The shares of Torm, like a vessel caught in a sudden current, have drifted upward this week. By midday, they had climbed 7.7%, a modest ascent for a company whose quarterly earnings, at $315.2 million, exceeded expectations. Yet such triumphs often feel hollow in the shadow of the sea’s vast indifference.

Management Sees Calm Seas Through the Rest of 2025

Torm’s second-quarter results-a $0.60 EPS, slightly above the $0.57 forecast-might have been a quiet affair, were it not for the revised guidance. Management, with the cautious optimism of sailors reading the wind, now anticipates $800 million to $950 million in TCE earnings for 2025, a nudge upward from previous estimates. EBITDA projections, too, have been adjusted, though the figures remain within the realm of cautious hope.

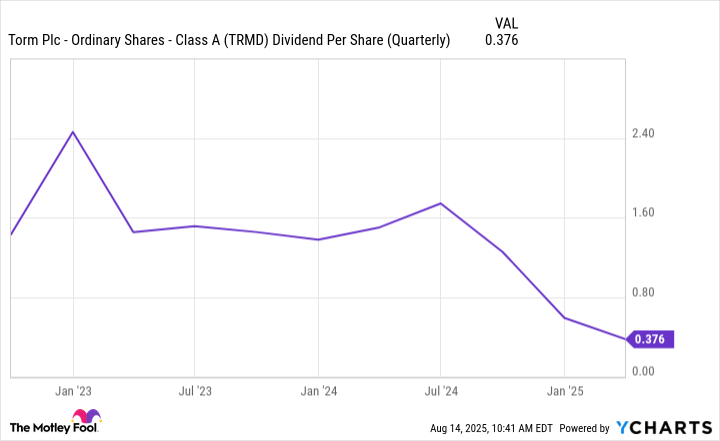

Investors, of course, are drawn to the promise of stability. But stability, like the horizon, is an illusion. The company’s dividend, with its 8.4% forward yield, offers a siren’s song to those seeking income. Yet the payout has dwindled over three years, a slow erosion that speaks to the fragility of such assurances. To chase it is to court the whims of a market that forgets as quickly as it remembers.

There is a poignancy in Torm’s story. It is a company that dances on the edge of prosperity, its fortunes tied to the tides of global trade. For now, the winds are favorable. But the sea, as any sailor knows, is never truly at rest. 🚤

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Banks & Shadows: A 2026 Outlook

2025-08-14 18:49