Well, well, well, it seems the Trump cryptocurrency has taken a nosedive, plummeting to new lows and losing most of its value in just a month. And guess what? The ongoing tariff wars waged by the US President are to blame for this tumble.

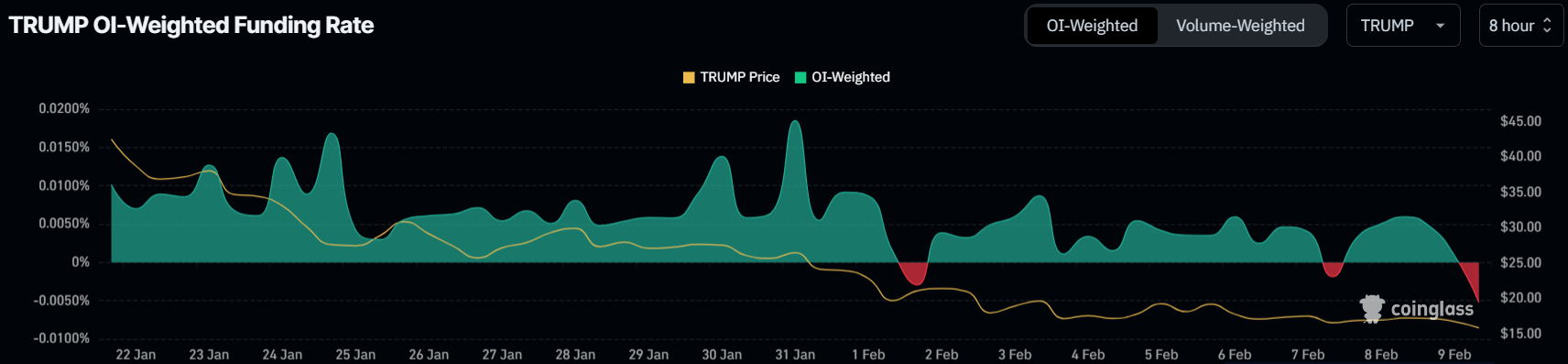

The bearish market conditions have made things worse, preventing any meaningful rebound. Traders are now favoring short positions over long bets, and funding rates for Trump have dropped to their lowest levels since mid-January. This shift suggests that traders are betting on further losses rather than a potential rebound.

The lack of price stability has fueled bearish sentiment across the market. Traders are now capitalizing on the downtrend rather than waiting for a reversal. Without a change in market conditions, this negative outlook is likely to persist, keeping Trump’s price under pressure.

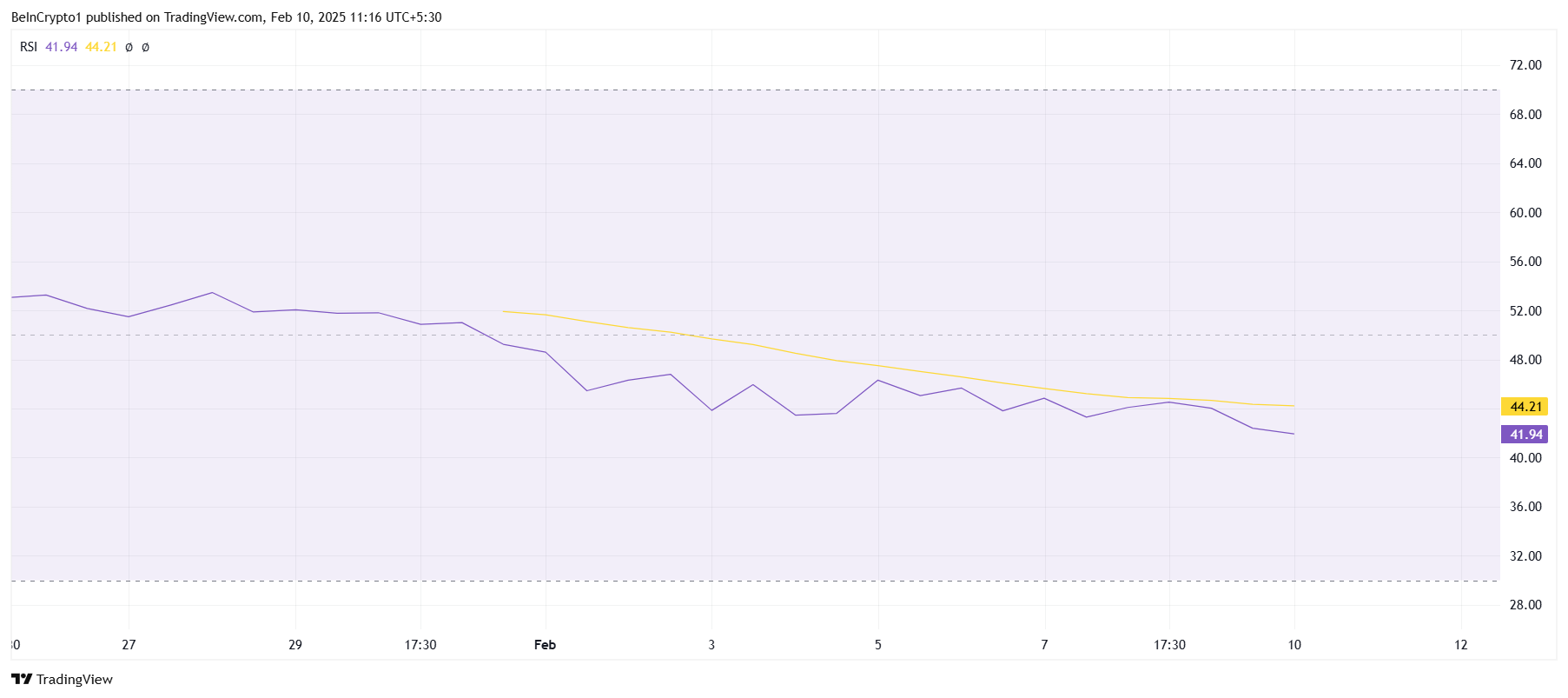

Technical indicators reflect the weakening momentum in Trump’s price action. The Relative Strength Index (RSI) has remained below the neutral 50.0 mark since early February, signaling continued bearish pressure. A deepening RSI suggests increasing selling activity with no immediate signs of relief.

A prolonged stay in the bearish zone often leads to extended downturns. Trump’s current trajectory shows no divergence, meaning the selling trend remains intact. Until the RSI moves above neutral territory, the probability of recovery remains low, and further declines could be expected.

Trump’s price hit a new all-time low (ATL) of $14.29 today, marking an 11% drop in the last 24 hours. The sharp decline was triggered by the loss of $16.00 as support, which acted as a crucial level for maintaining stability. Without a swift recovery, further downside remains possible.

If Trump continues its downward trend, the price could soon slip below the $10 mark. A break under this psychological level would erase almost all of its value since its listing day. Such a move could intensify liquidation risks, pushing the price further into uncharted territory.

The only way to invalidate the bearish thesis is for Trump to reclaim the $19.58 support level. If buyers return, the price could rise toward $26, partially recovering recent losses. However, given the current sentiment, a strong, bullish reversal appears unlikely without a major shift in market conditions.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-02-10 11:34