As a seasoned crypto investor with a decade of experience under my belt, I must say this week is shaping up to be quite the rollercoaster ride for us enthusiasts. With Frax Finance taking a bold step towards institutionalization by voting for BlackRock’s BUIDL-backed stablecoin, we could potentially see more mainstream adoption in the near future. The Sui network’s token unlock is another exciting event, but I can’t help but wonder if it will make a significant impact on the overall market cap, given the vast majority of tokens remaining out of circulation.

The Israeli investment firms launching Bitcoin mutual funds seems like a step backwards when compared to the ETF craze. Considering Israel’s recent geopolitical turmoil and capital flight, it might be challenging for these funds to garner substantial interest. However, who knows? Maybe they’ll surprise us and become the next big thing in the crypto world.

The Empyreal-powered no-code AI Agent Launchpad is an intriguing development that could democratize AI creation and customization. If executed successfully, it could open up new opportunities for developers and users alike. The Pendle airdrop, Movement Mainnet launch, and GammaSwap audit are also events to keep an eye on, as they have the potential to impact their respective communities significantly.

Lastly, let me leave you with a little humor – it’s always good to maintain a sense of perspective in this ever-evolving space. As I watch the crypto markets dance like a wild rodeo every week, I can’t help but remember an old saying: “Don’t put all your eggs in one basket, and then watch that basket on roller skates.” Happy investing!

This week is set to see several significant developments in the crypto world. For instance, Frax Finance plans to redesign its FRAX stablecoin into a new asset backed by construction (BUILD). Also, Sui has unveiled 64 million governance tokens, while six Israeli investment firms are introducing Bitcoin mutual funds.

1) In this week’s lineup, Empyreal’s Web3 SDK platform introduces its no-code AI Agent Launchpad. Meanwhile, Pendle is planning an airdrop, Movement is preparing for their Mainnet Launch, and GammaSwap’s yield tokens undergo an audit. Essentially, the crypto community has plenty to look forward to as they dive into 2025!

Frax Votes for BUIDL-Backed Stablecoin

In simple terms, Frax Finance has decided to employ BlackRock’s tokenized fund, known as BUIDL, as the foundation for their revamped frxUSD stablecoin, with the voting process concluding tomorrow.

For several years, the DeFi equivalent of a central bank in crypto has been introducing stablecoin options, and currently, they’re considering transforming their current FRAX stablecoin into frxUSD. As we speak, the majority of voters are in agreement and seem to support this proposed change.

Securitize has put forward a plan to incorporate BlackRock’s BUIDL token as a backing for Frax’s upcoming relaunch of frxUSD stablecoin. By connecting institutional-quality assets with decentralized finance, we are pushing the boundaries of innovation in the world of stablecoins, according to Securitize on social media.

In October, BlackRock made a public statement expressing their desire for exchanges to accept their BUIDL token as security for derivative investments. While Frax Finance’s latest product doesn’t fall under this category, it isn’t the only stablecoin backed by BUIDL that has been introduced recently. Just this month, Ethena Labs unveiled its new USDtb asset, which is also supported by BUIDL.

As a seasoned investor with over two decades of experience in the financial industry, I have witnessed the evolution of digital assets from their infancy to the powerful force they are today. Recently, I’ve been closely monitoring BlackRock’s strategic moves, and their latest directive to BUIDL for significant expansions within the crypto space has caught my attention. In light of Frax’s upcoming vote, it seems that the community is overwhelmingly in favor of the proposed plan, with little to no substantial opposition voiced so far. Based on this information and my own observations, I believe that this expansion will indeed materialize, marking yet another milestone in the ongoing maturation of the crypto market.

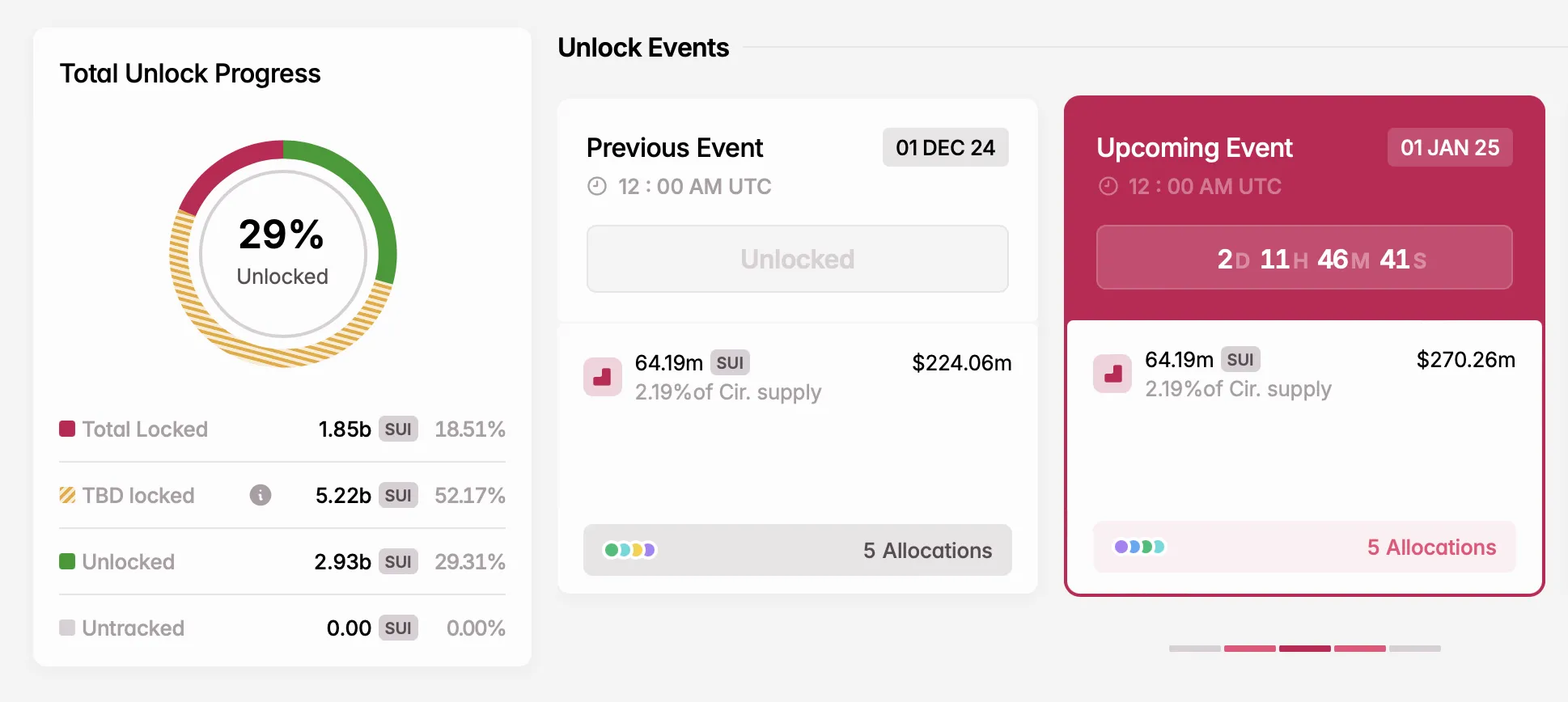

Sui to Unlock 64 Million Tokens

This week, the well-known blockchain network Sui is set to carry out a significant token liberation. On New Year’s Day, approximately 64 million SUI tokens will be freed, which currently stands at a circulating supply of around 2.92 billion. However, after this substantial release, the majority of tokens will still be kept out of circulation.

As a researcher delving into the topic, I’d like to highlight that SUI serves as a governance token. Notably, the initial distribution of this token is designed to reward early investors and contributors. More precisely, the tokens released will be allocated to Series A and B participants, the community reserve, and the Mysten Labs treasury.

Bitcoin ETFs Elusive for Israel, Mutual Funds Launch

This week, six Israeli financial companies plan to debut mutual funds that invest in Bitcoin. These Bitcoin mutual funds gained popularity a few years back as exchange-traded funds (ETFs) were still awaiting regulatory clearance.

By the year 2024, most newly introduced crypto mutual funds primarily focus on assets lacking suitable Exchange-Traded Funds (ETFs). Despite persistent efforts by Israeli businesses, these endeavors have yielded limited results so far.

For over a year now, investment firms have been urgently requesting approval for ETFs, even submitting proposals for bitcoin funds halfway through the year. However, the regulatory body seems to move at its own pace, as it needs time to thoroughly examine the details, according to an unidentified executive from an investment firm speaking to local press.

Essentially, these strategies might not be effective enough due to their timing, as Bitcoin appears close to entering a downturn in the market (bear market).

Furthermore, the success or failure of these Bitcoin-related products is not solely determined by Bitcoin’s own performance. Instead, local investment factors often play a significant role. To illustrate, the much-anticipated Bitcoin ETFs in Hong Kong saw a less-than-impressive launch despite initial high expectations.

In summary, the timing for this launch seems dubious given the current low interest in BTC mutual funds, due to the ongoing ETF mania. Since the conflict in Israel started in 2023, foreign investment has significantly dropped, with capital flight spiking by 63% as of October 2024.

Domestic technology industries within the country are experiencing a reduction in financing as well. Given these challenging conditions, Bitcoin mutual funds might not perform successfully either.

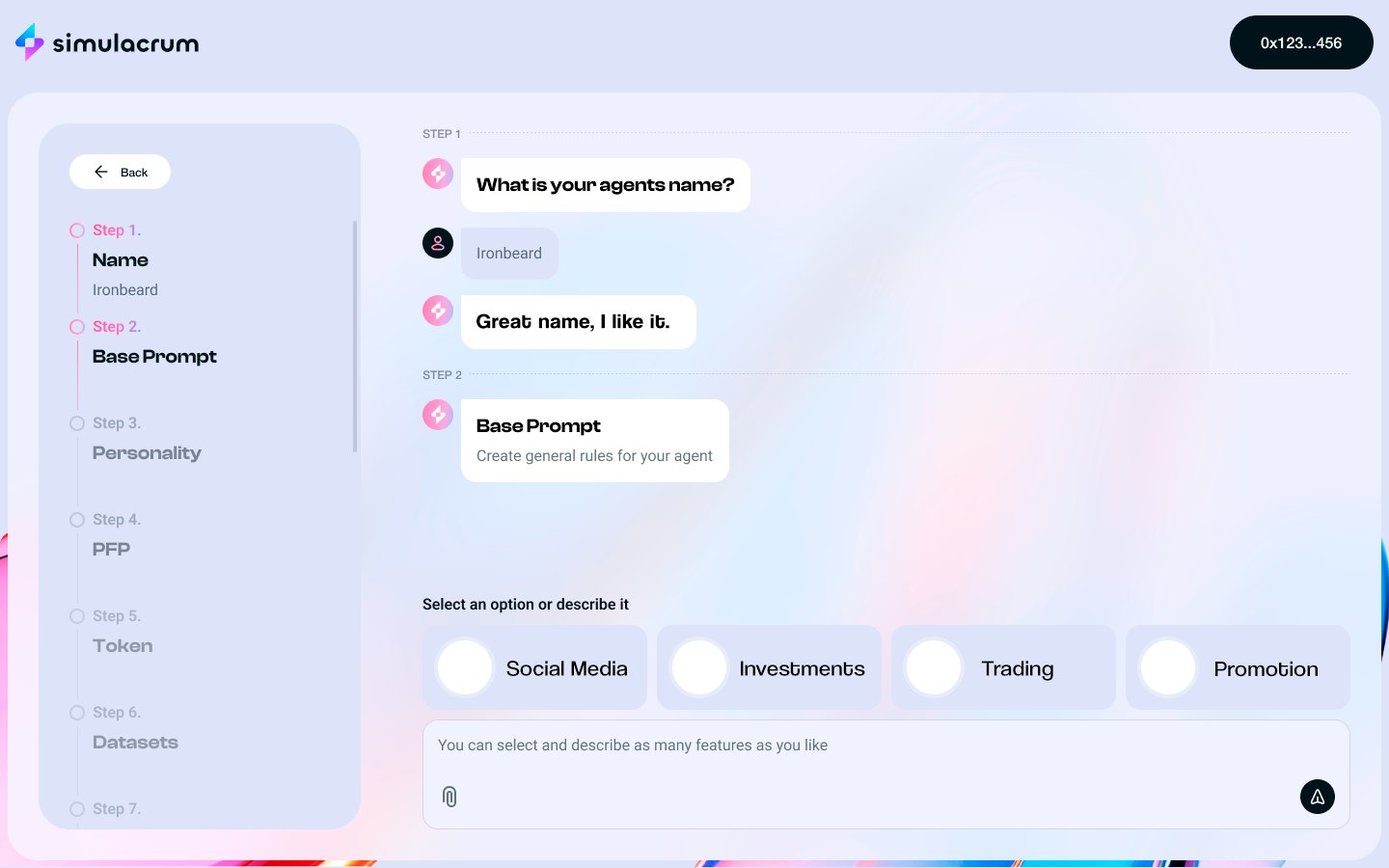

Empyreal To Power No-Code AI Agent Launchpad

In simple terms, Empyreal – a company specializing in web3 infrastructure – is planning to release a platform (often called a “launchpad”) for AI agents that don’t require coding. The primary development work is being handled by Simulacrum AI, while Empyreal’s technology will serve as the backbone powering its key features.

Via this user-friendly, no-code system, individuals can personalize these AI agents in several aspects such as modifying how they engage with users and using custom datasets. Moreover, these agents are designed to issue tokens and control their financial reserves. The initial real-world trial is set to be carried out via Simulacrum, an advanced AI system protocol.

Pendle Airdrop, Movement Mainnet, GammaSwap Audit

On New Year’s Eve, Pendle will capture a picture (or snapshot) of users who have invested in their vePENDLE asset. These users will then be rewarded with an additional allocation of tokens, known as an airdrop. Despite the ongoing bull market in the cryptocurrency sector, Pendle’s token value has declined significantly due to one of its major supporters, Arthur Hayes, selling off large quantities of it.

In simpler terms, the Movement project is all set to go live on its main network next January, following a successful trial run this month. This has led to an increase in the value of their MOVE token in the cryptocurrency market. Developers are hopeful for even more success as this is the first Ethereum L2 platform built using Move technology.

Today, the on-chain perpetual options platform, GammaSwap, is undergoing an audit. The focus of this audit is on their Yield Tokens, a feature that allows users to potentially earn high yields of around 60-80% Annual Percentage Yield (APY) in Ethereum.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Everything We Know About DOCTOR WHO Season 2

- Honkai: Star Rail – Hyacine build and ascension guide

- 50 Most Powerful Anime Characters of All Time (Ranked)

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- In Conversation With The Weeknd and Jenna Ortega

2024-12-31 06:02