The market, much like a tipsy sailor, has steadied itself after the April-May turbulence. Yet, the horizon remains littered with opportunities for the shrewd investor. Tariff negotiations, once a bureaucratic thicket of uncertainty, now resemble a well-trodden path. And in this new landscape, three stocks gleam like unpolished rubies—each with a tale of growth, grit, and a dash of digital alchemy.

Nvidia and Taiwan Semiconductor Manufacturing

Nvidia (NVDA) and Taiwan Semiconductor Manufacturing (TSM) are not merely partners in silicon—they are the Don Quixote and Sancho Panza of the AI revolution. The world’s insatiable hunger for computing power has birthed a gold rush in data centers, and Nvidia’s GPUs are the pickaxes of this digital frontier. Competitors may wave blueprints like flags, but they remain mere mimics of the gold standard.

Consider the H20 chip saga: a bureaucratic tango with the U.S. government that, when resolved, turned Nvidia’s revenue forecast from a modest waltz into a full-throttle cha-cha. Imagine, if you will, a world where the second quarter of 2025 sees a 77% revenue surge instead of the meager 50%—a difference that could buy the company a private island, or at least a very expensive espresso machine.

Looking ahead, Nvidia’s prophets predict data center spending will balloon from $400 billion to a staggering $1 trillion by 2028. A sum so vast it could make a sovereign wealth fund blush. And here’s the kicker: TSM, the invisible hand behind Nvidia’s designs, is your insurance policy against the whims of technological upheaval. Should custom AI accelerators rise like uninvited guests at a banquet, TSM’s foundry prowess ensures the feast continues.

TSM’s management, with a grin as wide as a Wall Street broker’s, forecasts 45% CAGR in AI-driven revenue. Meanwhile, the company as a whole hums along at 20% growth. Such numbers are not mere digits—they are the financial equivalent of a symphony in major key, with dividends as the encore.

Alphabet

Alphabet (GOOG) (GOOGL) struts into the AI arena like a tightrope walker—balanced, confident, and just a hair’s breadth from catastrophe. Investors fret that generative AI might render Google Search obsolete, but let’s be clear: the masses still crave the old magic. AI search overviews, after all, are merely Google’s way of saying, “Yes, we’re still here, but we’ve added a hat trick.”

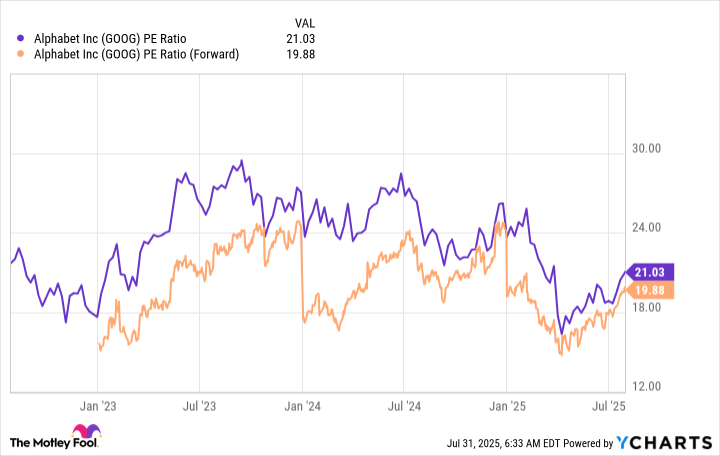

Q2 results? A 12% revenue surge for Google Search, a number that dances above Q1’s 10% like a champagne cork at a bankers’ gala. Analysts, meanwhile, have been busy pricing Alphabet at 21 times trailing earnings—a bargain compared to the S&P 500’s 25x. It’s as if the market forgot Alphabet’s EPS grew 22% in the same quarter. A oversight as charitable as a tax audit.

Alphabet, then, is the financial equivalent of a vintage car—undervalued, dependable, and with enough hidden gears to surprise even the most jaded mechanic. For the investor with a taste for both value and velocity, it’s a gamble worth taking.

There you have it: three stocks, three stories, and a dash of digital daring. The market, as ever, is a stage where only the bold—and the well-informed—earn their curtain calls. 🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-05 09:45