XRP is trading at $2.74, down 2.5% today, with a market cap of $162 billion and a 24-hour trading volume of $7.16 billion. The intraday price range swings from $2.71 to $2.83, like a rollercoaster ride where the bulls can’t seem to catch their breath.

XRP

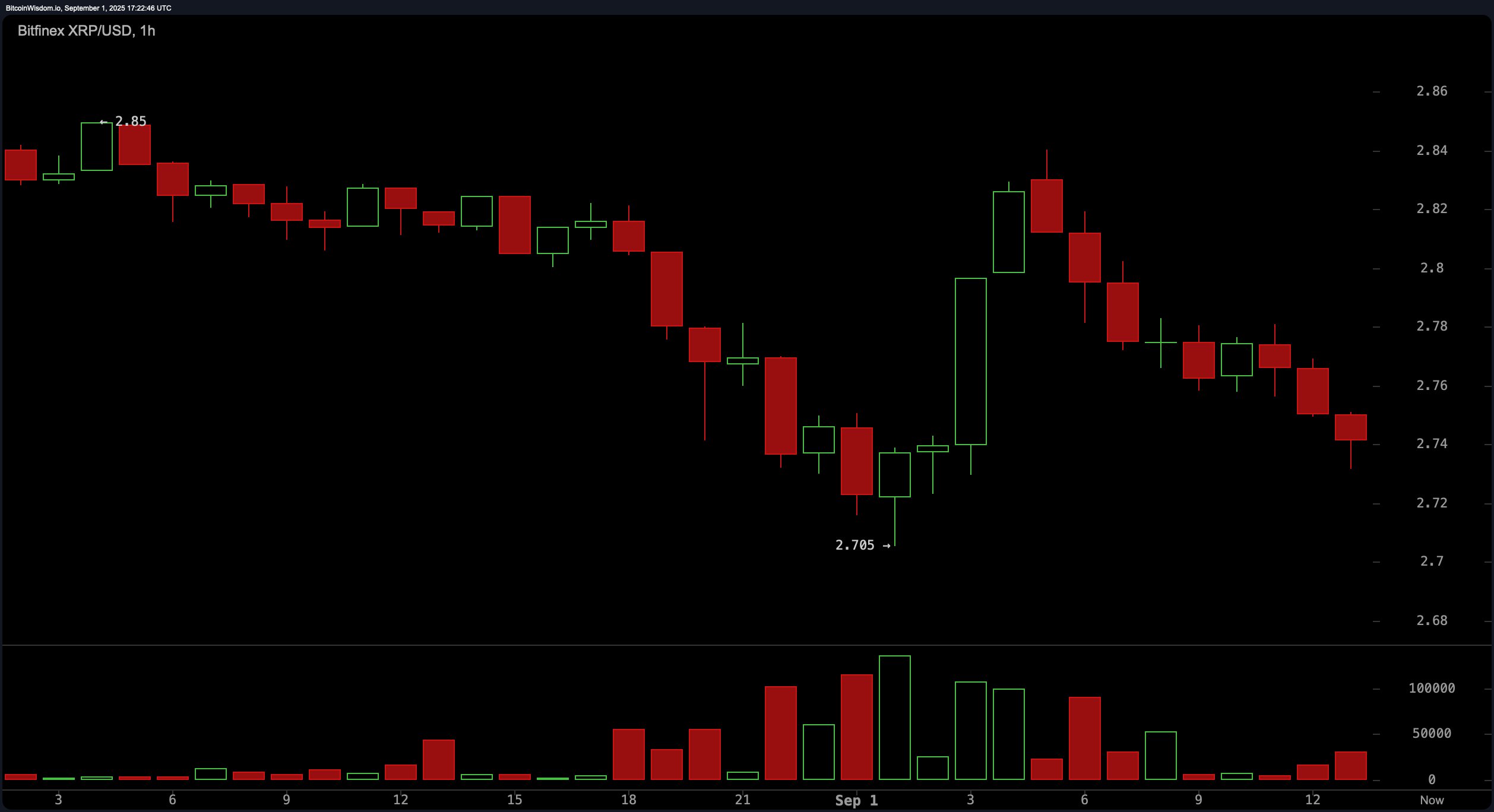

On the 1-hour chart, XRP has a clear case of “lower high-itis,” consistently closing below the $2.80 mark. A brief spike into the $2.84 to $2.85 range was quickly squashed, proving that the bears are in charge. If the price drops below $2.70, it might just be the beginning of a downward spiral. 📉

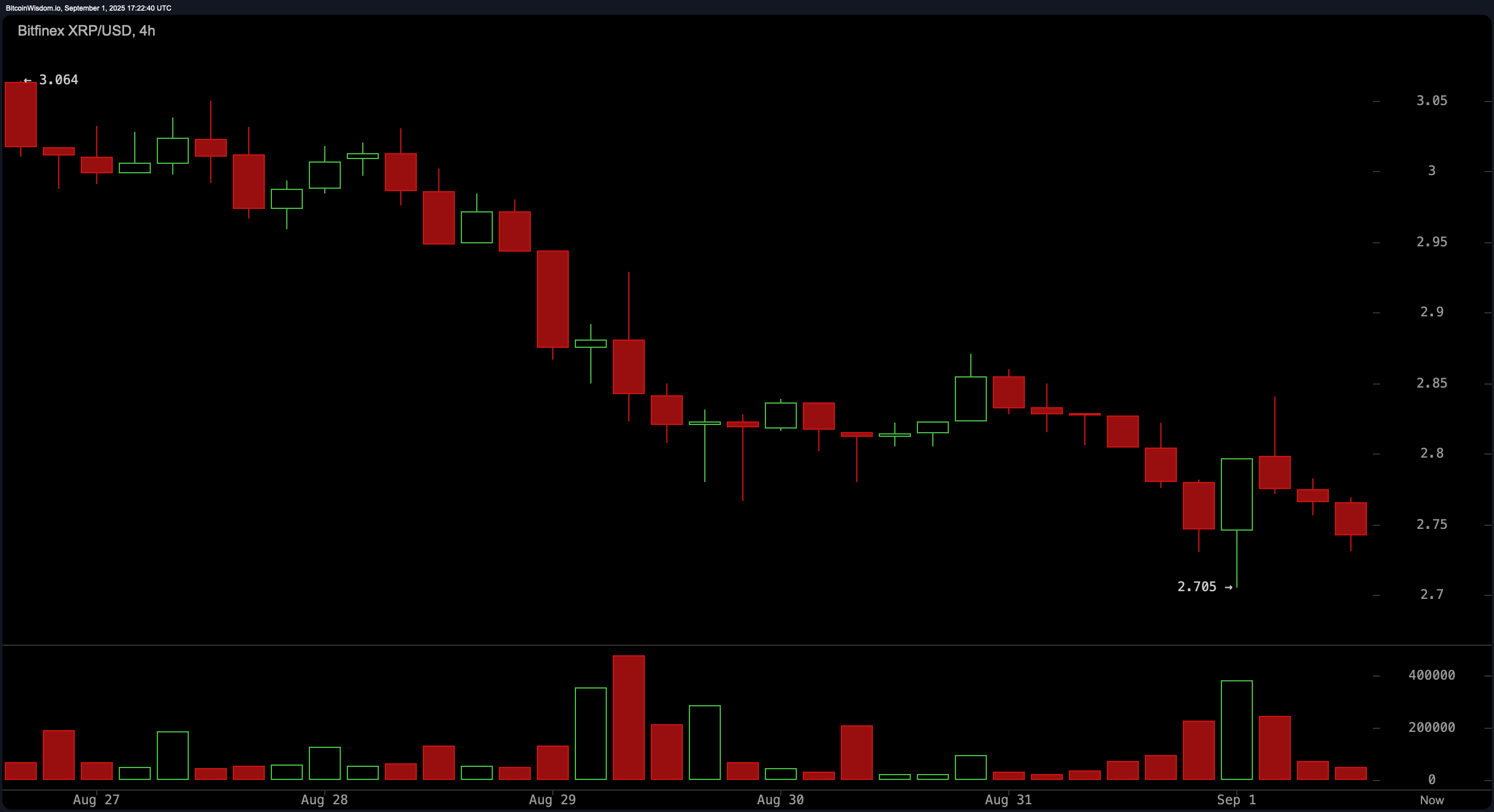

The 4-hour chart is a story of consistent decline since August 29, with each rebound failing to gain traction. The $2.85 to $2.90 range has become a no-fly zone, and a break below $2.70 could send the price plummeting to $2.66 to $2.68. But hey, who doesn’t love a good fall? 🍂

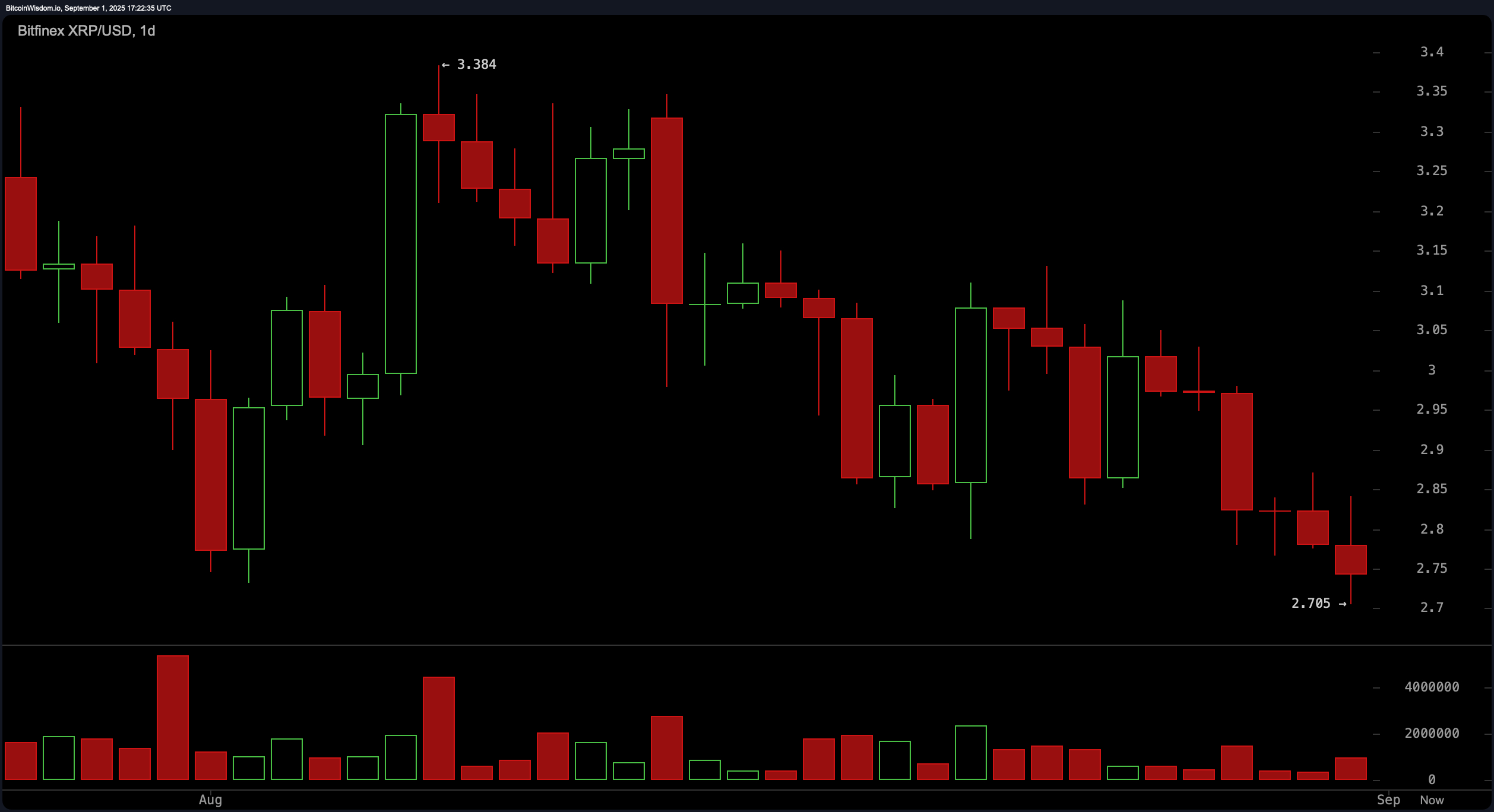

On the daily chart, XRP is stuck in a downward spiral, with a series of lower highs and lower lows since its August peak near $3.384. The $2.70 to $2.75 area is crucial, and any breach could spell trouble. Until the price can break and hold above $2.90, the bears will keep calling the shots. 🐻

Oscillators are giving us a mixed bag of signals. The RSI is at 39.09, the Stochastic oscillator is at 9.15, and the CCI is at −150.05, all pointing to a neutral momentum. The ADX at 18.41 suggests a weak trend, but the momentum oscillator at −0.33 and the MACD at −0.0665 are definitely leaning bearish. 🤷♀️

Moving averages (MAs) are reinforcing the bearish vibe. The 10-period EMA at $2.874, the 10-period SMA at $2.903, the 20-period EMA at $2.942, and the 20-period SMA at $2.973 are all bearish. However, the 100-period EMA at $2.768 and the 100-period SMA at $2.670 are showing a rare glimmer of hope. The 200-period EMA at $2.507 and 200-period SMA at $2.483 suggest potential buying opportunities, despite the short-term chaos. 🌟

Bull Verdict:

Despite the short-term pressure, the long-term buy signals from the 100-period and 200-period SMAs and EMAs hint at a possible accumulation point. If XRP can sustain a break above $2.90 with solid volume, it could spark a bullish rally toward $3.10 and beyond. 🚀

Bear Verdict:

XRP is showing technical weakness across multiple time frames, with lower highs, rejected rallies, and strong resistance below $3.00. The overwhelming bearish signals from moving averages and oscillators suggest that the bears are in control. A break below $2.70 could lead to more downside. 📉🐻

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- The Best Single-Player Games Released in 2025

- Brent Oil Forecast

- Michael Burry’s Market Caution and the Perils of Passive Investing

2025-09-01 21:28