When Warren Buffett makes an investment, it’s akin to a poet composing an epic – each move deliberate, calculated, and often prophetic. Given his legendary track record, it’s little wonder that his portfolio is watched with the intensity of a World Cup final.

Now, should the average investor attempt to mimic the Oracle of Omaha’s every step? Perhaps not. After all, not all of us are billionaires with infinite resources and an appetite for risk that could fuel the entire space program. However, borrowing a page or two from Buffett’s playbook has worked wonders for countless investors. And if you happen to have a thousand dollars burning a hole in your pocket, there are a couple of Berkshire Hathaway-backed stocks that might just spark some long-term magic.

1. Amazon

Amazon (AMZN) may not sit at the top of Berkshire Hathaway’s portfolio – it represents less than 1% of their holdings – but it certainly stands as one of its most intriguing. Amazon’s trajectory is something like that of a supersonic jet: what began as a modest online bookstore has exploded into a sprawling, multi-industry powerhouse. It’s not so much a retailer anymore as it is a conglomerate with a finger in every pie, from groceries to cloud computing.

While e-commerce continues to be the company’s bread and butter (and butter’s best friend), it’s Amazon Web Services (AWS) that truly greases the wheels of profit. Though it only represents about 18% of Amazon’s total revenue, AWS contributes to the lion’s share of Amazon’s operating income. It’s a bit like the story of a quiet librarian who’s also a secret millionaire: understated but incredibly important.

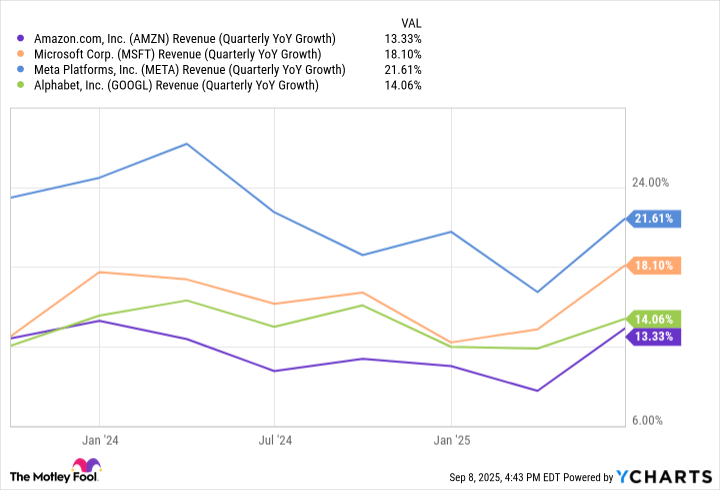

Sure, Amazon’s growth might be slowing compared to the likes of Microsoft, Alphabet, or Meta Platforms, but what sets it apart is its ability to generate impressive profits from high-margin businesses. It’s worth focusing on that steady income rather than the ebbs and flows of overall revenue. The real kicker? AWS and Amazon’s advertising sector are only scratching the surface of their potential growth. So, while others may be racing ahead, Amazon’s profits continue to build on rock-solid foundations, and it’s likely to remain a dominant force for years to come.

As far as competition goes, AWS remains the leader, though Microsoft and Alphabet are closing the gap. But with the cloud industry poised for continued growth, Amazon will likely continue to reap the benefits of its early dominance. Add to that its ventures into AI and an ever-growing array of entertainment platforms like Prime Video, Twitch, and even NBA broadcasts, and you have the makings of a business that’s too diversified – and too embedded in modern life – to ignore.

2. Visa

Visa (V), meanwhile, represents a completely different type of financial security. It’s the undisputed titan of the global payments industry, a financial infrastructure colossus that makes the gears of the modern economy turn without ever breaking a sweat. To call it a payment processor is like calling the Eiffel Tower “just a steel structure.” It’s more like the veins running through the world’s financial heart.

Visa processes an eye-watering 316 billion transactions annually – worth over $16 trillion. To put it simply, it’s the bridge connecting merchants, consumers, and their money. In return for its services, Visa earns a tidy percentage of each transaction, with margins so high they make some other businesses look downright puny by comparison.

Not only is Visa financially bulletproof, but it also keeps surpassing expectations, year after year. Over the last decade, its annual returns have averaged around 17%, comfortably outpacing the broader market’s 12.7%. While past performance isn’t always indicative of future returns, Visa’s expansive reach and its role as a pillar of the digital payments revolution suggest that it still has plenty of room to grow.

Visa’s business model is built on the fact that it’s everywhere. Accepted by millions of merchants around the world, it’s the go-to card for consumers, and as more places ditch cash in favor of card and contactless payments, Visa is positioned to profit. It’s a system that’s become so integral to the financial landscape that it’s hard to imagine it going anywhere anytime soon.

In other words, if you’re seeking a safe, long-term investment that’s crucial to the global economy, Visa has certainly earned its place in your portfolio. It’s as reliable as a Swiss watch, and just as indispensable to modern life.

So there you have it – two Berkshire Hathaway stocks that offer a blend of stability, growth potential, and a whole lot of smart, Buffett-approved business acumen. As ever, it’s not about trying to replicate the Oracle’s every move. It’s about looking at the logic behind those moves and seeing how you can carve out your own small piece of the financial universe.

And with that, perhaps your thousand dollars will grow into something far more than you imagined. Just don’t go expecting it to be as easy as pressing “add to cart.” 😉

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

2025-09-21 15:23