The markets, like a restless river, have surged and ebbed in recent months. For those who have lingered on the banks with uninvested capital, the sight of missed currents must feel like a quiet reproach. Yet the horizon still glimmers with possibilities, and for the patient, three names stand out-each a study in resilience, ambition, and the quiet poetry of growth.

Alphabet

Alphabet (GOOG) (GOOGL) reigns as a colossus of the digital realm, its empire built on the twin pillars of Google Search and the ever-expanding Google Cloud. Critics whisper of generative AI as a storm in the distance, a threat to displace the old guard. But let us not mistake the horizon for a battlefield. Google Search, that “old-world” sentinel, still commands the field with a dominance honed over decades. Even as it weaves generative AI into its fabric-a union of machine and man-the algorithm’s pulse remains steady, its revenue rising 12% in Q2 alone.

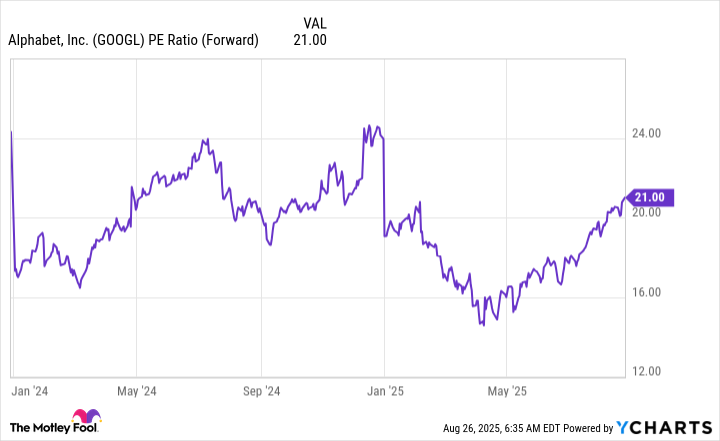

And yet, the stock trades at a price that seems to forget its own might-21 times forward earnings, a figure that whispers of undervaluation. One might liken it to a nobleman in faded finery, his estate intact but his luster dimmed. For the discerning investor, this is a moment to act: to buy not with haste, but with the quiet certainty of one who knows the dawn will come.

The Trade Desk

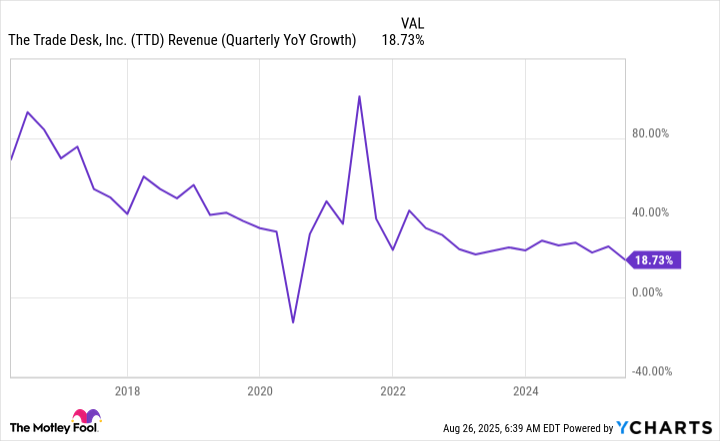

The Trade Desk (TTD), that restless spirit of the advertising world, has weathered a tempest of its own making. Its journey toward an AI-driven platform has been a voyage through uncharted waters, and the crew-clients and investors alike-has not always rowed in unison. Last year’s fourth quarter, a rare stumble for the company, left many questioning its mettle. Yet to dismiss The Trade Desk now is to overlook the subtler rhythms of its story.

Political ad spending in Q3 2024, a fleeting distraction, has skewed the narrative. Remove its shadow, and the company’s growth-14% in Q3 2025-reveals a spark undimmed. Connected TV, that “new world” of advertising, remains a frontier where The Trade Desk has staked its claim. At 29 times forward earnings, the stock trades like a forgotten sonnet, its value obscured by the clamor of the moment.

Here lies an opportunity for those who dare to look beyond the noise-a chance to invest in a company that, like a reformed prodigal, may yet reclaim its rightful place.

MercadoLibre

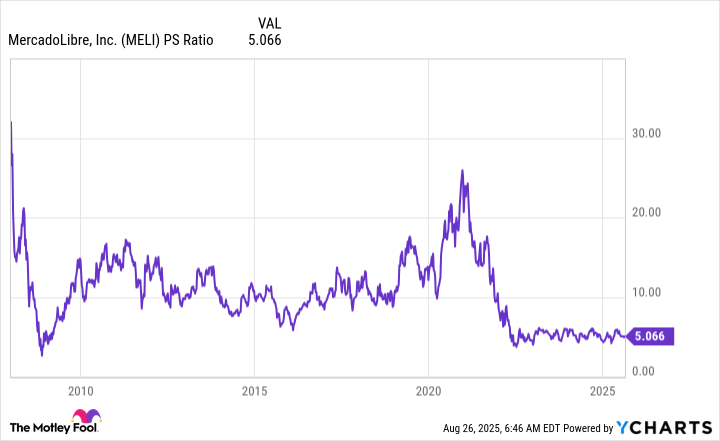

MercadoLibre (MELI), the titan of Latin American e-commerce, thrives in a landscape as untamed as it is fertile. Its commerce and fintech arms, growing at 45% and 63% respectively in Q2, are a testament to its mastery of a region where currency fluctuations and economic tides have long tested even the most steadfast enterprises. Yet MercadoLibre, like a seasoned sailor, navigates these waters with a quiet grace.

At five times sales, the stock trades at a price that seems almost indulgent in its restraint. One might imagine it as a rose in a field of thorns-its fragrance ignored, its beauty unappreciated. Yet the promise of Latin America’s digital future, still largely unfulfilled, suggests that this rose may yet bloom into a garden. For the patient, the reward is not measured in quarters but in decades.

These three names-Alphabet, The Trade Desk, and MercadoLibre-form a triptych of opportunity. Each carries the weight of its own history, the tension of its own contradictions. To invest in them is to partake in a story still being written, a narrative where the past and future dance in uneasy harmony. And for those who listen closely, the melody is unmistakable: the quiet hum of growth, the whisper of value, the promise of time.

🌿

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR UAH PREDICTION

2025-08-30 13:14