On September 9, 2025, Grayscale decided it was time for a little makeover, filing fresh paperwork with the Securities and Exchange Commission (SEC) to transform three closed-end trusts-BCH, LTC, and HBAR-into exchange-traded funds (ETFs). Well, well, isn’t that fancy?

Grayscale’s Bold ETF Dreams for BCH, LTC, and HBAR Funds

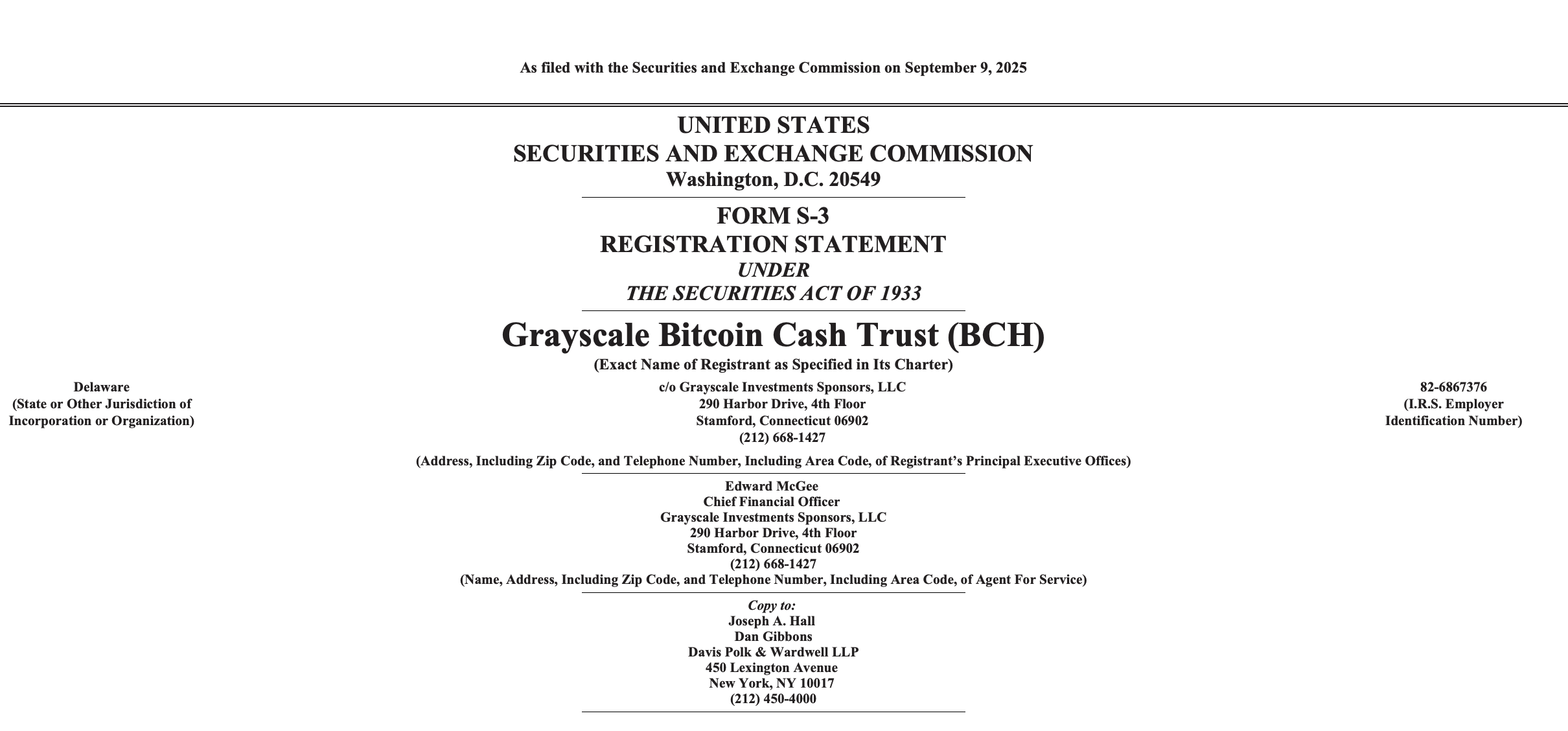

In a somewhat formal S-3 SEC filing, Grayscale made it clear that their BCH fund would soon bear the snazzy new title “Grayscale Bitcoin Cash Trust ETF” when it makes its grand debut. It’s aiming to list on NYSE Arca under the symbol “BCHG,” with shares being issued in batches of 10,000. As of September 5, 2025, around 82.8655 BCH is needed for that 10,000-share basket. The trust will be tracking the Coindesk Bitcoin Cash Price Index (BCX) for its price, and while cash creations are the current method, in-kind activity might be on the horizon-if NYSE Arca feels like being agreeable.

Back in July, NYSE Arca floated the idea of “generic listing standards,” which, if approved, could let this BCHG join the big leagues without the usual red tape. Grayscale seems confident BCHG will qualify, but let’s not get ahead of ourselves-no approval, no action. On September 10, 2025, BCH is up by 0.4%, and over the past two weeks, it’s seen a tidy 6% rise against the dollar. Not bad for a digital asset, eh?

Meanwhile, Grayscale isn’t stopping there. They also want to turn their Grayscale Litecoin Trust into an ETF too. The LTC fund plans to do the same thing as BCHG, listing on NYSE Arca with the ticker LTCN, issuing shares in 10,000-share baskets, and using cash creations for now. As of September 5, 2025, the fund requires 828.6548 litecoin per basket, and it will track the Coindesk Litecoin Price Index (LTX). The good news is that LTC is up 0.6% in the last 24 hours, with similar gains over the past two weeks.

But wait, there’s more! For Hedera (HBAR), Grayscale has filed an S-1 to create a new trust to list on Nasdaq under the symbol HBAR. Nasdaq’s 19b-4 application from February 2025 is still waiting for approval, so any big moves will depend on that. This new HBAR fund will issue shares in 10,000-share baskets too, and Coinbase will be the custodian. Sounds like a reliable bunch, doesn’t it?

Other players are also eyeing the HBAR market, with Canary Capital hoping to get their own HBAR-related fund onto Nasdaq. Interestingly, across all three of Grayscale’s products, the digital asset manager relies on the same core service providers: Coinbase Custody, Coinbase, Inc., and The Bank of New York Mellon. Each prospectus is still labeled “Subject to Completion” and dated September 9, 2025. Stay tuned, folks!

This is all part of a broader trend where Grayscale has already converted its Bitcoin and Ethereum products into exchange-listed ETPs. The big question is: will the SEC open the floodgates for all these altcoin ETF proposals? Time will tell, but in the meantime, Grayscale is leading the charge. Who’s next?

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Best Actors Who Have Played Hamlet, Ranked

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

2025-09-10 17:20