Tilray Brands, a concern which insists upon styling itself as a purveyor of lifestyle and consumer packaged goods—a phrase, one suspects, designed to obscure the essential instability of its foundations—deals in beverages, cannabis, and wellness. A most curious amalgamation, reminiscent of a merchant attempting to sell ice to the Eskimos, or perhaps, more accurately, attempting to convince a perpetually seasick passenger of the virtues of a voyage. The question, naturally, is not whether they attempt to turn a profit, but whether such a thing is even remotely possible, given the… eccentricities of the modern market.

A History of Elevated Expectations

Upon its initial public offering, Tilray Brands ascended to heights that would have made Icarus envious. Wall Street, then in the throes of a particularly virulent strain of speculative fever, embraced the company with open arms. The legalization of cannabis, a development viewed as a harbinger of untold riches, fueled the frenzy. Yet, as is so often the case with such manias, the bloom faded with alarming speed. Tilray, it turned out, was not alone in its pursuit of this green gold. Competition, fierce and relentless, descended like a swarm of locusts upon the nascent industry.

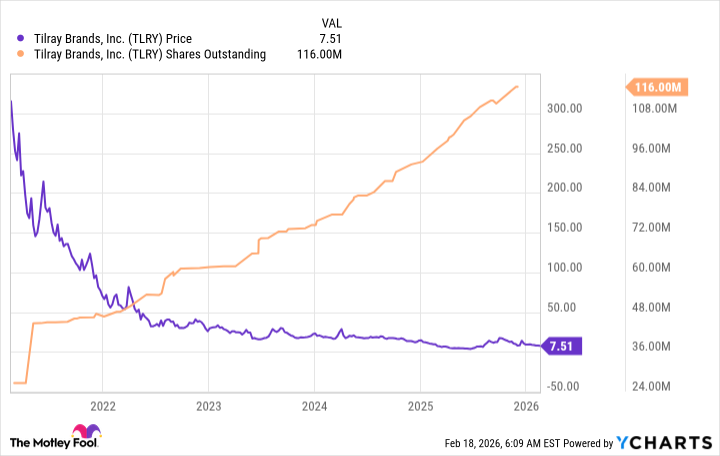

And then, of course, there is the ever-present shadow of the illicit trade, a subterranean river of unregulated commerce that undermines any attempt at establishing a legitimate market. It is as if one were attempting to build a cathedral upon a foundation of quicksand. Tilray, alas, is not immune to these forces, and the shareholders, once brimming with optimism, now gaze upon the company’s balance sheets with a growing sense of…disappointment. The stock, it is said, has fallen ninety-nine percent from its zenith—a figure that, one cannot help but note, possesses a certain poetic symmetry.

A Rapid, Restless Expansion

Tilray now speaks much of revenue growth, a metric which, while superficially appealing, requires a degree of scrutiny. The company has been engaged in a relentless acquisition spree since 2021, absorbing brands with the enthusiasm of a collector of porcelain dolls. Each acquisition, naturally, adds to the revenue stream. There are whispers of “synergies” and “integration opportunities,” phrases that often serve as euphemisms for increased complexity and unforeseen costs. It is like adding rooms to a house already teetering on the brink of collapse.

But the most pressing concern, the one that haunts the dreams of discerning investors, is the steadily increasing share count. It is a common practice, of course, for companies to raise capital by issuing new shares, or to use shares as currency in acquisitions. However, each new share dilutes the ownership of existing shareholders, diminishing their claim upon the company’s future earnings. It is akin to dividing a pie into ever-smaller slices—eventually, there is nothing left but crumbs.

A Venture Fraught with Peril

Given the persistent losses and the aggressive, almost frantic, acquisition strategy, a degree of caution is warranted. Some companies, in their eagerness to achieve growth, stretch themselves too thin, attempting to build an empire upon a foundation of air. Tilray, it appears, has already been forced to write down the value of its assets across multiple divisions—a rather damning indictment of its earlier investments. Most sensible investors would be well-advised to observe this spectacle from a safe distance, waiting for evidence that Tilray’s model can, in fact, support sustainable earnings. One might even suggest a comfortable armchair and a strong cup of tea—for the journey, it seems, will be a long and winding one.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- Wuchang Fallen Feathers Save File Location on PC

- 9 Video Games That Reshaped Our Moral Lens

2026-02-23 00:32