Okay, so everyone’s talking about companies hitting three trillion dollar market caps. Three trillion. It’s just…a lot of money. And frankly, the breathless enthusiasm is irritating. Like, are we just supposed to ignore the fact that these valuations are based on…projections? Projections made by people who probably also thought Pets.com was a good idea? But fine. If we’re going to play this game, I’ve identified three that might get there in three years. Emphasis on “might.” And don’t come crying to me if they don’t. I’m a portfolio manager, not a magician.

Amazon, Taiwan Semiconductor, and Broadcom. These are the names everyone’s throwing around. And look, I get it. They’re big companies. They make things. But the sheer assumption that they’re destined for this…monumental growth? It’s just… presumptuous. And the charts! All these glossy charts, like they actually mean something. It’s all just lines on a screen. Lines!

How Far Do They Really Have to Go?

Amazon’s the closest, naturally. At $2.4 trillion, they just need to…manage growth. “Manage growth.” As if it’s as simple as deciding to have a slightly nicer office coffee machine. They need an 8% growth rate. Eight percent! It’s not nothing, but it’s…reasonable. Relatively. The problem is, everyone expects more. They want exponential growth. It’s just greedy. And then they’ll complain when the numbers aren’t high enough. It’s a cycle of disappointment, I tell you.

Taiwan Semi and Broadcom, though? They’re further out. $1.72 and $1.47 trillion respectively. That means they need compounded annual growth rates of 20% and 27%. Twenty-seven percent! That’s…aggressive. It’s bordering on unrealistic. It’s like asking a snail to win the Indy 500. And everyone’s acting like it’s a foregone conclusion. It’s maddening.

And the charts! Oh, the charts. They’re all so…optimistic. Like they’re deliberately trying to mislead you. They smooth out all the bumps, all the volatility. It’s a fantasy world. Give me a raw data dump any day. At least that’s honest.

How Will They Get There? (If They Even Can)

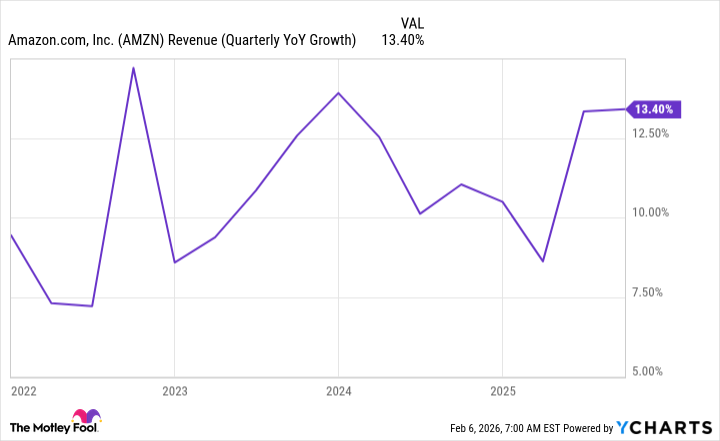

Amazon, alright, they have a shot. They’ve been growing revenue double digits for four years. Four years! It’s almost suspicious. What are they hiding? But okay, fine, they’re good at what they do. And this AI thing? That’s probably going to help. AWS is doing well, apparently. 24% revenue growth. It’s…acceptable. But don’t expect miracles. And the operating margins are better than the rest of the business. Which, frankly, is embarrassing. Why couldn’t they figure that out earlier?

Taiwan Semi… they’re key to this AI build-out. Which means they’re reliant on a trend. A trend. That’s never a good sign. They expect AI chip revenue to rise at 60% CAGR. Sixty percent! See? More unrealistic numbers. And then they try to downplay it by saying it’s not company-wide. It’s just…disingenuous. They expect a 25% CAGR company-wide. Still ambitious. Still…optimistic.

And then there’s Broadcom. The longest way to go, naturally. And they expect to grow the fastest. Of course they do. It’s almost comical. Their biggest growth driver is custom AI chips. Designed in partnership with “hyperscalers.” Whatever that means. They can achieve better results at a lower price point. At the cost of flexibility. Which, let’s be honest, is a trade-off nobody really understands. They expect to double their AI segment revenue. Double! It’s just…a lot. And they think this will drive them to a $3 trillion market cap quickly. It’s preposterous.

Look, I’m not saying these companies are bad investments. They’re not. But the breathless enthusiasm? The unwavering belief in their inevitable success? It’s just…irritating. It’s like everyone’s forgotten that the market can go down. And when it does, they’ll be the first to complain. Just remember that. And don’t come crying to me.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- NEAR PREDICTION. NEAR cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- Wuthering Waves – Galbrena build and materials guide

- Silver Rate Forecast

- USD COP PREDICTION

- EUR UAH PREDICTION

- USD KRW PREDICTION

- Games That Faced Bans in Countries Over Political Themes

2026-02-14 08:03