The so-called “experts” yammer on about beating the S&P 500. A fool’s errand, mostly. Chasing rainbows and phantom gains. Unless, of course, you’re willing to get your hands dirty, to stare into the abyss and recognize the opportunity in the wreckage. The herd wants “safe.” I want something bleeding, something misunderstood, something the algorithms have already written off for dead. That’s where the real money is. And right now, that smell leads straight to The Trade Desk.

They call it a “growth stock.” A quaint little label for a company that’s been brutally clubbed over the head and left for vultures. Eighty percent down from its peak? That’s not a correction, that’s a liquidation. But here’s the beautiful, terrifying truth: sometimes, a massacre is just a fantastic buying opportunity. Everyone’s chasing the shiny objects, the next meme stock, while a genuinely solid business is being tossed into the bargain bin. The sheep are distracted. Good. Let them be.

The Trade Desk: Where Ads Go To Die (and Thrive)

The Trade Desk. Programmatic advertising. It sounds… sterile. Clinical. But beneath the jargon lies a fundamental shift in how ads are bought and sold. It’s about getting the right message to the right eyeballs, bypassing the bloated, inefficient mess of traditional television. They connect clients to everywhere – podcasts, streaming services, the digital ether itself. A slick operation, yes. But the world is overflowing with slick operations. What matters is the price. And the price, my friends, is currently INSANE.

Amazon. Of course, Amazon. The all-consuming beast. They’re muscling in on everything, aren’t they? Advertising is just another territory to conquer. They have the data, the infrastructure, the sheer, relentless drive to dominate. They can target ads based on what you’re thinking about buying before you even realize you want it. It’s unsettling. And effective. But here’s the kicker: Amazon’s dominance doesn’t mean The Trade Desk is doomed. It means they have to fight. And I, for one, enjoy watching a good fight. Especially when the underdog is trading at a ridiculous discount.

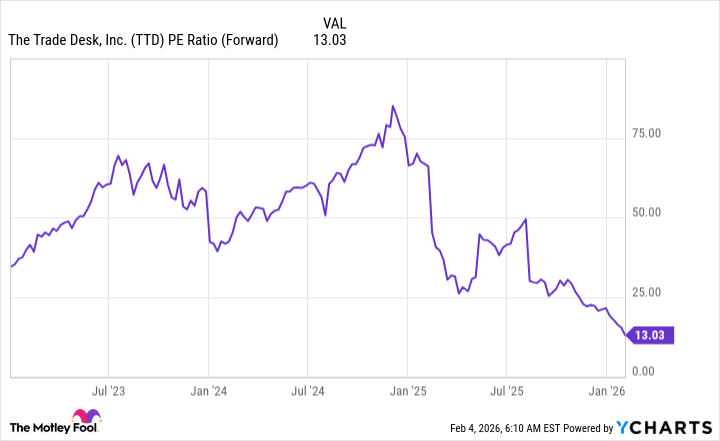

Last quarter, revenue rose 18%. Not the explosive growth of yesteryear, admittedly. But still faster than the market’s plodding average. And Wall Street is projecting 16% growth for 2026. Solid. Dependable. BORING, almost. But the real story isn’t the growth rate. It’s the valuation. Thirteen times forward earnings? Are you KIDDING me? The S&P 500 is trading at twenty-two times! It’s a goddamn STEAL.

This isn’t some high-flying tech bubble waiting to burst. This is a profitable company, operating in a growing market, trading at a price that suggests it’s about to go bankrupt. It’s a disconnect so glaring, it’s almost obscene. The market is obsessed with the next shiny object, while ignoring a perfectly good business that’s been left for dead. Let them have their bubbles. I’ll take the value. I’ll take the madness.

So, load up. Ignore the noise. Embrace the chaos. This isn’t a prediction. It’s a confession. I’m going all in. And if it crashes and burns? Well, at least it’ll be a spectacular crash. A glorious, screaming descent into oblivion. And I’ll be there, watching it all unfold, with a cold beer and a wicked grin. Because sometimes, the best investments are the ones that scare the hell out of everyone else.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-08 21:32