stability’ quite like mixing old-school retirement plans with digital gold, right?

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Banks & Shadows: A 2026 Outlook

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-14 22:28