![]()

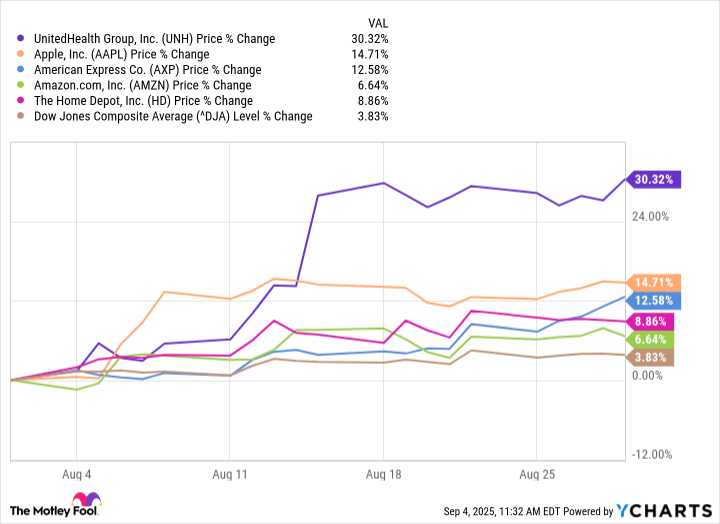

Let me tell you about August 2025. It was one of those months where everything seemed to go right for a few select stocks in the Dow Jones Industrial Average. The index itself? Meh, up 3.8%. But some companies? Oh, they decided to throw a party without inviting me-or at least my portfolio. Now, as an activist investor with a penchant for noticing when things are slightly off, I couldn’t help but dig into why these five stood out. And let me tell you, there’s more here than meets the eye-or maybe it’s just that I can’t stop obsessing over details.

So here we go, the five companies that made waves in August 2025. Buckle up; this is going to get petty.

UnitedHealth Group: Up 30.3%

UnitedHealth Group (UNH) had been on life support all year, down a staggering 50% before August hit. So naturally, when Warren Buffett shows up with $1.5 billion, everyone acts like he’s Moses parting the Red Sea. Look, I’m not saying Berkshire Hathaway doesn’t know what it’s doing-I mean, GEICO runs circles around most insurers-but did anyone else think it was weird how suddenly everyone started talking about UNH again? Like, “Oh, sure, now it’s undervalued!” Meanwhile, Michael Burry jumps in too, buying shares and call options faster than you can say *The Big Short*. Did no one else see this coming? Or am I just paranoid because I didn’t buy in earlier?

And then there were the earnings. Revenue jumped to $111.6 billion-a number so big it feels like it should come with its own zip code. Full-year guidance looked strong, projecting growth of 15%. But honestly, does anyone else feel like they’re overselling this whole thing? Because if I hear one more person say “healthcare megatrend,” I might scream.

Apple: Up 14.7%

Ah yes, Apple (AAPL), the company that apparently needs constant validation even though it prints money. Buffett sold 20 million shares to fund his UnitedHealth spree-which, fine, fair enough-but Apple still managed to crush expectations. Revenue up 10%, earnings per share up 12%. Great! Fantastic! Wonderful! Except…why do people keep acting surprised when Apple delivers good numbers? Are we really that cynical as investors? Or is it just me?

Here’s the kicker: iPhone sales popped, Macs flew off shelves, and Services grew double digits. But let me ask you something: Why does every tech company insist on calling their cloud division “the future” when literally half the planet already uses it? Just once, I’d love to hear someone admit, “Yeah, we’re making stuff up as we go.” Instead, we get platitudes about innovation and AI. Spare me.

American Express: Up 12.6%

American Express (AXP) has always struck me as the snooty cousin of Visa and Mastercard. You know, the one who insists on using words like “bespoke” while sipping artisanal coffee. Their strategy works, though-catering to corporate accounts and wealthy customers pays off handsomely. Plus, they operate their own payment network, which means they collect interest instead of just processing fees. Smart move, AmEx. Very smart.

Revenue climbed 9%, adjusted EPS rose 17%. Not bad. But here’s what really got under my skin: CEO Steve Squeri casually mentioned upgrading the Platinum card to appeal to younger generations. Younger generations! Do millennials even use credit cards anymore? Every time I try to swipe mine, I get lectured about Venmo. Ugh.

Amazon: Up 6.6%

Of course Amazon (AMZN) crushed it. Of course. AWS brought in $30.87 billion in revenue, advertising soared 23%, and Prime Day broke records. According to Adobe Analytics, shoppers spent $23.8 billion during the event. Impressive, sure, but have you ever tried navigating Amazon’s website? Half the time, I end up buying three extra items I didn’t need because their algorithms are stalking me. Creepy, right?

Still, you can’t deny the brilliance of AWS. Cloud computing is basically the oxygen of modern business now. Without it, companies would suffocate under the weight of building their own data centers. But seriously, could they tone down the marketing emails? My inbox looks like a ransom note.

Home Depot: Up 8.8%

Finally, we have Home Depot (HD), which thrived despite the housing market looking like it ate something bad. Turns out, people aren’t moving-they’re fixing up what they’ve got. Smaller projects, bigger profits. Who knew?

Sales rose 4.9%, and adjusted EPS edged higher. Solid numbers, sure, but can we talk about Home Depot’s app for a second? Every time I try to order paint samples, it glitches out. How hard is it to make a button work? Is this rocket science? Clearly, I’m missing something.

In conclusion, August 2025 was a month full of winners-and yet, somehow, I still found reasons to complain. That’s talent, folks. 😏

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-09-07 20:26