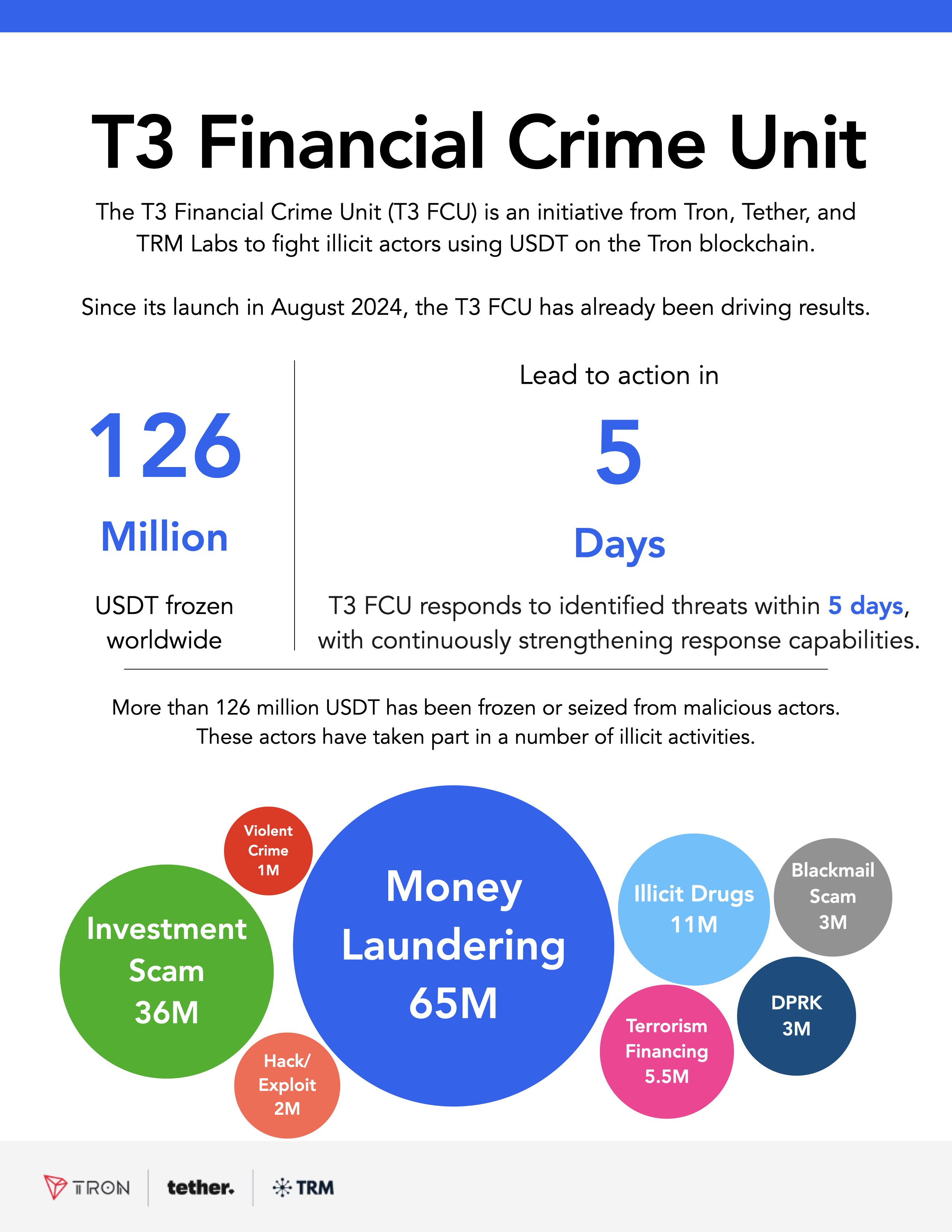

As a seasoned crypto investor with over a decade of experience in this ever-evolving digital frontier, I’ve witnessed the rollercoaster ride that is the world of cryptocurrencies – from their meteoric rise to unprecedented heights, to the inevitable crashes and scandals that have marred their reputation. The recent news about Tron’s T3 Financial Crime Unit freezing $100 million in USDT since its September inception has piqued my interest, not only because it signifies a positive step towards combating illicit activities, but also because it highlights the ongoing challenges that this industry faces in terms of financial crime and regulation.

Having invested in various cryptocurrencies over the years, I’ve come to understand the importance of accountability, transparency, and oversight within the crypto sector. The partnership between Tron, Tether, and TRM Labs is a step in the right direction, as it demonstrates a shared commitment to rooting out money laundering and other criminal activities on their respective platforms.

The fact that T3 monitored over $3 billion in USDT transactions across five continents speaks volumes about the global reach of these digital assets, and the need for international cooperation to ensure their safe and responsible use. The uncovering of $3 million in USDT linked to North Korean actors is a stark reminder of the potential for crypto to be exploited by nefarious actors, but also offers a glimpse into the effectiveness of efforts aimed at thwarting such activities.

However, as the recent cases involving Binance, Tornado Cash, and Tether illustrate, the crypto industry still has much work to do in terms of adhering to anti-money laundering regulations. The consequences of failing to do so can be severe, both for individuals and companies involved, as well as for the reputation of the entire industry.

In light of these developments, I remain cautiously optimistic about the future of cryptocurrencies. While there is no denying that they offer tremendous potential for innovation and economic growth, it is crucial that we continue to prioritize accountability, transparency, and compliance with regulations. After all, as the old saying goes, “The best-laid plans of mice and men often go awry,” but with proper oversight, we can help ensure that the crypto revolution stays on track.

And now, for a little levity, let me leave you with this: As a crypto investor, I’ve learned to expect the unexpected – it’s like riding a rollercoaster without a safety harness! But hey, if you can’t handle the heat, get out of the kitchen… or in this case, the crypto market.

Since its establishment in September, the Financial Crime Unit of Tron’s T3 collaboration with Tether and TRM Labs, has successfully halted over $100 million worth of transactions using Tether’s USDT.

The unit focuses on identifying and blocking illicit activities involving the stablecoin.

Crypto Money Laundering Remains a Critical Challenge

As a global crypto investor, I’ve been keeping a close eye on the activities of T3, a monitoring unit that meticulously examines millions of transactions spanning five different continents. Notably, they’ve recently shared that they have tracked over $3 billion worth of USDT transactions, underscoring their extensive reach and diligence in the digital currency market.

TRM Labs offers blockchain analysis software that aids in identifying and securing assets suspected of being involved in illegal activities within the Tron blockchain network.

As a crypto investor, I find myself in awe of Tron’s robust network, with an impressive $60 billion in circulation of the stablecoin USDT. This makes it the second-largest stablecoin ecosystem, trailing only Ethereum. However, it’s concerning to note that a significant portion of these funds often gets frozen due to activities linked to “money laundering as a service.” This refers to a disturbing trend where illicit funds are cleansed through dark web services, a practice that undermines the integrity and trust in our digital economy.

Additionally, these other objectives encompass combating investment frauds, illegal drug trades, funding for terrorist activities, extortion, cybercrimes such as hacking, and acts of physical violence.

Additionally, T3 discovered approximately $3 million worth of USDT tied to North Korean entities. It is claimed that these resources were employed to finance the government’s fundraising initiatives by exploiting cryptocurrencies.

Financial Crime and Crypto Regulation in Focus

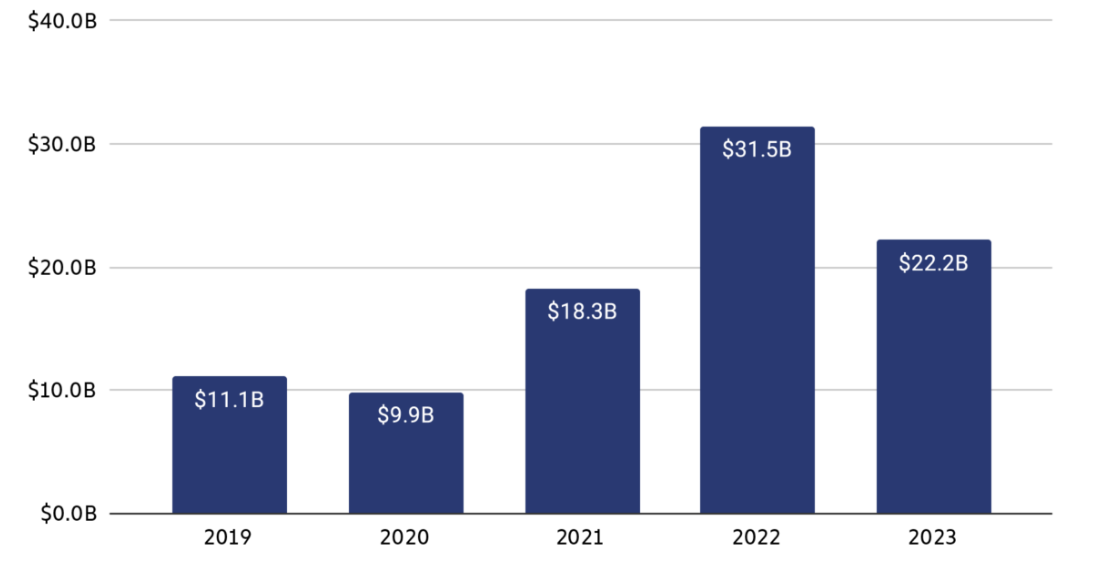

2024 saw an increased emphasis on combating money laundering by both regulatory bodies and the cryptocurrency sector, with this focus continuing into 2025 as a key area of concern.

Back in 2024, Binance was fined an amount of $4.4 million in Canada due to non-compliance with Anti-Money Laundering (AML) rules. Even after multiple reminders, the platform neglected to adhere to the AML legislation set by the nation.

Furthermore, Binance and its ex-CEO Changpeng Zhao (CZ) are named as defendants in a class action lawsuit initiated in Seattle. This legal action claims that the platform’s weaknesses in Anti-Money Laundering (AML) protocols allowed crypto money laundering operations, preventing three investors from recovering their stolen funds.

In a notable legal matter, a developer for Tornado Cash named Alexey Pertsev was given a 64-month prison term by a Dutch judge. The court found him guilty of funneling over $1.2 billion in cryptocurrency funds through the service designed to anonymize transactions.

As a researcher delving into this intriguing domain, I find myself grappling with the recent reversal of sanctions against Tornado Cash by a US federal appeals court. This ruling has sparked renewed debates about striking a balance in regulating blockchain tools, considering both privacy preservation and crime prevention.

Additionally, Tether, the entity responsible for issuing USDT, faced criticism in 2024 over allegations of money laundering activities. In October, a Wall Street Journal report suggested that some third parties potentially exploited Tether to carry out illicit activities such as drug trafficking, financing terrorism, and hacking.

Nevertheless, Tether CEO Paolo Ardoino refuted such allegations. He stated that there is no active cryptocurrency money laundering probe being conducted against the firm.

The initiatives spearheaded by Tron’s T3 team underscore the increasing importance of responsibility and supervision in the cryptocurrency market. Both global regulatory bodies and key players in the industry are committed to combating financial misconduct, a mission that will persist in the future.

Read More

2025-01-03 02:56