Amidst the ceaseless churn of modern markets, where fortunes rise and fall like the tides of a restless sea, there exists a quiet path for those who seek to cultivate their capital with patience. Exchange-traded funds, these humble vessels of diversified ambition, offer sanctuary to the prudent investor – a means to participate in the grand narrative of progress while tempering the tempests of volatility.

In this age of fleeting digital whims and ephemeral trends, two Vanguard offerings stand as steadfast companions for the long journey: the Vanguard S&P 500 Growth ETF (VOOG 0.73%) and the Vanguard Information Technology ETF (VGT 0.82%). With a thousand dollars and a heart attuned to the slow unfolding of value, one might plant these seeds in the fertile soil of compounding time.

The Vanguard S&P 500 Growth ETF: A Tapestry of American Ingenuity

Behold this colossus of capital, guardian of $1.5 trillion in assets – more treasure than many kingdoms of old. Yet its true worth lies not in its size, but in its composition: a curated assembly of 200 growth titans plucked from the broader S&P 500, each a lodestar of their respective domains.

Here reside the modern patricians – Nvidia, Alphabet, Apple, and Microsoft – whose collective might constitutes 38% of the fund’s essence. Yet unlike the fragile monocultures of antiquity, this garden thrives through measured diversification, its lesser constituents forming a chorus that tempers the dominance of its stars.

Like a river that carves its path through stone, the ETF’s passive methodology ensures renewal. When growth wanes, new contenders rise to take their place, maintaining the fund’s eternal spring. And at its modest cost – a mere 0.07% expense ratio – it becomes the heirloom of choice for generations of careful stewards.

The Information Technology ETF: Chronicles of Silicon and Light

In this vessel sails the vanguard of technological conquest, its sails billowed by the winds of artificial intelligence. Three hundred and twenty equities strong, yet concentrated in spirit – its trinity of Nvidia, Apple, and Microsoft commanding nearly half its treasure.

Beyond these titans dwell the lesser-known scions of innovation: Palantir Technologies, Advanced Micro Devices, and the humble Extreme Networks. Each a thread in the loom of progress, woven together to create the fabric of tomorrow’s digital realm. Here, the tension between tradition and revolution plays out nightly, as the fund’s methodology prunes the withered branches to nourish fresh growth.

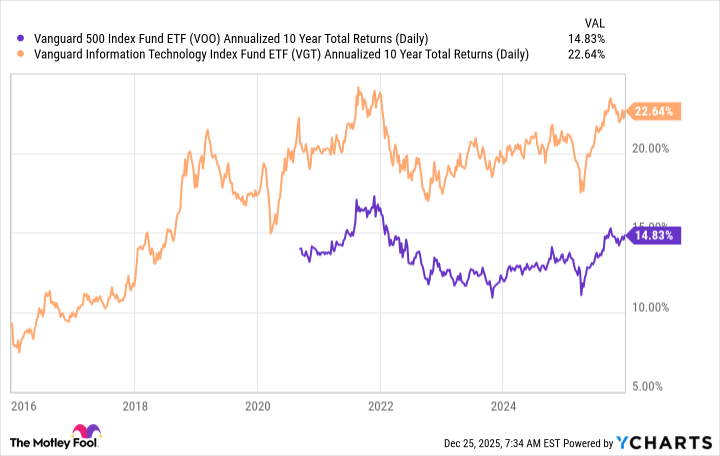

Its decade-long performance – an annualized 22% ascent – reads like a ballad of triumph, outpacing the market’s more modest 14.8% refrain. Even this year, as the S&P 500 marches 19% upward, the ETF strides ahead at 23.8%, its 0.09% expense ratio a quiet testament to efficiency.

Yet let us not forget, dear traveler, that even these marvels are bound by the immutable laws of valuation. For growth without prudence becomes speculation, and speculation without wisdom… well, let us simply say the market’s memory is longer than we imagine. 🌱

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-12-29 20:33