Ladies and gentlemen, train your monocles: the tokenized U.S. Treasury bonds, those shy, digital butterflies, have fluttered higher—an ascent of 6% since the propitious dawn of May 2, 2025.

Tokenized Treasuries—$6.89B: A Fintech Ballet With Extra Pirouettes 🩰

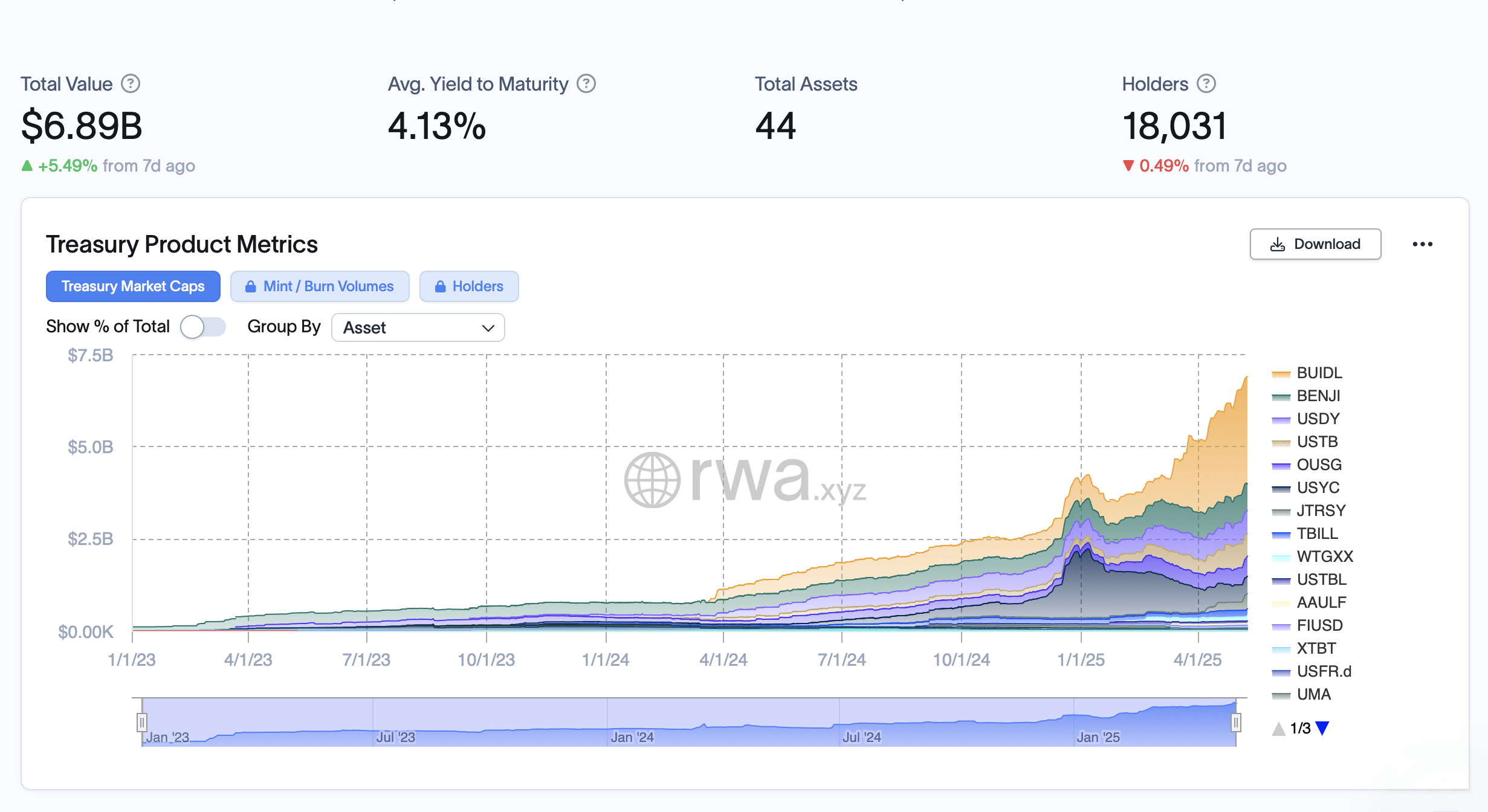

It was a Friday that could make even the most world-weary banker tap his calculator—May 2, 2025, the grand metric needle quivered at $6.5 billion. “Historical milestone!” the headlines trumpeted, as if Treasuries could blush. And now, in the span of a single week—faster than you can say “quantitative easing”—we have soared 6% to a rather flirtatious $6.89 billion, with a cool $390 million waltzing into these digital vaults. The smart money, it would seem, got a little smarter—or just became hopelessly infatuated. 💸

Since the year began—a mere five lunar cycles ago—this field has ballooned (helium supplied by zeroes and ones) from $4.03 billion to $6.89 billion, a metamorphosis owing more to Kafka than Keynes. Meanwhile, Blackrock’s USD Institutional Digital Liquidity Fund (the BUIDL, not to be mistaken for a Scandinavian metal band) pocketed $36 million since May 2. With the solemnity of an emperor counting his coins, its balance swelled from $2.871 billion to $2.907 billion.

Over yonder in the onchain coliseum, Franklin Templeton’s BENJI mustered $10.61 million, inching from $716.84 million to $727.45 million—the financial equivalent of finally completing a jigsaw puzzle only to find out a piece is missing. However, let us not neglect Ondo’s USDY, whose ambitions soared higher, netting $48.53 million in gains for an arrival at $629.73 million. Clearly the tortoise sometimes wears a Ferrari badge. 🐢➡️🏎️

One must remember (but preferably, forget) that Superstate’s Short Duration U.S. Government Securities Fund (USTB) took a little tumble—$651.51 million to $607.43 million—suggesting even digital assets have their gravity. The rest, from OUSG to TBILL, performed with varying degrees of enthusiasm, as recorded by the fastidious scribes at rwa.xyz.

The ceaseless gush of cash into these blockchained Treasuries hints at an odd new orthodoxy: asset managers and their flocks are growing noticeably fond of these digital doodads. No longer mere curios in some cryptographic cabinet, these onchain wrappers are stomping onto the mainstage. As long as yields wink and settlement remains less painful than a root canal, what’s been niche could soon become so ubiquitous your grandmother might ask you about BENJI at brunch. 👵🥞📈

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- Everything We Know About DOCTOR WHO Season 2

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 10 Shows Like ‘MobLand’ You Have to Binge

- All 6 ‘Final Destination’ Movies in Order

2025-05-10 22:03