Prepare for a potentially turbulent week in the world of cryptocurrencies as numerous significant events are set to unfold. These include Sonic’s debut token listing on Binance and the large-scale release of ONDO tokens, which may lead to price fluctuations throughout the market.

Investors looking towards the future might find it beneficial to design their trading approaches around these upcoming events this coming week.

Sonic’s S Listing on Binance

On December 24th, Binance disclosed their intention to remove all current Fantom (FTM) trading pairs for spot transactions on January 13th. This decision coincides with Fantom’s rebranding and token swap project, preparing the platform for the listing of Sonic’s newly minted token, S.

1-to-1 exchange: Users’ FTM tokens will be swapped for Sonic tokens, keeping the number of S tokens equal to their existing FTM holdings. The initial circulating supply of Sonic tokens is estimated to be around 2.88 billion, with a total supply of 3.175 billion, mirroring FTM’s metrics at the inception of the Sonic network.

For those holding FTM tokens, if they decide against upgrading to the S token, they are still able to utilize FTM within the Opera network. Nevertheless, engaging in transactions, decision-making processes, and other activities on the Sonic network necessitates the use of the S token.

With this rebranding, we’re paving the way for Sonic’s mainnet debut in February, introducing a host of innovative elements. Among these are a Decentralized Exchange (DEX) and a homegrown Remote Procedure Call (RPC), designed to enhance network dependability and scalability.

Aerodrome DEX Upgrade

This coming week, we’ll see the launch of an update, Version 2 (V2), for Slipstream – the exchange that made Aerodrome a leading Layer-2 (L2) decentralized exchange (DEX). Aerodrome refers to this upgrade as a fusion of DeFi’s most productive liquidity pools with adjustable fees that respond to market volatility. The goal is to create a blockchain experience resembling an order book, all while providing users with better returns.

Aerodrome detailed how they are finally providing a platform that resembles an on-chain order book, aiming to return the highest possible rewards to its users.

After the introduction of Slipstream in April, it has demonstrated impressive performance across most major indicators. This improvement is attributed to Slipstream’s function of safeguarding liquidity provider positions by enabling them to set boundaries for providing that liquidity (focused liquidity). Since its launch, Aerodrome has significantly increased its influence over Uniswap on Base, rising from approximately 20% to a dominance of around 60%.

The updated Slipstream V2 from Aerodrome provides reduced transaction costs, quicker transactions, enhanced liquidity, and a significant increase in earnings. This latest version also introduces dynamic fees and additional innovative features, which could potentially amplify commission returns by as much as 40%.

To put it simply, the current average annual interest rate stands at 53.17%. If this rate were to increase by 40%, it would jump up to approximately 74.44%. Such an increase might influence both the Aerodrome’s cash flow and its market value.

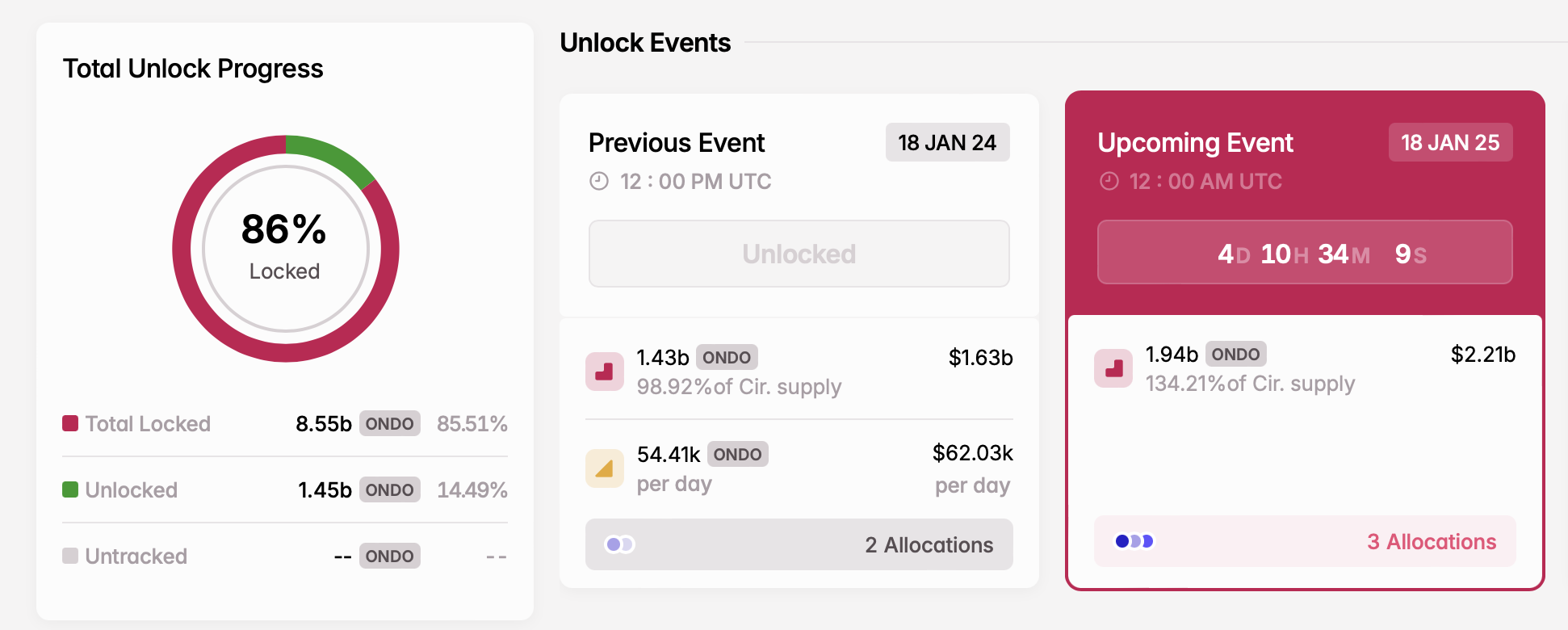

ONDO Token Unlock

One of the significant crypto events this week is the release of ONDO tokens from their lock on January 18th. As per BeInCrypto’s report, Ondo Finance plans to distribute approximately 1.94 billion ONDO tokens, currently estimated at a value of $2.15 billion. This distribution represents an additional supply equivalent to 134.21% of the current circulating ONDO tokens. The newly released tokens will be utilized for private sale participants, fostering ecosystem growth, and advancing protocol development.

A study revealed that about 9 out of 10 instances of an asset being unlocked tend to put downward pressure on its price, and this effect is even more pronounced in significant events where the decline can be more dramatic. The findings indicated that when investors unlock shares, there’s a somewhat controlled response in terms of price movement compared to when team members unlock their holdings.

Concerning tokens designated for the advancement of our ecosystem, these tokens tend to have distinctly beneficial impacts. Frequently, they lead to price rises (an average increase of +1.18%), either by introducing liquidity or encouraging expansion within the ecosystem. These tokens are primarily used for infrastructure development, which in turn fosters lasting growth within the ecosystem.

Solv Protocol Token Launch

This week, significant news in the crypto world involves the debut of Solv Protocol’s native token, SOLV, on January 17th. Solv Finance is a decentralized system primarily dedicated to liquidity and infrastructure for digital asset yields, as well as offering a staking solution for liquid Bitcoin. The platform has constructed a decentralized Bitcoin reserve that currently holds more than 25,000 BTC.

The project just managed to gather around $22 million during its latest funding round, which roughly estimates its worth at about $200 million. With Bitcoin DeFi products experiencing increasing growth in terms of Total Value Locked (TVL) and usage, Solv Protocol is quickly becoming a significant figure in this sector.

On Binance and Bitget platforms, the SOLV token can be traded using USDT, BNB, FDUSD, and TRY. Moreover, the protocol offers a public sale with a Binance mega drop event, allowing BNB coin holders to potentially gain from this opportunity.

The Rewards System relies on a fixed BNB score, augmented by bonuses from Web3 Quests when using a Binance wallet, as explained by Binance.

Mode’s AI Terminal Launch

One significant crypto development this week is the Mode’s AI Terminal. This AI-driven chat assistant empowers users to execute DeFi operations, which could revolutionize user interactions with Decentralized Finance protocols.

According to James Ross, the creator of Mode, it’s expected that Artificial Intelligence (AI) will fundamentally change the way people engage with Decentralized Finance (DeFi) platforms and networks.

Instead of dealing with intricate DeFi app interfaces, users can easily perform transactions and deploy contracts using Mode’s AI Terminal and Assistant, which allows for smooth, direct interaction with the blockchain. This new approach is designed to streamline and improve the overall DeFi user experience.

Blast Mobile Platform Release

This week, Blast is generating buzz due to the upcoming launch of its mobile platform. Additionally, the Layer-2 network plans to announce a significant update in tokenomics. These advancements are designed to enhance user experience and drive adoption, making BLAST an intriguing token worth keeping an eye on.

For several months now, we’ve been deeply focused on our work, and we’re nearing the point of release. We’re making the final adjustments to Blast’s mobile platform, revising our tokenomic structure, and preparing for important announcements. All these updates will be unveiled next month. This was shared in a post made in December.

Over the weekend, the L2 network recommended that all Blast Dapps should give out Points and Gold to their users before any upcoming alterations.

Blast announced that there won’t be a gold distribution for January. It’s important that everyone logs into the Blast website using their digital wallets.

US CPI

wrapping up this week’s list is the upcoming release of the US Consumer Price Index (CPI), scheduled for Wednesday. This significant US economic data will have an impact on Bitcoin by indicating inflation patterns and Fed policy. In addition to the CPI, the forthcoming inauguration of President Trump is causing some market unease. It represents the first pro-Bitcoin administration to occupy the Oval Office in the United States.

Currently, Macro is leading the conversation. The PPI will be under scrutiny tomorrow, with the CPI coming up on Thursday. We’re only a week away from the first pro-Bitcoin administration in the U.S…Yes, there might be further drops, but the fact that we’re not seeing any significant rises at the moment suggests that Trump’s inauguration is less likely to trigger a sell-off event. This was a perspective shared by one user on X.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

2025-01-13 18:23