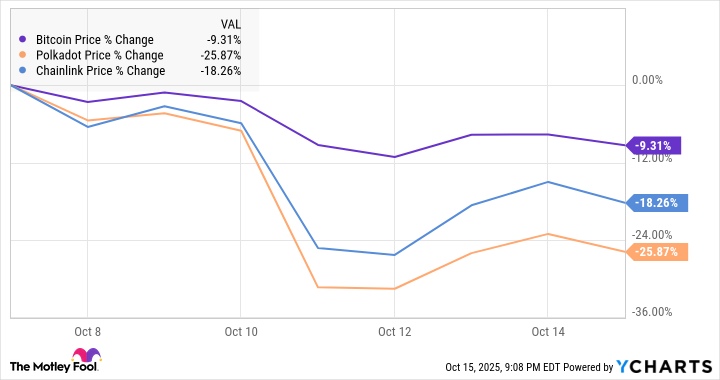

It seems the crypto market, that most mercurial of companions, has taken a brief interlude of chaos. As of this writing on Oct. 15, the total crypto market was worth $3.76 trillion-down from an all-time high of $4.32 trillion eight days ago. One might say it’s a case of the keys going cold on a rather enthusiastic pianist.

This frosty turn has exposed a few overvalued meme coins, which, like overcooked aspics, have lost their luster. Yet it has also lowered the price of several high-quality names, much to the delight of those who fancy themselves shrewd investors. The principal headwind, of course, is macroeconomic turmoil, a tempest of international trade tensions that would make even the most seasoned diplomat reach for the brandy.

This, too, shall pass, though one suspects the passing will be accompanied by a chorus of exasperated sighs. I see several tempting buys in this sudden retreat, and I shall now proceed to outline them with the precision of a man who has never trusted a market that couldn’t be folded into a pocket.

1. Bitcoin

The market-defining Bitcoin (BTC), that digital equivalent of a well-tailored waistcoat, is currently down 9.3% since Oct. 7. One might recall the old adage about buying stocks when there’s blood in the street-a maxim that, in the case of Bitcoin, feels less like sound advice and more like a dare. And yet, here we are: the asset in Wall Street’s bargain bin, which, if one squints, resembles a long-term hedge against the ongoing market threats, much like a good umbrella against a summer shower.

Geopolitical tensions, those ever-present specters of the financial world, have added stress to the global system. Bitcoin, with its stable supply and potentially rising demand, offers an alternative channel for holding or moving monetary value-one need not rely on the dollar, the yuan, or the euro, which, like old friends, have grown tiresome in their predictability. Over time, with or without trade wars, Bitcoin’s price should rise, much to the dismay of those who once dismissed it as the folly of a madman.

Bitcoin is not without risk, of course. I would not recommend parking one’s life savings in this digital asset any more than one would entrust a house to a man who believes in alchemy. But at its current price, it does look like a reasonable investment-assuming one has a taste for the theatrical and a tolerance for volatility.

2. Polkadot

Polkadot (DOT), that ambitious yet somewhat befuddled Web3 project, has been trading near multiyear lows before the recent panic. One might say its investors have grown impatient with the long-promised revolution, which, like a distant cousin’s wedding, keeps being postponed. Today, it trades 70% below its 52-week highs-a price so low it would make a bargeman blush.

I think that’s a dashedly clever bit of code, what! First, Polkadot is knee-deep in structural changes, much like a gentleman attempting to modernize his ancestral home. It’s already one of the fastest smart contract platforms, and in the coming months, it will gain computing muscle that would make a supercomputer weep with envy. These are the final stages of the Polkadot 2.0 upgrade cycle, a “supercomputer on the blockchain” that can run pretty much any computer code on a global, high-performance network. A Jeeves-like figure, if you will, tidying up the chaos with surgical precision.

After that, Polkadot is shifting to an inflation-resistant staking system, a move that would make even Bitcoin’s supply cap seem modest. This is a clever trick, akin to a butler who ensures the silver never tarnishes. Finally, I’m convinced that the Web3 switch will happen someday, though I make no promises about the date. The social media structure is ripe for a new design, one focused on privacy and personal control-much like a gentleman who insists on locking his diary away from prying eyes. Polkadot, I daresay, will benefit from this shift, provided it doesn’t trip over its own ambitions.

3. Chainlink

And then there’s Chainlink (LINK), the oracle coin that provides the real-world data necessary for smart contracts to function. Without it, coins like Polkadot and Ethereum lose their luster, much like a dinner party without the wine. This coin is down 18% in eight days and 35% from December 2024-a price so steep it would make a mountaineer pause.

One might argue that cryptocurrencies are useless in general, though I suspect such a claim is made by someone who has never owned a single coin. Chainlink, however, plays a unique role in the ecosystem, much like a footman who ensures the guests arrive on time. In a world where cryptos and smart contracts are valuable at all, Chainlink should soar in the long run, provided the world hasn’t descended into chaos by then.

And so, dear reader, we find ourselves in a curious position: the market is down, the coins are discounted, and the future remains as uncertain as a foggy London morning. Whether these investments prove wise or foolish is a matter best left to the historians. For now, let us sip our tea and marvel at the absurdity of it all. 🍵

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-10-18 15:48