Let me confess something: I’ve spent more time agonizing over which brand of laundry detergent to buy than most people spend picking their retirement investments. And yet, here we are. The myth that investing requires a Bloomberg terminal strapped to your forehead is about as accurate as my belief that Instagram filters make me look younger. Enter ETFs-the financial equivalent of buying a mixed box of chocolates. You don’t know what you’ll get, but at least you’re not licking individual wrappers.

Take it from someone who once tried to explain dollar-cost averaging to her dentist mid-root canal: ETFs are the gift that keeps on giving, especially when the market feels like a toddler’s temper tantrum. Two of them, in particular, have been quietly outperforming my expectations-and my nephew’s TikTok dance skills.

1. Schwab U.S. Dividend Equity ETF

I once dated a man who bragged about his “consistent dividends” from a utility stock. Three months later, he was crying into his kale smoothie when the company cut payouts. Enter SCHD (Schwab U.S. Dividend Equity ETF), which treats dividend history like my grandmother treats her bridge club-only the longest-standing members get a seat at the table.

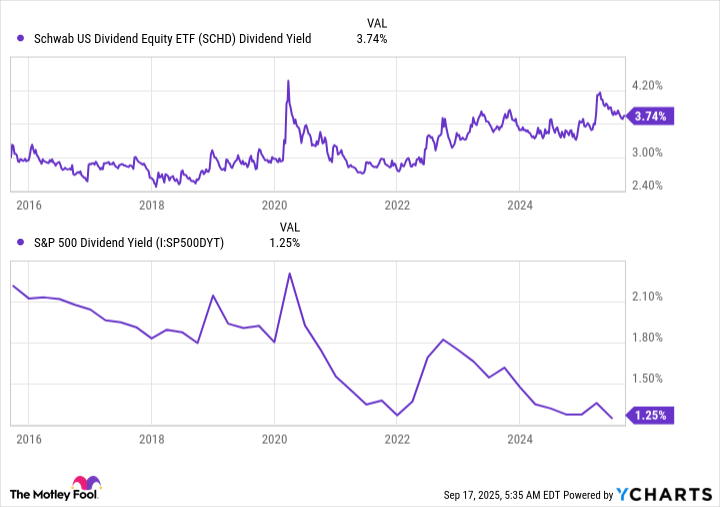

This ETF tracks companies with at least a decade of dividend payments, the financial version of a gold watch for longevity. Its current 3.7% yield is like finding a $20 bill in your winter coat pocket: unexpected, welcome, and three times what the S&P 500 coughs up. And those payouts? They’ve grown 160% since 2013. Reinvest them, and you’ll understand compounding better than my yoga instructor understands “downward dog.”

Dividends here aren’t quite as reliable as my neighbor’s daily complaints about my garden gnomes, but they’re close. When markets hiccup-as they did last time I tried to host Thanksgiving-you’ll appreciate the cushion. Think of it as financial Tums for your portfolio’s indigestion.

2. Vanguard Total International Stock ETF

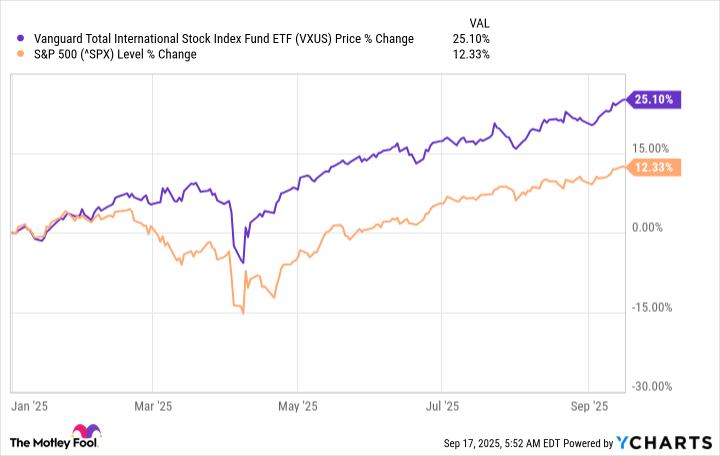

My cousin Marjorie once insisted Europe was “just like New Jersey with better wine.” She’s not wrong, but VXUS (Vanguard Total International Stock ETF) offers exposure to 4,300+ companies from 46 countries, which is fancier than my Airbnb in Lisbon. It’s like marrying a Swiss Army knife-practical, adaptable, and vaguely intimidating at family gatherings.

This ETF splits its assets like a UN cocktail party: 39% Europe (the sober diplomats), 27.2% emerging markets (the loud tech founders), 25.4% Pacific (the sushi enthusiasts), and tiny slivers of North America and the Middle East (the folks who got lost on the way to the bar). While it’s trailed the S&P 500 recently-much like my 10K race times-it’s doubled the index this year. Timing, like fashion, is everything.

At 0.14% expense ratio, VXUS costs less than my monthly Netflix habit. I’d still keep U.S. stocks as the main dish, but 10% international seasoning? Chef’s kiss. Just don’t ask me to pronounce “MSCI All Country World ex-US Index” after a glass of Malbec.

Investing should feel less like tax season and more like discovering a $20 bill in last year’s jeans. These ETFs won’t make you a billionaire-unless you’re 12-but they’ll keep your portfolio looking sharper than my ill-advised mullet of 1997. Now if you’ll excuse me, I need to call my broker. Or maybe just rethink my life choices. 😏

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Gold Rate Forecast

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-09-21 14:15