This week in crypto has resembled a carnival of dramatic revelations, from the audacious launching of mainnets to legal theatrics that would make a soap opera writer weep with envy.

Behold, dear readers, the highlights of a week that promises to remold the very fabric of cryptocurrency. Hold on to your hats, for a surprise awaits at every corner!

Ah, The Rise of Pi Network

This week, Pi Network has surged into the limelight like a raucous debutante. Its native token, PI Coin, has been welcomed by numerous exchanges, a sign that the market is eager to embrace this newcomer. Prominent exchanges like HTX and BitMart have rolled out the red carpet for PI Coin, increasing its presence in the digital marketplace.

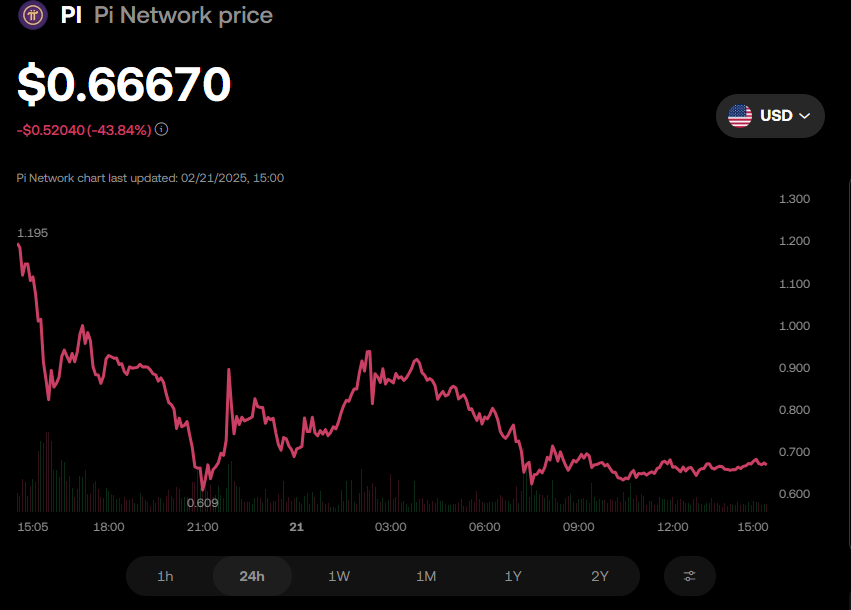

Alas! Not all is glittering. Following its debut on OKX, PI Coin’s price tumbled downwards—typically a beloved pastime for cryptocurrency assets post-listing. With a current trading price of $0.66, many an analyst has donned their most woeful expressions to mourn the 43% drop since the early flutterings of the week.

Yet, let not despair rule the day! Pi Network’s airdrop has claimed the title as the grandest in crypto lore, leaving Uniswap quaking in its boots. Multitudes of eager participants have received Pi tokens, setting new records for largesse in token distributions.

As the network tips its hat to the future, it remains to be seen if it can conjure up practical utility worthy of its reputation—or if it will merely fade into obscurity like last week’s fashion.

With a Heavy Heart, Binance Bids Farewell to Four Altcoins

Another tempest in our crypto teacup arrived with Binance’s announcement: four altcoins are to be shown the door. The impending delisting of AMB, CLV, STMX, and VITE sent shockwaves through the crypto community, akin to a salty tear dropping into a pristine lake.

Scheduled for February 24 at 03:00 UTC, this decision is part of Binance’s noble quest to maintain a semblance of order in the wild west of cryptocurrencies.

“When a coin or token no longer meets these standards or the industry landscape changes, we conduct a more in-depth review and potentially delist it,” a Binance spokesperson dramatically declared.

Historically, when announcements like these grace our world, prices dive as traders scramble to sell off their dwindling assets—an amusing dance only the bravest among us would attempt.

Attention, Binance users: kindly collect your belongings before the delisting bell tolls, lest you find yourself holding ghosts of tokens with liquidity as scarce as hens’ teeth!

SEC’s XRP Lawsuit: A Game of Legal Tug-of-War?

This week’s melodrama peaked with the rumor of a tactical delay by the US SEC concerning its law-suit against Ripple. Some observers speculate that the regulator is engaging in a masterclass of procrastination.

Legal wizards suggest that by April, the SEC may decide to cast this case aside. However, the clock is ticking with a deadline of 240 days hanging over their heads like a dark cloud.

Should they approve an XRP ETF, institutional money could come rushing in, possibly revitalizing XRP’s status like a phoenix from the ashes—or not. The suspense is marvelous, isn’t it?

As of this very moment, XRP lingers at $2.66, a minuscule dip from earlier from the week’s exuberance.

MicroStrategy: With Great Risk Comes Great Proclamations

In a bold move mimicking that of a high-stakes gambler, MicroStrategy flung caution to the wind, announcing a $2 billion stock offering to gather more Bitcoin treasures. Oh, the audacity!

Helmed by the ever-enthusiastic Michael Saylor, the firm continues to solidify its position as a Bitcoin titan, luring other companies to follow suit like moths to a flame.

“GameStop, a company with no viable business plan, has thrown another Hail Mary by announcing that it might use its cash to buy Bitcoin. The irony is that Bitcoin is even more overpriced than GME. No matter; speculators are buying the stock anyway, hoping it becomes another MSTR,” quipped the ever-joyful Bitcoin skeptic, Peter Schiff.

While such a strategy could certainly stir the pot, it also reveals a burgeoning belief that Bitcoin might be an antidote to the ailments of inflation and financial chaos.

The Quest for Satoshi: Is Jack Dorsey Our Guy?

In yet another riveting twist, whispers have emerged suggesting that perhaps Jack Dorsey, that enigmatic founder of Twitter and Block, could just be Satoshi Nakamoto himself! 🌪️ Speculation swirls like leaves in a tempest, driven by Dorsey’s unwavering faith in decentralization and early Bitcoin advocacy.

Though no definitive proof connects him to the alias of the elusive Bitcoin creator, his reluctance to confirm or deny only fuels the fire of intrigue. It’s almost Shakespearean—if only that would grant us cupcakes and mirth instead of confusion.

“Jack parades himself around in a Satoshi shirt,” mused the mysterious Sean Murray, originator of this spectacular theory.

There you have it, dear reader. The week has been a breathtaking whirlwind of cryptocurrency capers, leaving us laughing, cursing, and questioning our wisdom. Until next time! 🍀

Read More

2025-02-21 17:58