In a world where the ephemeral nature of wealth dances mockingly before our eyes, a recent analysis by Messari has unveiled a disheartening truth: token buyback programs, those grandiose promises of stability, have crumbled under the weight of reality, failing to halt the relentless descent of several major tokens into the abyss of despair.

Ah, the irony! As these buyback programs gain traction, one cannot help but chuckle at the folly of networks that have embraced such strategies, believing they could tame the wild beast of market volatility.

Are Token Buybacks Effective? Messari’s Analysis Says Otherwise

BeInCrypto, in its infinite wisdom, has pointed out the burgeoning trend of token buybacks. The list of networks engaging in this charade is extensive, including Arbitrum (ARB), Aave (AAVE), Jupiter (JUP), and Hyperliquid (HYPER), among others. Yet, one must ponder: are they merely chasing shadows?

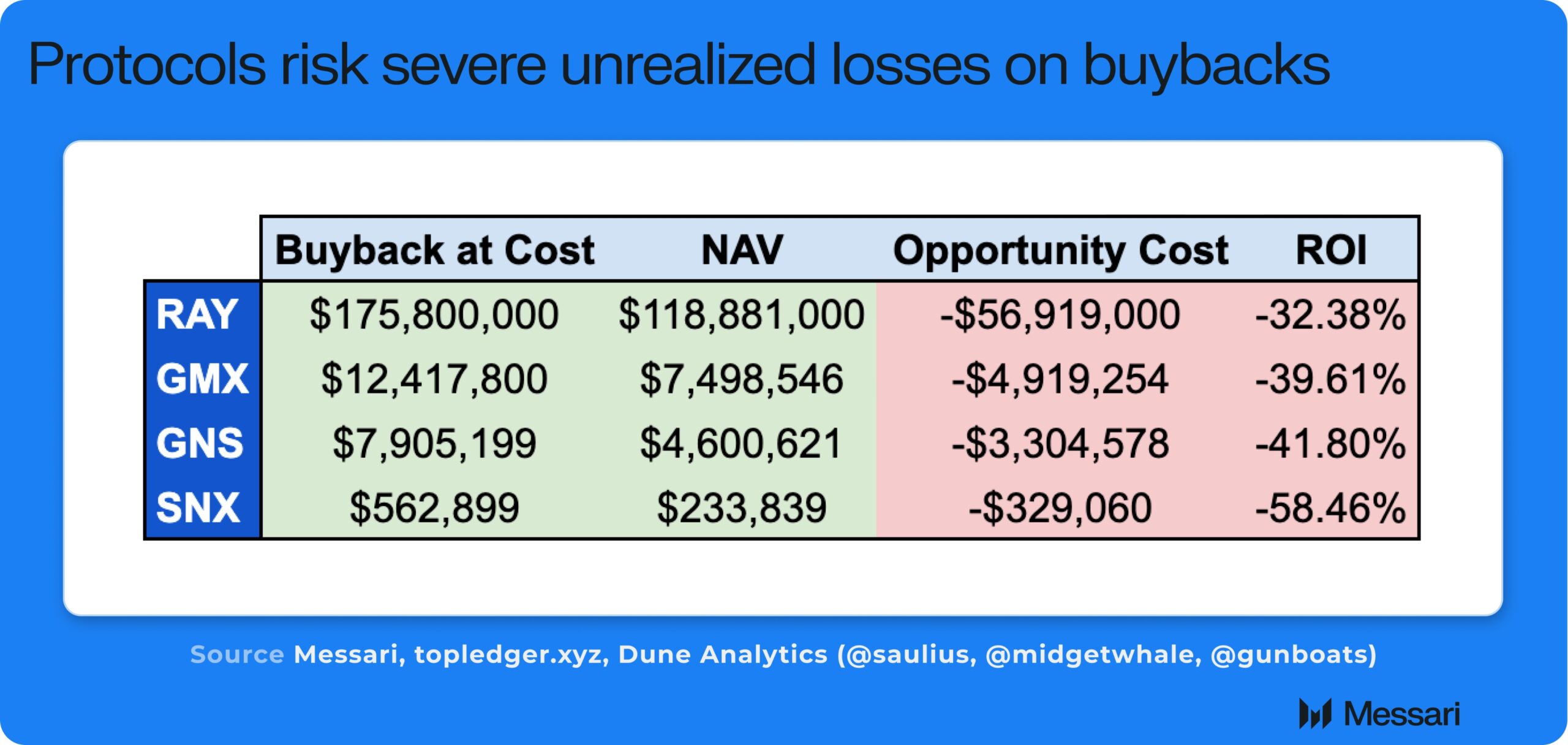

Messari’s analysis, however, reveals a grim reality. These strategies have largely failed for projects like Raydium (RAY), GMX (GMX), Gains Network (GNS), and Synthetix Network (SNX). Instead of igniting a spark of demand and price, these programs have been followed by steep losses, leaving investors to weep in their coffee.

Among the tokens, SNX has taken the crown of despair, plummeting 77%, while GNS has followed closely, plunging by 76%. GMX, not to be outdone, experienced a 34% decrease, and RAY, poor RAY, saw a 26% fall in value. What a tragic comedy!

“RAY, GMX, GNS, and SNX have programmatically bought back millions in tokens which are now worth way below cost,” lamented Messari’s enterprise research analyst, Sunny Shi, on X. A true tragedy of our times!

Shi, with a glimmer of sarcasm, identified three major flaws in token buyback strategies, dubbing them the “programmatic token buyback fallacy.” First, he emphasized that buybacks are largely irrelevant to price action. Instead, he argued that the true drivers are factors like revenue growth and market narrative, rather than the futile repurchase of tokens.

Secondly, he explained that when a project’s revenues are high, and token prices are elevated, buying tokens back at inflated prices is akin to throwing money into a bottomless pit. What a waste of capital!

Finally, Shi noted that in periods of low prices and revenues, when cash is essential for innovation or restructuring, companies find themselves lacking the necessary funds. Meanwhile, they sit on significant unrealized losses from their buyback investments, a cruel twist of fate.

“This is just poor capital allocation. The mindset should be growth at all costs or real value distribution to holders in the form of stables/majors (see veAERO or BananaGun),” he concluded, with a hint of exasperation.

Mason Nystrom, Junior Partner at Pantera Capital, echoed this sentiment, adding a dash of humor to the mix.

“Solid analysis on how programmatic buybacks can negatively impact a business as they force protocols into a dilemma of buying back tokens at inflated prices and limiting the capital that protocols can use to drive fundamental growth vs just token price,” he said, shaking his head in disbelief.

Nystrom argued that companies and protocols should use the revenue to invest in growth or conduct strategic buybacks with long-term goals. This approach, he believes, will ultimately create more value for token holders. A noble thought, indeed!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Summer Game Fest 2025 schedule and streams: all event start times

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

2025-03-21 11:33