As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find myself intrigued by Toncoin (TON). Over the past 30 days, its impressive surge of 45.45% has certainly piqued my interest. The RSI remaining near overbought territory indicates that this isn’t just a fleeting rally but a sustained bullish trend.

Toncoin‘s price has skyrocketed by 45.45% in the past month. The Relative Strength Index (RSI) is approaching overbought levels, indicating strong buying activity and less selling pressure. Moreover, recent exchange outflows imply that investors are becoming increasingly confident about Toncoin.

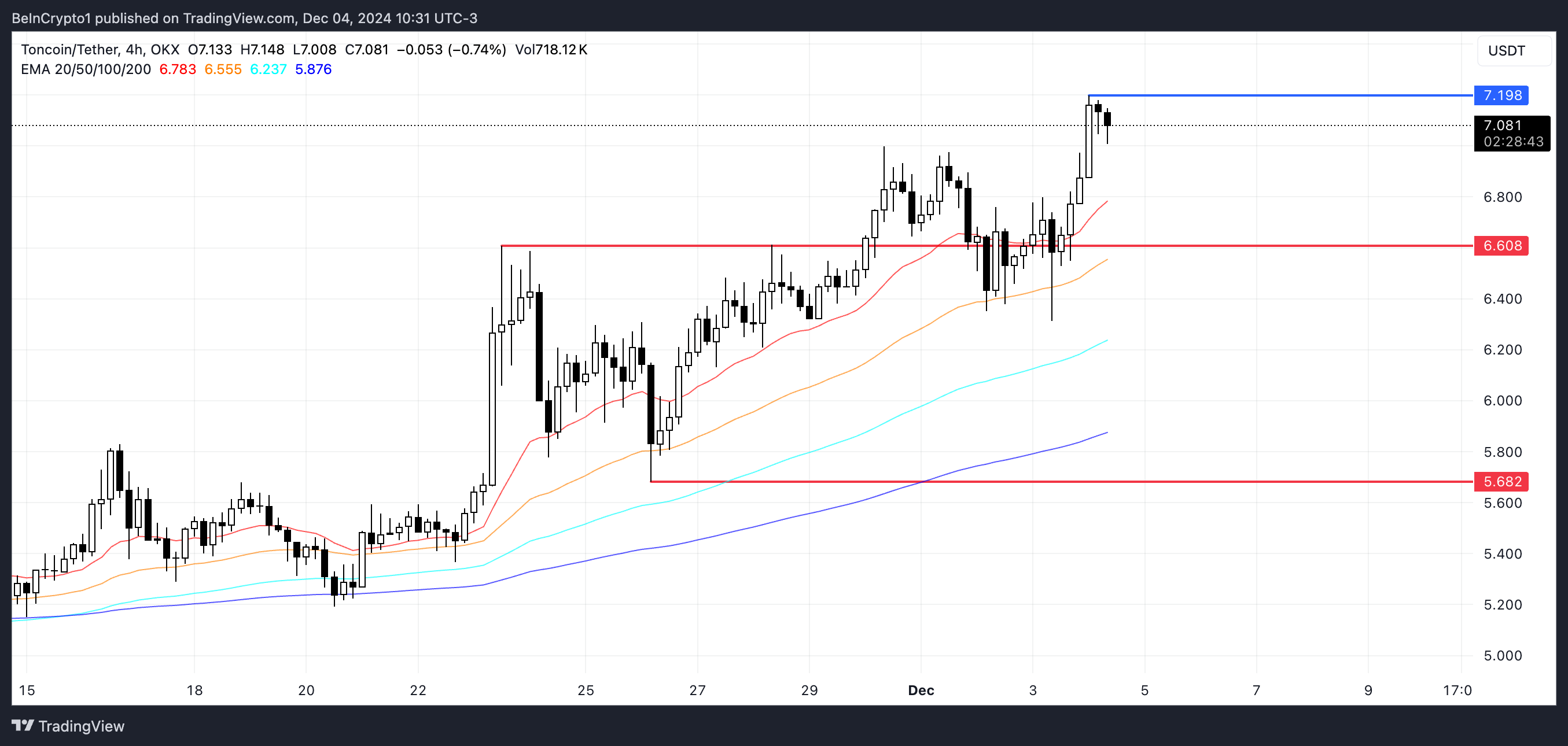

The EMA lines are adding strength to the positive trend, as the price consistently hovers above short-term averages. If Tezos (TON) continues its climb, it may successfully breach the resistance level of $7.198 and target $8 by December; however, a potential reversal could see it testing support at $6.6 and even lower at $5.6.

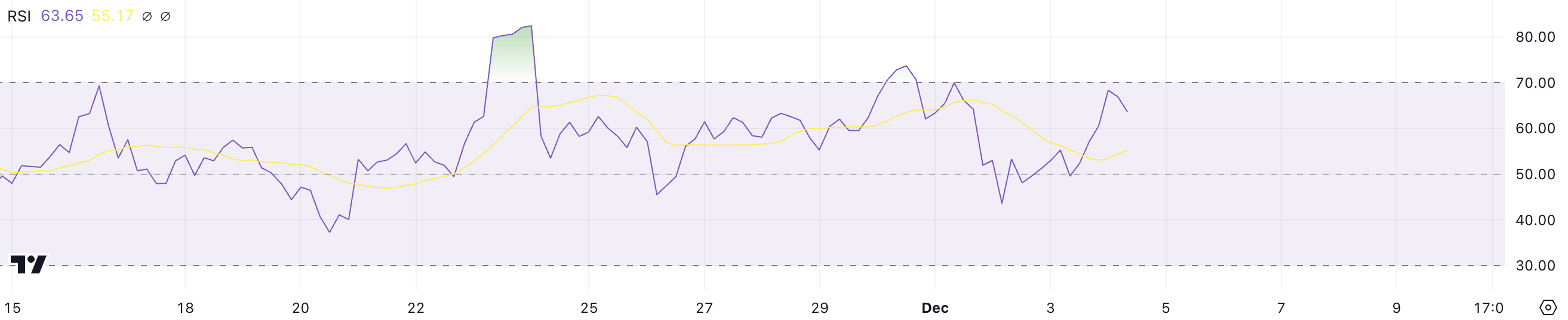

TON RSI Is Still Close to 70

The Relative Strength Index (RSI) for TON recently came close to reaching the overbought mark of 70, only to pull back to its current level of 63. This dip indicates a slight decrease in buying pressure, yet it’s important to note that the RSI still resides within bullish territory, suggesting that overall strength remains relatively robust.

In this market, the upper hand seems to be with the buyers, but it’s uncertain if the current trend will cause a substantial increase in prices unless there’s additional demand.

The Relative Strength Index (RSI) gauges the rate and intensity of price fluctuations, where figures exceeding 70 signal overbought states, while numbers below 30 denote oversold ones. At present, TON’s RSI stands at 63, implying it maintains a promising stance for potential increases.

As a crypto investor, if the price of TON reclaims the 70-mark, similar to its closing value in late November, I believe it could gather pace again and potentially challenge price points beyond $7.2, indicating another promising bull run with a possible breakout.

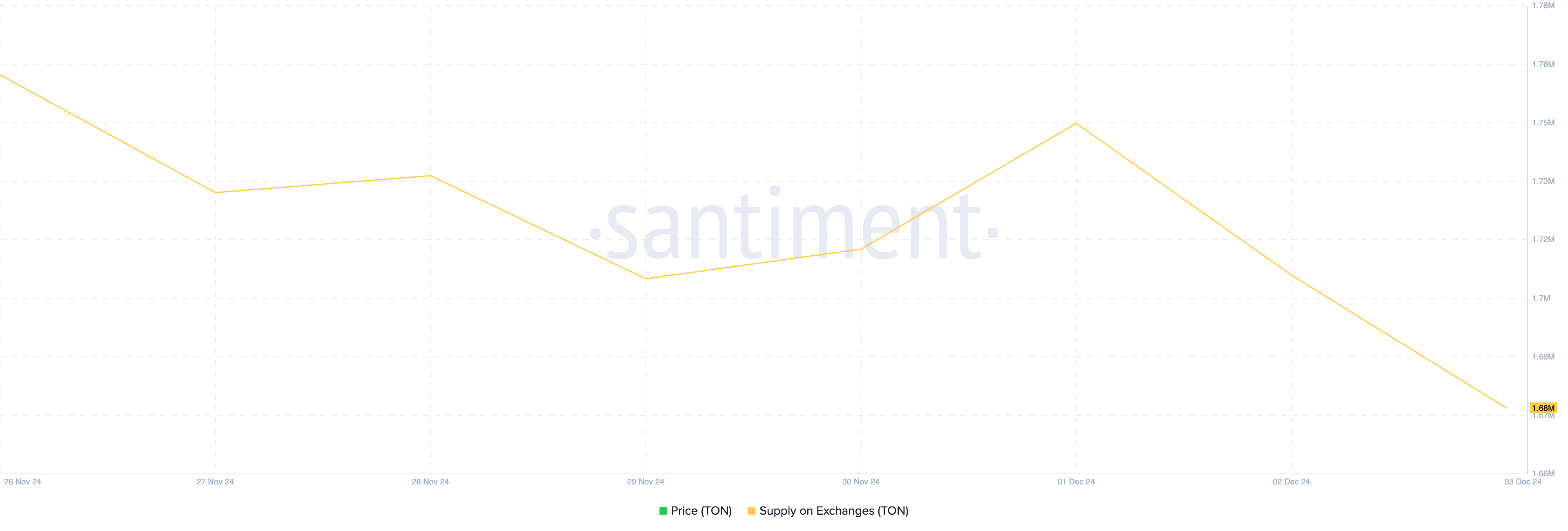

Toncoin Supply on Exchanges Dropped In The Last 3 Days

The amount of TON tokens on exchanges has dropped to about 1.68 million, a decrease from 1.75 million on December 1st. This reduction suggests that holders have withdrawn roughly 800,000 TON coins from exchanges over the past three days.

As a crypto investor, observing such a substantial withdrawal implies a decrease in selling activity, potentially indicating a transition towards long-term investment or staking strategies.

The quantity of a token listed on exchanges represents the amount that can be easily traded. An abundance of supply is typically viewed as bearish, suggesting that traders may be planning to offload their holdings.

In other words, when the availability of a coin like TON on exchanges decreases, as we’re seeing now, it often indicates that people are buying and holding onto it in anticipation of its success. This accumulation can lead to an increase in demand, which could potentially drive up the price because there will be less coin available for sale.

TON Price Prediction: Can It Reach $8 In December?

The trend on Technical Analysis (TON) charts shows a bullish outlook, as the short-term indicators are placed above the long-term ones, and the current price is significantly higher than its immediate moving averages.

This pattern suggests a robust upward trajectory, supporting the ongoing optimistic market direction. So long as the price remains above those lines, it’s likely that this trend will continue.

If Telegram Open Network (TON) continues its upward trajectory and successfully surpasses the $7.198 resistance point, there’s a possibility that it might continue gaining momentum, potentially reaching around $8 by December, a value last observed in June 2024.

In other words, if the current upward trend changes and a downward trend occurs instead, the price of TON could initially be tested at the $6.6 support level. A more significant correction might even push it down to $5.6.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- All 6 ‘Final Destination’ Movies in Order

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

2024-12-04 20:30