Ah, dear reader, gather ’round and feast your eyes upon the tale of Tron (TRX), a cryptocurrency that has decided to don its finest attire and waltz into the spotlight last Friday. It reached a dazzling $0.3344—the kind of figure not seen since early December 2024. Bulls, those bullish beasts of the market, have taken firm control, their hooves stomping out an ascending rhythm as though performing some grand ballet of numbers. While other altcoins languish in indecision like uninspired poets, Tron marches forward with the confidence of a man who knows he’s wearing the best hat at the party.

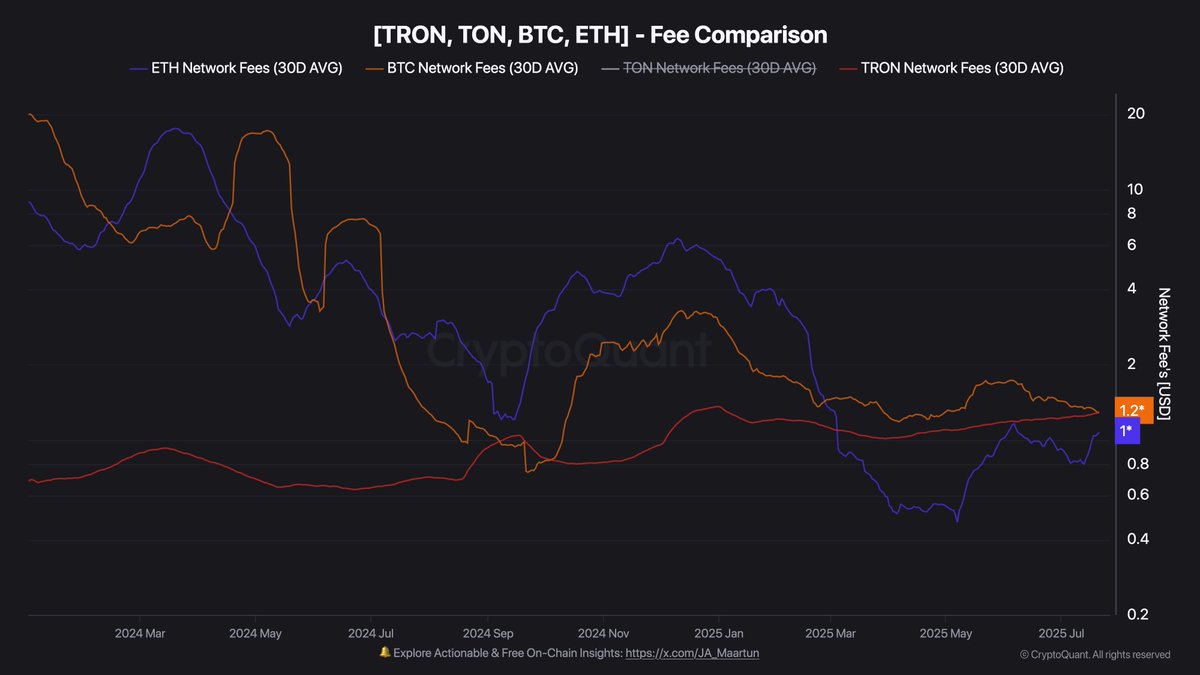

But what sorcery fuels this ascent? Ah, the answer lies within the mystic scrolls of on-chain data, courtesy of CryptoQuant. Behold: fees on the Tron network have surged past Ethereum’s, aligning themselves with none other than Bitcoin itself! A modest $1.29 per month in transaction fees may seem humble, yet it whispers sweet nothings of increased user activity and slightly pricier transactions. Oh, how the mighty Ethereum must feel, watching its fee-based revenue crown snatched away by this upstart contender. Truly, the gods of blockchain drama are having a field day. 🎭✨

And so, as if summoned by cosmic forces, the rising tide of adoption lifts all ships—except perhaps Ethereum’s leaking galleon. The fundamentals align perfectly with the bullish price action, suggesting that Tron might just be warming up for a breakout performance worthy of an opera house encore. Will TRX soar beyond its current highs? Only time will tell, but one thing is certain: the audience is captivated. 👀📈

The Great Fee Surge Meets Explosive On-Chain Activity

Enter Darkfost, a sage among analysts, who reveals that this surge is no mere flash in the pan born of recent protocol tweaks. Nay, it is bolstered by a steady rise in on-chain activity—a staggering 14 billion cumulative transactions! Such a number could make even the most stoic accountant weep with joy. Monthly averages hover around 8.5 million transactions, indicating not idle curiosity but genuine demand across sectors such as stablecoins, gaming, and DeFi. Yes, dear reader, people are actually using Tron—and paying for it too! 💸🎮

What marvels us further is that despite these rising costs, users flock to Tron like moths to a flame. This resilience speaks volumes about its utility in realms where low-cost efficiency reigns supreme. But wait, there’s more! Each transaction burns a smidgen of TRX, creating a delightful feedback loop: more usage equals more burning, which equals less supply. And when demand remains robust while supply dwindles? Ah, the stage is set for structural support of TRX’s value. Deflationary mechanisms combined with growing adoption paint Tron as a phoenix rising from the ashes of mediocrity. 🔥🚀

TRX Price Action: A Tale of Resilience Amidst Minor Turmoil

Lo and behold, after flirting with yearly highs of $0.3344, TRX now trades at $0.3137, having endured a minor pullback. Fear not, for the broader trend remains bullish, upheld by the steadfast 50-day moving average—a blue ribbon guiding our hero through turbulent waters since March. Even now, TRX clings proudly above the psychological bastion of $0.30, signaling that this retreat is but a brief intermission before the next act begins.

The 100-day and 200-day moving averages tilt skyward, confirming the shift in momentum. Should the bulls hold their ground and defend the sacred $0.30 level, TRX may soon retest its zenith and perhaps ascend toward the celestial realms of $0.35–$0.36. The curtain falls for now, but rest assured, the drama of Tron continues to unfold. Stay tuned, dear reader, for the next chapter promises to be nothing short of spectacular. 🎭📈

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- The Weight of First Steps

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-22 22:23