As the world increasingly turns to stablecoins, the shadows of security risks loom larger, casting a wary eye over the digital landscape. But who, pray tell, are the valiant tokens standing tall against the storm of cyber threats?

- Tether’s USDT, the grand old duke of stablecoins, reigns supreme according to the Skynet scoring system, with a regal score of 94.72. One can almost hear the jingle of coins as it expands its empire from $138 billion to $154 billion in mere months. 🪙

- Alas, the crypto space is not without its share of tragedies, where security breaches have led to the tragic fall of stablecoin values, often due to exploits and price depegs. A veritable Greek drama, if you will. 🎭

The first half of 2025 witnessed a surge in stablecoin use cases, with a monthly settlement volume soaring by 43% to a staggering $1.39 trillion. Yet, this rapid ascent has also unveiled the widening chasms in security posture, compliance, and operational risk that the community must address. It’s a bit like finding out your castle is built on quicksand. 🏰💦

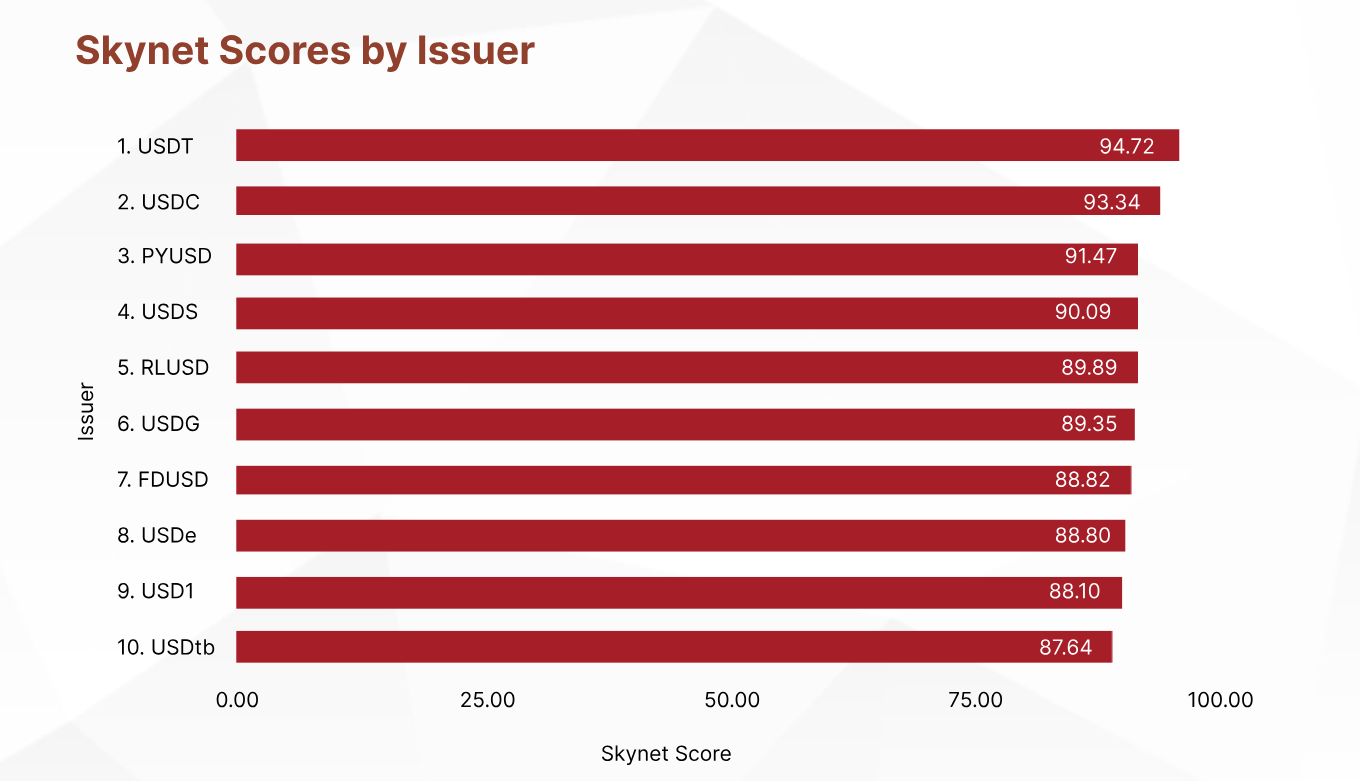

CertiK, the vigilant knight of the crypto realm, has ranked the top fiat-pegged tokens from a security and risk standpoint. Their six-item Skynet rating framework, a modern-day Iliad, evaluates each token based on operational resilience, governance strength, fundamental health, code security, market dynamics, and community trust. 🛡️📊

According to the Skynet framework, Tether’s USDT (USDT) stands atop the pedestal with an overall score of 94.72. The security firm lauded USDT’s decision to swell its ranks from $138 billion to $154 billion in the first half of 2025. One might say, it’s a tale of ambition and success. 🏆

In the second place, we find Circle’s USDC (USDC) with a commendable score of 93.37. With a MiCA license in hand and an IPO under its belt, Circle’s token supply has ballooned from $41 billion to $61 billion. While it may trail behind Tether, CertiK has crowned it the “fastest growing” major stablecoin. A true underdog story, if ever there was one. 🐢➡️🐇

PyUSD (PYUSD), the brainchild of PayPal and Paxos, takes the third spot with a score of 91.47. Its market cap has doubled in the first half of 2025, and recent developments include expansions into Solana (SOL) and Arbitrum (ARB), along with a rewards program. It’s like a phoenix rising from the ashes, but with better Wi-Fi. 🔥🌐

In fourth place, USDS by Sky, with a score of 90.09, has seen its fortunes rise since the rebranding of DAI into Sky. Its expansion into multiple chains, particularly Solana, has propelled it to become the fifth largest stablecoin. A true testament to reinvention. 🌱➡️🌟

Ripple’s RLUSD (RLUSD) rounds out the top five with a Skynet framework score of 89.89. Despite lagging behind USDT and USDC in terms of supply and security mechanisms, it boasts a perfect record of zero security incidents since its launch. Sometimes, the quiet ones surprise us the most. 😌

Other notable tokens mentioned in the top 10 include First Digital USD (FDUSD), USDG by Paxos, Ethena’s USDe (USDE), USDtb, and World Liberty Financial’s USD1. Each a story in its own right, much like the chapters of a grand novel. 📚

The impact of security incidents on stablecoins

CertiK, the watchful guardian of the blockchain, reports that 344 crypto security incidents occurred in the past year, resulting in the theft of $2.47 billion worth of crypto assets. While these incidents don’t always target stablecoins directly, they often suffer the most, like the innocent bystander caught in a crossfire. 🏹💔

Take, for example, First Digital USD, whose price tumbled to $0.76 amidst rumors about the security of its reserves. Only after the issuer disclosed audited holdings did it manage to claw back to its $1.00 value. A stark reminder that in the world of stablecoins, trust is as fragile as a soap bubble. 🫧💥

Causes leading to stablecoin value drops in the past 10 years

Price depegs (Total: 14):

- Compliance events

- Problems with asset liquidity

- Delisting from exchanges

- Suspected asset mishandling

- Company halts issuance

Exploits (Total: 7):

- Token contract vulnerability

- Other contract vulnerability

- Chain vulnerability

Death Spirals (Total: 3):

- Design failure

- Insufficient reserve asset

The sanctity of fiat-pegged tokens lies in their reserves, a sacred trust that, once broken, can lead to their downfall. CertiK’s report reveals that operational failures, rather than technical flaws, are often the culprits behind the most devastating losses. It’s a reminder that even in the digital age, human error remains the greatest threat. 🤔🚫

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Best Single-Player Games Released in 2025

- Where to Change Hair Color in Where Winds Meet

2025-07-23 13:07