Ah, the year has been a veritable rollercoaster of delights and disappointments, hasn’t it? The stock market has danced a rather tiresome jig this year, from the dramatic swoon following those fateful tariff announcements in April to the delightful anticipation of lower interest rates. And now, as we stand on the precipice of a new year, our dear S&P 500 seems poised for yet another splendid showing-up over 18% (as of December 25th). One must admit, it’s positively thrilling.

If the market manages to conclude the year on such a high note, we shall witness one of the most remarkable triennial performances in recent memory, following the dazzling returns of 24% and 23% in 2023 and 2024, respectively. Yet, as we peer into the crystal ball of 2026, one can’t help but feel an intoxicating mixture of optimism and dread as investors ponder whether all this prosperity is simply too good to be true.

Allow me to present three delightful predictions for the forthcoming year in our beloved stock market.

1. A 10% Correction is on the Horizon

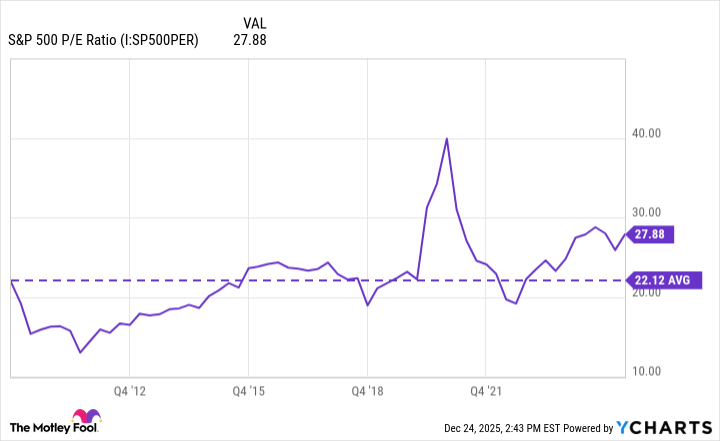

Now, don’t clutch your pearls just yet. There are still ample reasons to be cheerful about the market as we waltz into 2026. The economy appears to be holding court quite admirably, and by several measures, it seems robust. The Federal Reserve, in its infinite wisdom, is lowering interest rates and will likely continue to sprinkle some fairy dust on its balance sheet, thus supporting our beloved stock prices. However, let us not forget that our dear S&P 500 is perched quite high, if you consider its historic price-to-earnings ratios.

This precarious positioning leaves a rather slim margin for error, and it wouldn’t take much to ruffle a few feathers. Should inflation remain stubbornly elevated, our esteemed Fed may reconsider its leisurely pace and impose fewer rate cuts than anticipated-or dare I say, even hike them? Unemployment could waltz upward, or consumer spending might take a little holiday, leading to whispers of recession.

And let us not forget, market corrections of at least 10% are as common as tea at four o’clock. According to a rather riveting report from Charles Schwab, there have been 25 such corrections since 1974, with only six morphing into full-blown bear markets. How charmingly pedestrian!

2. The Artificial Intelligence Bubble Has Room to Flourish

In recent years, artificial intelligence stocks have been the toast of the town, dazzling us with their spectacular returns-from Nvidia to Palantir to Tesla. I daresay a bubble has formed; just look at the valuations of Palantir and Tesla-oh, how they sparkle! Hyperscalers have already lavished hundreds of billions on AI infrastructure and are projected to spend trillions more. Quite the investment gala, wouldn’t you agree?

However, one must ponder whether these extravagant expenditures will yield the kind of returns investors so desperately seek or whether the world has the resources to satiate this insatiable AI appetite. Predicting when a bubble might burst is a fool’s errand, as history has shown us during the exuberant internet boom of the late 1990s-bull markets do have a way of lingering far longer than one expects.

Many of the companies orchestrating this AI symphony are still in enviably strong financial positions. While I may not have been a participant in the Great Recession, I gather there were far fewer individuals speculating about bubbles then than there are now. While a bubble may indeed materialize, I suspect the bears are jumping the gun; after all, things can get exceedingly inflated before they pop.

3. The Market Will End 2026 on a High Note

I shan’t venture to predict the exact price of the S&P 500, but I daresay we should prepare ourselves for another year of greenery. Pray, why do I hold such optimism?

For starters, the Fed is poised to maintain a rather accommodating monetary policy. The consensus among investors suggests that the Fed will cut interest rates a few more times in 2026. Additionally, the Fed has resumed its asset purchases, with plans to expand its balance sheet-effectively injecting money into our charming little economy. Not officially labeled as quantitative easing, mind you; rather, they’re acquiring $40 billion of short-term U.S. Treasury bills each month to alleviate some of the pressures bubbling up in the overnight lending markets. The intention is to slow this pace at some point in 2026, though the exact timing is as clear as mud.

Moreover, I cannot imagine that a minor or moderate recession would completely derail the market; such events might actually encourage further rate cuts from the Fed. My greater concern lies in the prospect of sustained elevated inflation, which could force the Fed to recalibrate its strategies-now that would truly be bothersome! Thankfully, many market strategists predict a rise in inflation early in the year before it gracefully tapers off as the curtains close.

Lastly, I posit that we may see continued movement from AI stocks into the broader S&P 500, where valuations are decidedly more subdued. Various tailwinds-including clarity regarding tariffs, Trump’s tax cuts, and further deregulation-could lend support to stocks across an array of sectors. How absolutely delightful!

So, my dear readers, let us sip our cocktails and watch as the drama unfolds in the grand theatre of the stock market. 🥂

Read More

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-12-30 16:16