Author: Denis Avetisyan

New research leverages advanced graph neural networks to uncover hidden relationships between congressional trading and stock market performance.

Researchers introduce a novel temporal graph network and dataset to model legislative financial ecosystems and detect information asymmetry.

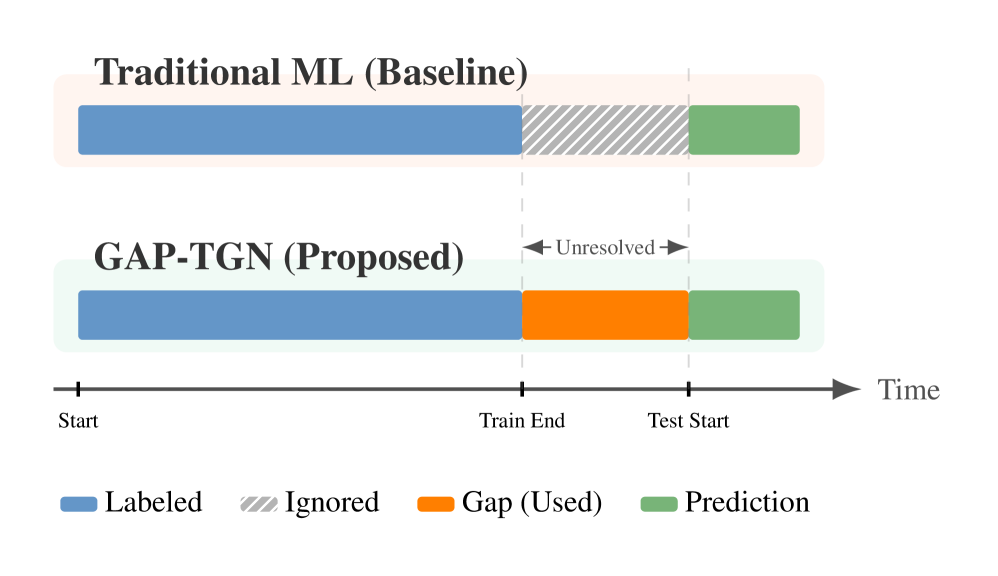

Concerns regarding potential information asymmetry and conflicts of interest persistently shadow US congressional stock trading. To address this, we present ‘Detecting Information Channels in Congressional Trading via Temporal Graph Learning’, introducing a novel temporal graph network (GAP-TGN) and the Capitol Gains dataset to model complex legislative-financial ecosystems. Our approach demonstrates improved prediction of stock performance based on congressional trading activity compared to traditional tabular baselines by capturing dynamic relationships between legislators, corporations, and market events. Can this framework ultimately enhance transparency and inform regulatory efforts surrounding financial trading by US lawmakers?

The Opaque Web: Mapping Influence in Financial Markets

The intricate connections between money in motion, persuasive lobbying efforts, and the resulting legislative outcomes represent a critical, yet often obscured, element of modern market behavior. A thorough understanding of this interplay is essential because financial transactions aren’t simply economic events; they can serve as signals of intent, funding for influence campaigns, or even direct attempts to shape policy. Simultaneously, lobbying acts as the mechanism through which private interests attempt to translate financial resources into legislative advantage. Consequently, legislative activity – the laws and regulations ultimately enacted – can profoundly impact market dynamics, creating opportunities for those ‘in the know’ while potentially fostering conflicts of interest if the connections between these three spheres remain opaque. Disentangling these relationships is therefore not merely an academic exercise, but a necessary step towards a more transparent and equitable market landscape.

Currently, investigations into the connections between money and political outcomes are hampered by a distinctly fractured data landscape. Financial disclosures, lobbying reports, and legislative records – each crucial in its own right – are typically maintained by separate entities with differing reporting standards and frequencies. This creates significant obstacles for researchers attempting to establish clear causal links; for example, campaign contributions reported quarterly may not align temporally with subsequent legislative votes or the timing of specific regulatory decisions. The lack of high-resolution, synchronized data prevents a nuanced understanding of influence, obscuring whether financial activity precedes and potentially influences policy changes, or simply reflects pre-existing trends. Consequently, pinpointing the precise mechanisms through which financial flows translate into political advantage remains a substantial challenge, limiting the ability to assess the true extent of ‘political alpha’ and potential conflicts of interest.

The pursuit of understanding how policy decisions impact markets necessitates a detailed examination of influence networks, but current data limitations hinder meaningful analysis. A truly comprehensive dataset would integrate financial transactions – capturing contributions and investments – with lobbying disclosures and detailed legislative activity, all meticulously time-stamped to reveal causal relationships. This ‘multimodal’ approach moves beyond simple correlation, allowing researchers to quantify the ‘flow of influence’ – the demonstrable link between financial activity and policy outcomes. Identifying consistent patterns within this data – what is increasingly termed ‘political alpha’ – offers the potential to not only understand market movements driven by policy changes, but also to proactively assess risk and identify opportunities arising from the complex interplay between money and power.

The Limits of Static Views: Modeling Dynamic Systems

Traditional graph neural networks (GNNs) are designed to process static graphs, representing relationships at a single point in time. This limits their ability to model systems where relationships and node attributes change sequentially, such as financial markets or political networks. These real-world systems are characterized by asynchronous updates – events occur at irregular intervals and influence the network state before information fully propagates. Standard GNNs, relying on synchronous message passing, struggle to effectively capture these temporal dynamics and the resulting dependencies between events, as they often aggregate information from the entire graph at each time step, obscuring the order and timing of interactions.

Continuous-Time Dynamic Graphs (CTDGs) represent relationships that change over time, differing from static graphs by explicitly encoding the temporal evolution of edges and nodes. This representation allows for modeling asynchronous events and varying interaction frequencies, critical in systems like financial markets and social networks. However, effectively processing CTDGs necessitates specialized neural network architectures beyond those designed for static graphs. Standard Graph Neural Networks (GNNs) assume a fixed graph structure, while CTDGs require mechanisms to handle time-varying adjacency matrices and node features. These specialized architectures often involve recurrent or attention mechanisms to capture temporal dependencies, and may incorporate techniques like asynchronous message passing to address the challenges of irregular time intervals and event ordering inherent in continuous-time data.

Temporal Graph Networks (TGNs) establish a framework for analyzing evolving relationships by representing data as graphs that change over time; however, practical implementation with large, real-world datasets presents challenges in computational efficiency and scalability. Standard TGN architectures often require substantial memory to store and process the complete temporal history of node and edge attributes, leading to increased training times and resource consumption. Furthermore, the iterative propagation of information across the graph in discrete time steps can become a bottleneck as the graph size and temporal depth increase. These limitations restrict the applicability of TGNs to datasets with a limited number of nodes, edges, or time steps, hindering their use in domains like financial modeling and social network analysis where large-scale, long-term dependencies are critical.

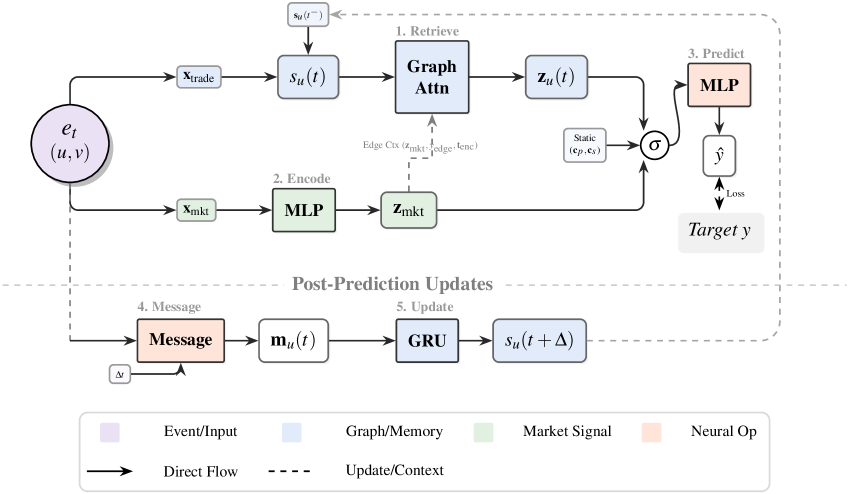

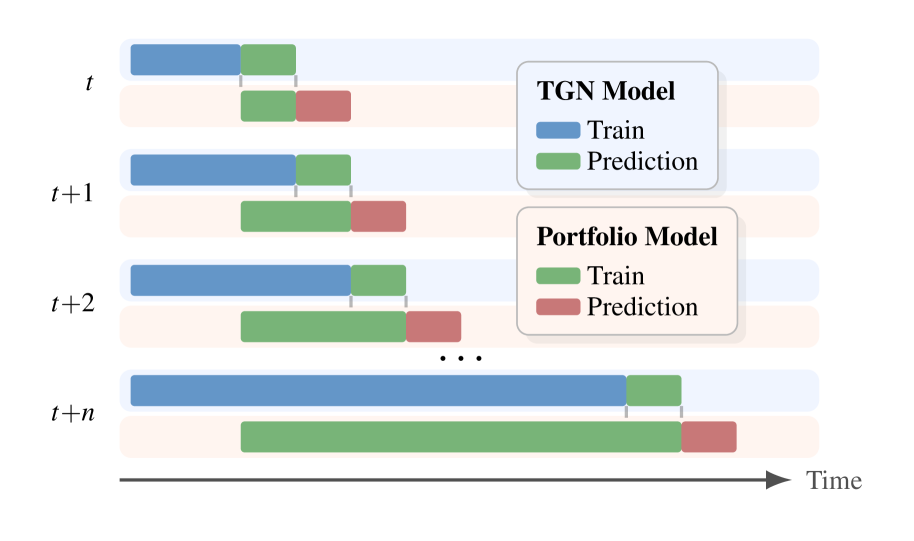

GAP-TGN is a novel Temporal Graph Network (TGN) designed to model dependencies within financial networks over extended time horizons. The architecture utilizes asynchronous propagation, allowing information to flow between nodes at varying time steps reflecting real-world financial interactions, and gated fusion, which selectively integrates information from different time steps to prevent vanishing gradients and improve long-term dependency modeling. In evaluations focused on identifying positive trading cases, GAP-TGN achieved a 51% improvement in F1-Score compared to traditional tabular baselines when assessing performance in a long-horizon predictive setting, demonstrating its enhanced capacity to capture complex temporal patterns in financial data.

Decoding Influence: The Architecture of GAP-TGN

GAP-TGN utilizes Gated Fusion to integrate data from three primary sources: legislative disclosures, lobbying records, and campaign finance data. This process involves combining feature vectors representing entities (nodes) and their relationships (edges) from each data source. Gated Fusion employs learned weights to control the contribution of each source to the final node and edge representations, allowing the model to prioritize more relevant information. Specifically, a gating mechanism determines which features from each source are passed through, effectively modulating the influence of each data type on the overall graph representation and improving the model’s ability to capture complex relationships.

GAP-TGN employs Graph Attention to assign weights to edges connecting nodes in the influence network, thereby prioritizing the most impactful relationships. This is achieved through an attention mechanism that calculates attention coefficients based on the features of connected nodes, effectively quantifying the relevance of each connection. Higher coefficients indicate stronger influence, allowing the model to focus on interactions deemed more significant during propagation and aggregation of information. This weighted approach contrasts with uniform treatment of all edges and enables GAP-TGN to discern and emphasize key connections within the complex network of lobbying, disclosure, and campaign finance data.

GAP-TGN incorporates a Gated Recurrent Unit (GRU) to address the temporal aspect of influence propagation. GRUs are a type of recurrent neural network capable of processing sequential data and maintaining a hidden state that represents information about past inputs. In the context of GAP-TGN, the GRU processes data points – representing lobbying contacts, contributions, or disclosures – as they occur over time. This allows the model to capture how relationships and influence evolve; for example, a contribution made at time t can affect the weight of an edge at time t+1. The gating mechanism within the GRU selectively updates and forgets information, enabling it to focus on the most relevant historical data when determining current influence, and mitigating the impact of irrelevant or outdated information.

Crucially, GAP-TGN’s asynchronous propagation mechanism allows for efficient updates even with incomplete or delayed information.

Beyond Prediction: Uncovering Political Alpha and Charting Future Directions

The GAP-TGN model showcases a noteworthy capacity for forecasting market trends by analyzing connections to the political sphere, as evidenced by its performance on the ‘Capitol Gains’ dataset. This innovative approach leverages information regarding political affiliations and activities to anticipate shifts in financial markets, achieving a balanced F1-Score of 0.440 – a metric indicating a strong trade-off between precision and recall. This result suggests that incorporating political data can offer a valuable, previously underutilized signal for predicting market movements, potentially allowing for the development of more informed investment strategies and a deeper understanding of the interplay between politics and finance. The model’s success highlights the potential for similar data-driven approaches to uncover hidden relationships and predictive patterns in complex systems.

The predictive capabilities of GAP-TGN extend beyond mere market forecasting, offering a novel approach to uncovering potential conflicts of interest within financial ecosystems. By analyzing the connections between political activity and market movements, the model can flag instances where insider information or undue influence may be at play. This allows for increased scrutiny of transactions and relationships, fostering a more transparent and equitable marketplace. The ability to objectively assess the impact of political connections on financial outcomes empowers regulators and investors alike, ultimately contributing to a fairer and more stable economic environment. Through data-driven insights, GAP-TGN facilitates a proactive approach to identifying and mitigating risks associated with opacity in financial dealings.

The predictive capabilities of the GAP-TGN model, already demonstrated through analysis of political connections, stand to be considerably amplified by the integration of broader economic datasets. Currently, the model focuses on information gleaned from legislative activity; however, supplementing this with corporate financial statements – including metrics like revenue, debt, and profitability – would provide a more holistic view of an organization’s health and potential responsiveness to political shifts. Furthermore, incorporating macroeconomic indicators, such as inflation rates, unemployment figures, and GDP growth, could reveal systemic factors influencing market behavior and refine the model’s ability to anticipate future movements. This synergistic approach promises a more nuanced and accurate assessment of political alpha, potentially unlocking even greater predictive power and offering investors a more comprehensive understanding of risk and opportunity.

The architecture underpinning GAP-TGN, designed to decipher patterns within temporally-linked and irregularly-timed data, holds promise beyond the realm of financial markets. Researchers anticipate adapting this framework to address challenges in supply chain management, where understanding the cascading effects of disruptions – from raw material sourcing to final delivery – relies heavily on analyzing asynchronous events. Similarly, the model’s capacity to identify influential connections and predict future states is highly relevant to social network analysis, potentially enabling a deeper understanding of information diffusion and emergent behaviors within complex online communities. This expansion isn’t merely about applying a tool to new datasets; it represents a shift towards leveraging graph-based temporal networks for predictive modeling across diverse fields characterized by dynamic relationships and incomplete information.

The pursuit of predictive power within the Capitol Gains dataset reveals a humbling truth: systems aren’t built, they’re cultivated. This research, modeling legislative financial ecosystems with the GAP-TGN, doesn’t construct understanding so much as allow it to emerge from the complex interplay of temporal connections. The network doesn’t simply predict stock performance; it reflects the hidden currents of information asymmetry. As Brian Kernighan observed, “Debugging is twice as hard as writing the code in the first place. Therefore, if you write the code as cleverly as possible, you are, by definition, not smart enough to debug it.” Similarly, the elegance of the GAP-TGN lies not in its complexity, but in its capacity to reveal the inherent, and often unpredictable, logic of the market itself. Every connection mapped, every temporal shift accounted for, is a testament to the system’s capacity for emergent behavior – a prophecy of both insight and inevitable, fascinating failure.

What Blooms From the Seed?

This work, charting the currents within a legislative financial ecosystem, reveals not so much a solution as a deepening of the mystery. The construction of ‘Capitol Gains’-a dataset attempting to map influence-feels less like engineering and more like tending a garden. One anticipates, with a certain weariness, the inevitable emergence of weeds-unforeseen connections, spurious correlations, and the ever-present specter of data drift. Every feature engineered is, in effect, a prophecy of future inadequacy.

The gains offered by temporal graph networks are not merely quantitative; they are a recognition of inherent systemic dynamism. However, to model the flow of information is not to understand it. The true challenge lies not in prediction, but in recognizing the limits of predictability. Systems do not yield to analysis; they become the analysis, constantly reshaping themselves to evade complete comprehension.

Future work will undoubtedly explore more elaborate graph structures, attention mechanisms, and perhaps even attempts at causal inference. Yet, it is likely that the most fruitful paths will involve acknowledging the fundamental unknowability of these systems. The goal should not be to control the flow of information, but to cultivate a humble awareness of its chaotic, emergent nature. The garden will grow, regardless.

Original article: https://arxiv.org/pdf/2602.05514.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2026-02-06 09:47