“`html

So, it turns out that cryptocurrency projects like Aave, dYdX, Jupiter, and Hyperliquid are getting all fancy with token buyback mechanisms. Who knew crypto could be so… traditional? 🙄

Inspired by the stock market (because why not?), these buybacks are supposed to help crypto projects build a sustainable economic model. But let’s be real, does anyone actually know if this will make their tokens worth more than a cup of overpriced coffee? ☕️💰

The Booming of Crypto Projects’ Token Buyback Programs

Token buybacks are like that friend who keeps buying rounds at the bar—great in theory, but does it really help? When crypto projects buy back their tokens, they can either stash them away or burn them like last year’s fashion trends. 🔥 In theory, this creates scarcity, which is supposed to drive up prices. But hey, we’ve seen this movie before, and it’s not winning any Oscars. 🎬

Take Aave (AAVE), for example. In March 2025, they announced their new Aavenomics, which sounds like a fancy term for “let’s buy back our tokens and hope for the best.” They’re planning to repurchase $1 million worth of tokens weekly for six months. That’s a lot of tokens! 💸

In a perfect world, this buyback could total $100 million. But let’s not hold our breath. 😅

“We consider it the most important proposal in our history, feel free to have a read and provide feedback,” said Marc Zeller, founder of the Aave Chan Initiative (ACI). (Translation: Please validate our life choices.)

Meanwhile, dYdX is also getting in on the action with “Proposal #225” to buy back DYDX tokens. Because if everyone else is doing it, why not? 🤷♀️

Hyperliquid (HYPE) and Jupiter (JUP) are also on the buyback bandwagon, with Hyperliquid planning to repurchase a whopping $600 million worth of tokens annually. That’s a lot of zeros! 💥

Jupiter is also in the game, committing to using 50% of fees for buybacks, which is estimated at $250 million annually. They’ve even surpassed Raydium to become Solana’s second-largest protocol. Talk about a glow-up! 🌟

These are just a few of the usual suspects. Other projects like Gnosis, Gains Network, and Arbitrum are also hopping on this trend. So, could this reshape the cryptocurrency market? Or is it just a shiny new toy? 🤔

What’s Driving This Token Buyback Trend?

One user on X (formerly Twitter) commented on this buyback strategy:

“Buybacks create steady demand and reduce circulating supply, which can stabilize or even increase token prices.” commented Capitanike. (Because who doesn’t love a good supply and demand lesson?)

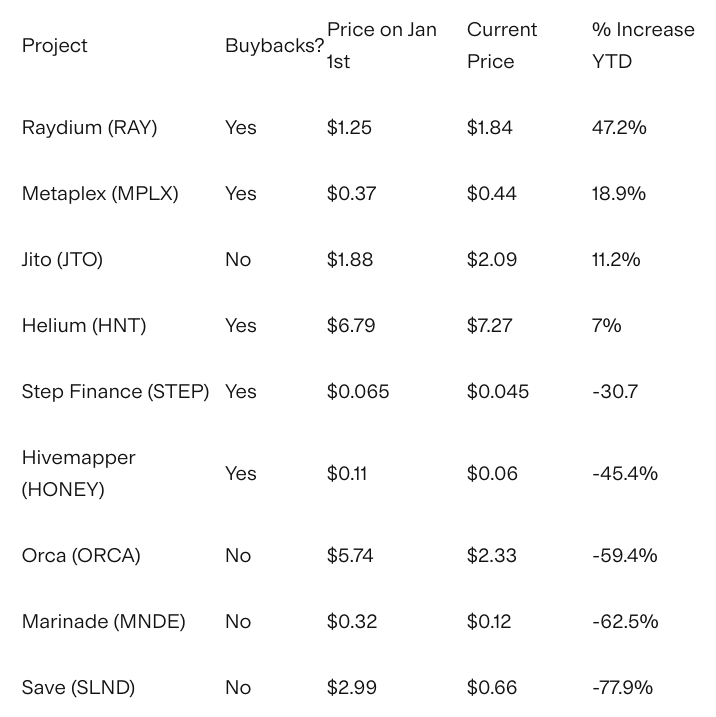

It’s all about supply and demand, folks! By reducing circulating supply, crypto projects are trying to create scarcity. According to SolanaFloor, projects with buyback programs outperformed those without by 46.67% in 2024. So, there’s that! 📈

Plus, buybacks can signal that a project is financially healthy. Because nothing says “trust me” like a project throwing money around like confetti! 🎉

And unlike the token burn strategy, many projects (like AAVE and Gains Network) are redistributing repurchased tokens to stakers or holders. It’s like a little gift that keeps on giving! 🎁

But hold your horses! Token buybacks aren’t all sunshine and rainbows. As this strategy becomes more popular, regulators like the SEC might start poking around for potential manipulation. Yikes! 😬

And if a project miscalculates its buyback strategy, it could end up reducing token supply too much. If they can’t balance new issuance or

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-19 11:16