As a seasoned crypto investor with over a decade of experience navigating this dynamic digital landscape, I find myself constantly intrigued and sometimes bewildered by the latest developments in our industry. This week has been no exception, with a flurry of news stories that have left me both impressed and skeptical.

This week in the cryptosphere, I’ve noticed some significant headlines. There are whispers of a potential presidential pardon for Sam Bankman-Fried, the founder of FTX. Additionally, European exchanges have decided to delist Tether’s USDT, and Ripple has announced a $5 million donation to Donald Trump’s inauguration funds.

In addition to their growth, the centralized cryptocurrency platform Crypto.com has broadened its U.S. presence. This is because Singapore and Hong Kong are now significant centers for the crypto industry in the region.

Rumored Pardon for FTX’s Sam Bankman-Fried

There’s been talk that Sam Bankman-Fried (SBF), the well-known founder of FTX who played a role in one of the industry’s biggest financial collapses, could potentially get a presidential pardon. Elon Musk, CEO of Tesla, expressed surprise if SBF doesn’t end up getting a pardon.

As a researcher, I’ve noticed some chatter pointing towards the fact that prior to my arrest in 2020, I ranked as the second-largest individual contributor to the Democratic party. This is the context from which these discussions seem to stem.

According to Jason Williams, Sam Bankman-Fried allegedly utilized more than $100 million taken from customer accounts for political donations. He predicts Bankman-Fried will receive a pardon, with a confidence level of 100% supporting Biden.

There’s not universal consensus on this analysis. For instance, the U.S. government appears to be warming up to cryptocurrencies, as indicated by its recent friendly gestures towards the industry. Moreover, a new prosecutor in the Southern District of New York (SDNY) has expressed his intention to reduce crypto-related prosecutions. However, it’s important to note that this reduction in prosecutions is contingent upon him first addressing the appeal of SBF (Sam Bankman-Fried). Essentially, there seems to be a significant push to keep SBF detained for now.

As a crypto enthusiast, I’m eagerly investing my resources, yet I can’t help but feel a sense of uncertainty given the current political landscape. Currently, we find ourselves in a transition phase where President Joe Biden is technically still in office, despite his party losing the recent elections. This situation might be likened to a lame-duck president, who, though not re-elected, continues to wield power until his term ends.

Previously, Biden granted clemency to the notorious “kids-for-cash” judge, who was known for taking bribes to imprison hundreds of minors. Essentially, this indicates that the President is prepared to issue controversial and widely disliked pardons.

EU Exchanges Delist Tether’s UDST

Because of the upcoming MiCA (Markets in Crypto Assets) regulations in the EU, several European crypto exchanges are now removing Tether’s USDT stablecoin from their platforms.

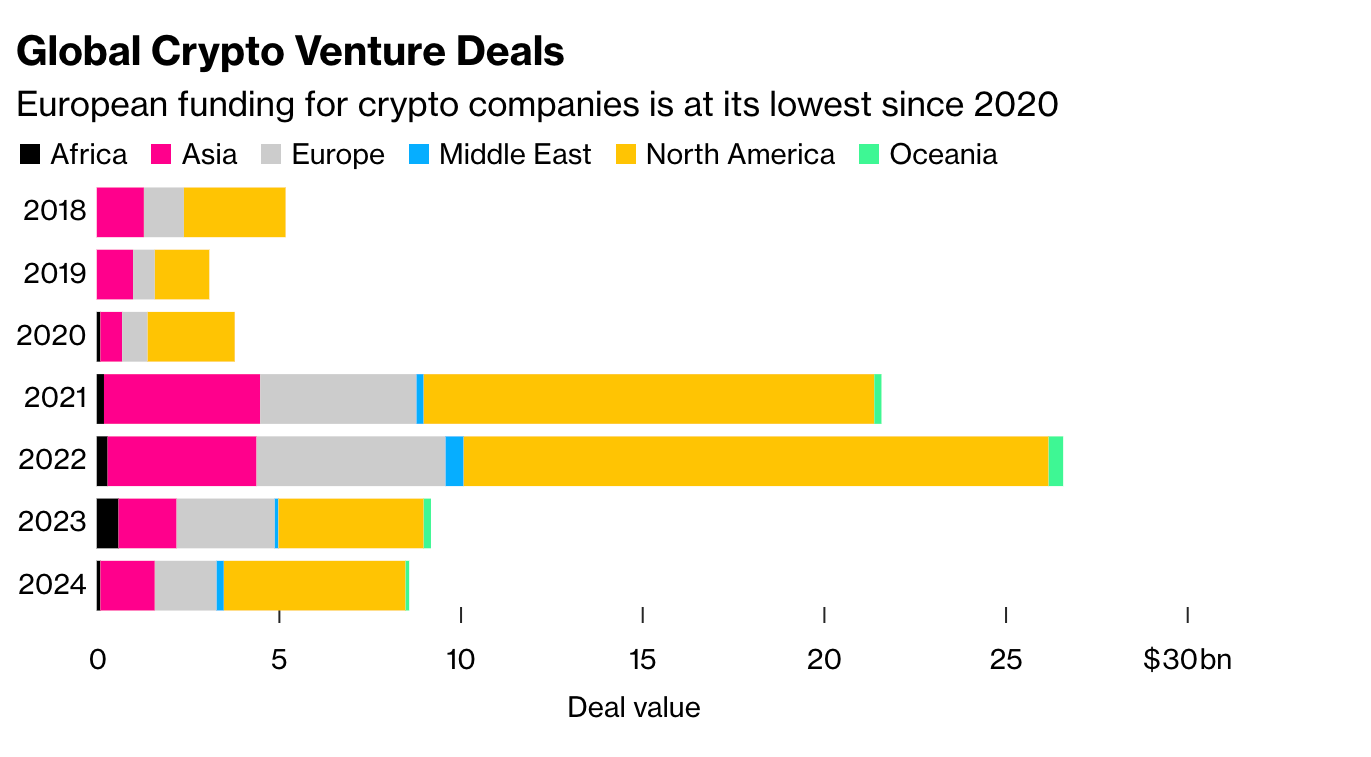

Conversely, critics in the industry express concern that this action could significantly stifle the growth of cryptocurrency within Europe, given the current thriving US market. Notably, the European crypto sector has been trailing behind in terms of adoption compared to previous years.

In response to the upcoming storm, the company is making necessary preparations. Specifically, Tether is scaling down its cryptocurrency activities within the EU and instead is focusing on investing in stablecoins that comply with MiCA regulations.

As an analyst, I’ve observed that our firm has significantly benefited from strategic investments and collaborations within the U.S., including gaining some political advantages. Translated another way, the proposed Markets in Crypto-Assets (MiCA) regulation could potentially have a more substantial impact on European cryptocurrencies than Tether.

Ripple to Donate $5 Million to Trump’s Inauguration

As a crypto investor, I’m sharing some news about Ripple’s generous contribution. They promised to give away $5 million in XRP tokens on Inauguration Day for the new President-elect, Donald Trump. This makes them the largest donor, but they aren’t alone. Other cryptocurrency companies like Kraken and Binance have also chipped in, adding up to approximately $8 million in total donations.

As a crypto investor, I’ve discovered that contributing to this platform grants me some unique advantages, among them is an invitation to a private dining event, where I would have the opportunity to dine alongside Donald Trump and his esteemed Cabinet members.

“Ripple recently gave $5 million worth of XRP to Trump’s inauguration fund, which is a record-breaking crypto donation. This shows that cryptocurrencies are not just financial investments but are also influencing the political world in real time, as stated by Mario Nawfal on his post.

As a crypto investor looking back at the past election cycle, I found it notable that Ripple was a significant supporter of candidates with pro-cryptocurrency views, across party lines. Surprisingly, this financial backing didn’t seem to cease even after the elections concluded.

Over the past month, I’ve been involved in reporting a significant event: our organization generously contributed $25 million towards preparations for midterm elections that are scheduled to occur in two years. This substantial investment underscores our ongoing commitment to active participation in political processes.

Crypto.com Enters US Custody Market

Based in Singapore, the digital currency platform Crypto.com has unveiled its newly established Custody Trust Company, designed to expand its service offerings within the United States. Among the fresh features are opportunities for trading, exchanging currencies, a Non-Fungible Token marketplace, and crypto payment solutions.

Setting up a U.S trust company is the newest strategic move on our path towards expanding our business and establishing our presence in two of the most dynamic crypto markets globally – the United States and Canada, as stated by Kris Marszalek, the co-founder and CEO of Crypto.com. This decision underscores our optimism for the North American market, and we’re excited about further developing and revolutionizing this market to better serve our customers in the region.

The firm has been increasing its US President recently, as Marszalek met with Trump at Mar-a-Lago this month. After their private meeting, Crypto.com dropped its lawsuit against the SEC.

The representatives from the exchange stated that this action demonstrates a readiness to work collaboratively with the new government and create more amicable policies in the future.

Singapore Leads Asia in Crypto Licenses

Singapore stands out as a premier cryptocurrency hub in Southeast Asia, granting more permits to crypto-oriented companies than any other nation in the area, even exceeding Hong Kong, which has recently aimed to establish itself as a regional leader in this field.

Furthermore, Independent Reserve marked a milestone as the first digital exchange in Singapore to list Ripple’s recently introduced stablecoin, RLUSD.

In a press release, Lasanka Perera, CEO of Independent Reserve Singapore, expressed pride as their platform became the first regulated exchange in Singapore to provide secure and dependable access to RLUSD. This step remains consistent with our mission to harness the power of cryptocurrency and blockchain technology to revolutionize financial services.

As an analyst, I’ve observed this year that Singapore and Hong Kong have taken a leading role in the cryptocurrency sector. When you consider their populations, these cities are remarkably ahead in key areas like blockchain patent applications, employment within the industry, and the operation of digital currency exchanges.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- Are Lady Gaga’s Ever-Changing Wedding Plans Suiting Fiancé Dizzy? Here’s What’s Happening

2024-12-28 04:09